August was a pretty interesting month on the spending front. I don’t feel as though I spent a lot of money, but I did put a significant amount toward our London vacation. My mom put the bulk of our purchases (flight, hotel, excursions, travel insurance, etc.) on her credit card and let me pay my portion (we always split the cost 50/50 on vacations) over time. Thankfully, in August, I was able to fully pay off my portion, so I am back in the green! This month, I also had to pay my yearly fee for my renters’ insurance, so it was just a lot of these bigger expenses that easily added up.

Here were my goals for August:

- Pay off London – Complete!

- Spend below my means – Not complete. Womp, womp. I was actually very surprised to learn that I was $1,000 over budget this month. I have no idea how that happened because I don’t feel as if I used my credit card all that much (although I did run up my balance more than expected, and I was able to pay it off at the beginning of September).

- Try to stay under $150 in Ubereats orders – I spent $157 this month, so I’m going to consider this a win. I almost broke even with my goal.

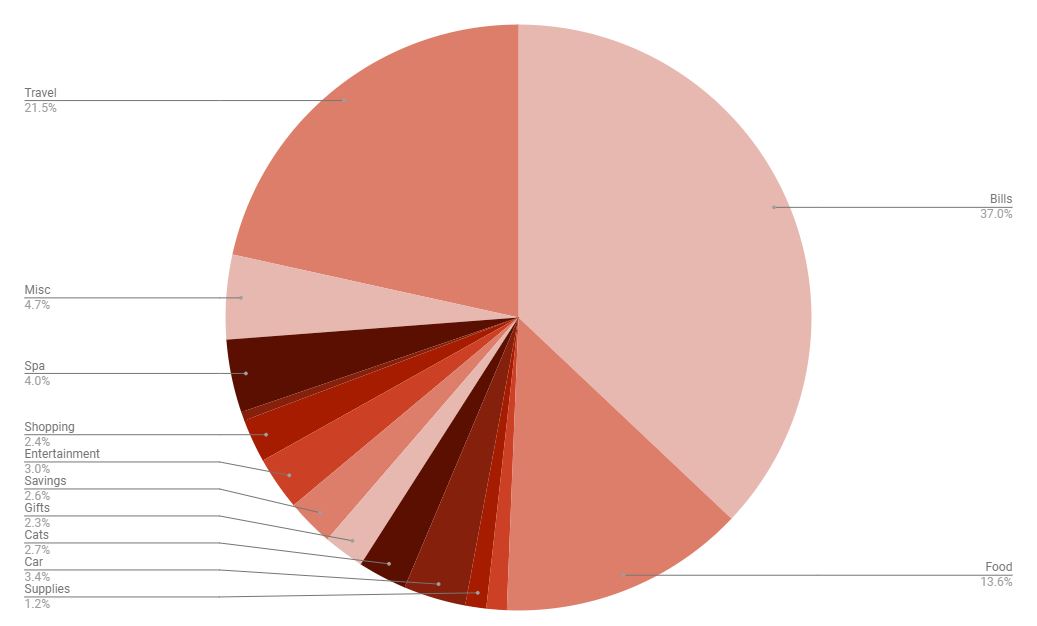

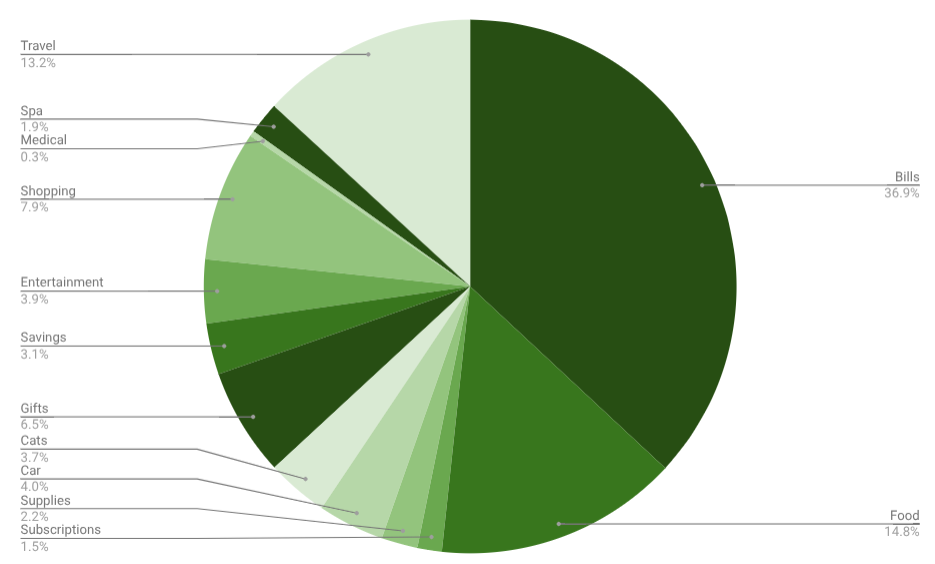

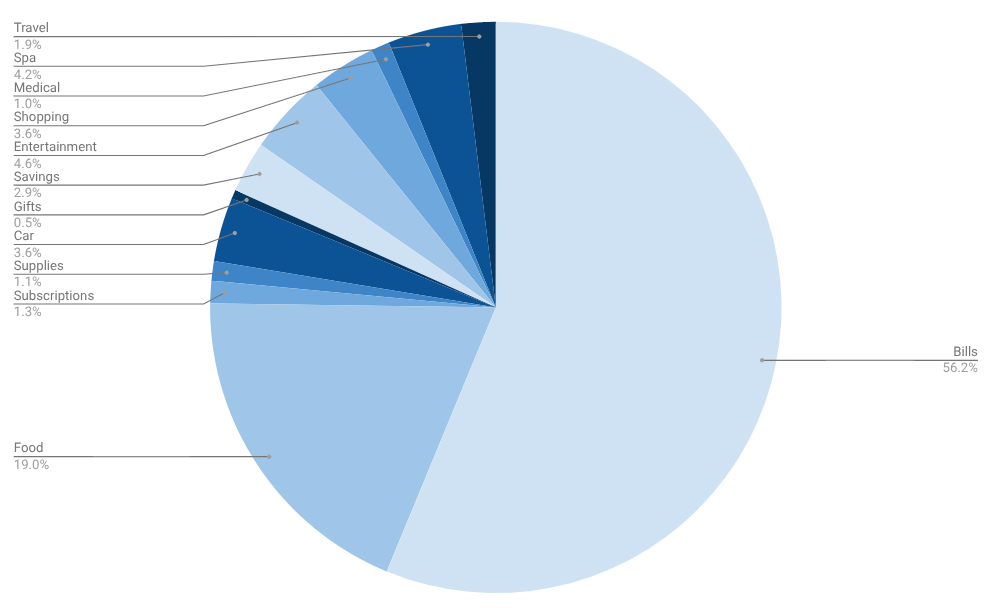

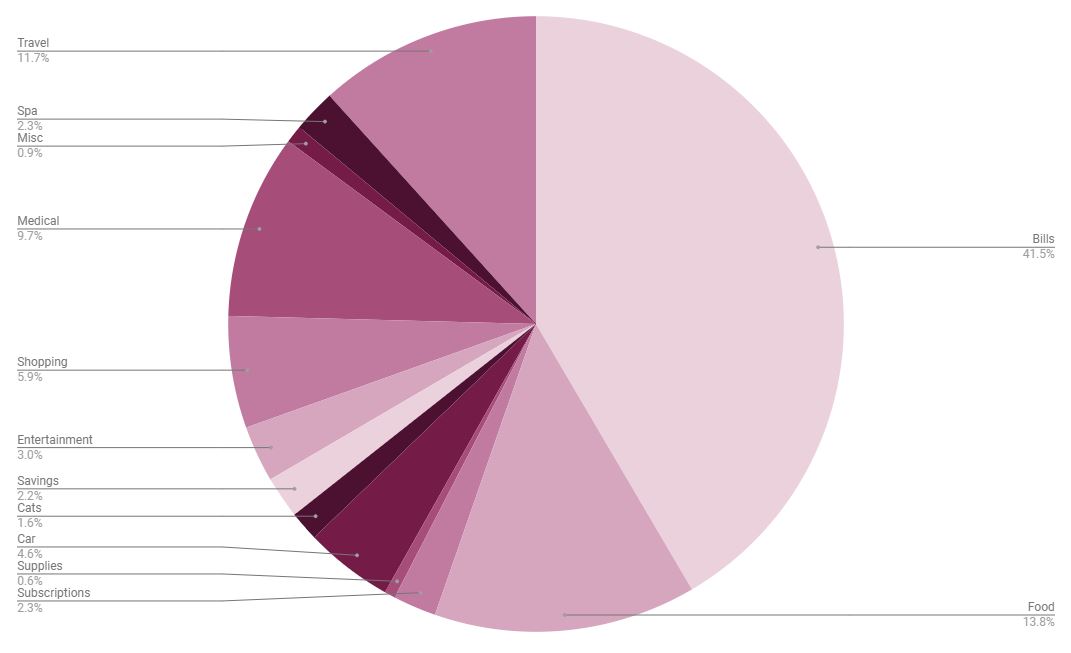

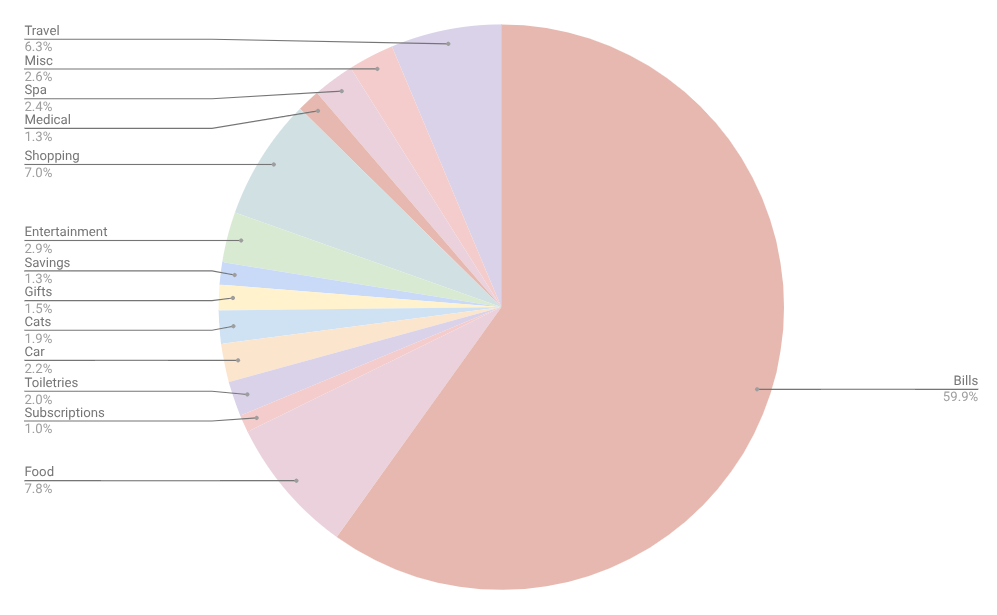

Here’s how things shook out this month. As a reminder, this is a spending report, which means I am only talking about the money I spent after it hits my bank account. You will not see anything related to my 401k, health insurance premiums, HSA contributions, etc.

Spending Breakdown

Categories That Increased

TRAVEL ($1,447 | ↑ $702)

Hoo boy! This was quite the total. I have fully paid off my mom for all of our London expenses and also paid for TSA Pre-Check, my UK travel visa, and British pounds that we bought at a currency exchange kiosk. We’re under 30 days away from our trip!

BILLS ($2,488 | ↑ $470)

Slight increase this month since I didn’t have my car payment included in July’s spending report. But my electric bill was slightly lower than July, so that’s exciting! It’s been steadily increasing every month.

MISCELLANEOUS ($313 | ↑ $313)

I had to pay my yearly fee for renters’ insurance. I bumped up some of my coverages this time around (personal property and loss of use) because last hurricane season was a scary one. Let’s hope I don’t have to worry about submitting any claims this year.

SPA ($271 | ↑ $162)

Lots of fun things in August! I got my hair cut and colored, got a facial, and got my underarms and brows waxed. I’ve been using my wellness reimbursement (we get $300 every year) to pay for my massage/facial treatments, so now that I’ve blown through that stipend, I’ll probably cancel my massage membership. It’s pricey at $80 a month, and that’s money I can put to use elsewhere.

FOOD ($913 | ↑ $80)

While my Ubereats spending came down by $110, my grocery spending went up by $168. And I spent a little more on meals out that weren’t online orders, accounting for the overage. I have a new plan for getting my online orders to a reasonable number (more below!), so we’ll see if that helps lower my food spending at all.

MEDICAL ($32 | ↑ $13)

I bought a big bottle of vitamin D supplements. Exciting stuff!

CAR ($231 | ↑ $4)

A very small increase for the car this month because I had to pay a toll invoice. Otherwise, everything was pretty similar to July!

CATEGORIES THAT DECREASED

SHOPPING ($161 | ↓ $285)

I wrote last month that “hopefully this category decreases a lot in August,” and it did! Hooray! I was paying so much money for travel expenses that I had to limit my shopping budget. Here’s what I bought last month:

- Clothing: $60 (a new pair of shoes)

- Home: $33 (a fall-scented candle and six hand sanitizers from Bath & Body Works)

- Miscellaneous: $19 (toothbrush cover, a set of two small jars, and my desktop vacuum)

- Beauty: $18 (tweezers (!!!) and nail polish top coat)

- Books: $16

- Hobbies: $15 (a box of markers)

GIFTS ($153 | ↓ $215)

July was a super expensive month for gift-giving, and things calmed down a bit in August. I bought toys for my fur-neice and -nephew for their birthdays, had my monthly ASPCA donation, and paid for afternoon tea for Mom and me.

SUPPLIES ($78 | ↓ $46)

This month, I didn’t bulk-buy a bunch of body wash to use in my bubble baths! That helped bring down the price, although I did have to replenish some household supplies that I only need to buy a few times a year, like laundry detergent, dishwasher pods, etc. (I always wait until Target is doing their “buy $50 of laundry detergent and get a $15 gift card!” deal, so I stock up.)

CATS ($181 | ↓ $29)

A pretty easy month for the cats. I bought them a boatload of different wet cat food (they’re like their mama – they like variety!), a new Halloween scratching pad, and treats. I also paid for Eloise’s vet wellness plan.

ENTERTAINMENT ($198 | ↓ $20)

The majority of this category comprises restaurant dates with friends and my mom. I also paid $15 for extra tokens for one of my iPhone games.

SUBSCRIPTIONS ($75 | ↓ $9)

A slight decrease. I didn’t use a Book of the Month credit (the past two months of book selections haven’t been great, wah), but I did join a new Patreon community so that was an extra $10.

CATEGORIES THAT STAYED THE SAME

SAVINGS ($175)

I’m still putting $75 a month away in a Christmas fund and $25 a week away in emergency savings. Things are going well in this department, although I could probably bump up the amount I’m putting into my emergency savings on a weekly basis.

Overall Thoughts

Overall, I’m pretty happy with my August spending. There weren’t a lot of frivolous purchases (for me, at least, lol, since I’m not the most frugal person!) and a majority of my money went toward travel and food, which is normal for me. One thing I have been thinking a lot about is how to lower my Ubereats budget. Originally, my goal was to spend less than $100 per month, but as the past few months have shown, that’s very hard for me to hit! I wish it weren’t, but that’s just the reality of my life right now. Instead, I think I’m going to challenge myself to only order Ubereats twice a week. I can order it once for dinner and once for lunch. And I’m going to gamify it (because gamifying things really works for me!). If I can go a week without either a dinner or lunch Ubereats order, then I can put $10 into a special savings fund. I don’t know how I’ll use this fund yet, but I want to use it for a fun, frivolous purchase. If I don’t have Ubereats at all one week, that’s $20 to my savings fund. We’ll see if that gets me excited to spend less money on online orders.

Anyway, here are my goals for September: get Eloise registered as an emotional support animal (which means I can waive any pet fees/pet rent on my future apartment; these fees can sometimes be $400-$500!), Ubereats twice a week, and spend below my means.

What was your last frivolous purchase?