Hi, friends! I’m here with my first budget update of 2021. I knew I wanted to continue these budget updates (you guys seem to really enjoy them!) but wasn’t sure in what capacity. I *think* this is how I’ll be doing them going forward (quarterly updates), although I’m contemplating a monthly budget update that dives a little deeper into my budget as a whole rather than my overall spending. Let me know if that sounds interesting at all! (I do plan on writing a post soon that gives the nitty-gritty about my budget this year, but the monthly post would be something different.)

Anyway, Q1 was a good one. I received six paychecks, my tax refund, and my stimulus check. Woop, woop! I was able to buy some big-ticket items, like my sectional and spin bike. In Q2, I’m hoping to buy a new TV, desk chair, and area rug, but we’ll see how everything pans out. Here’s the breakdown:

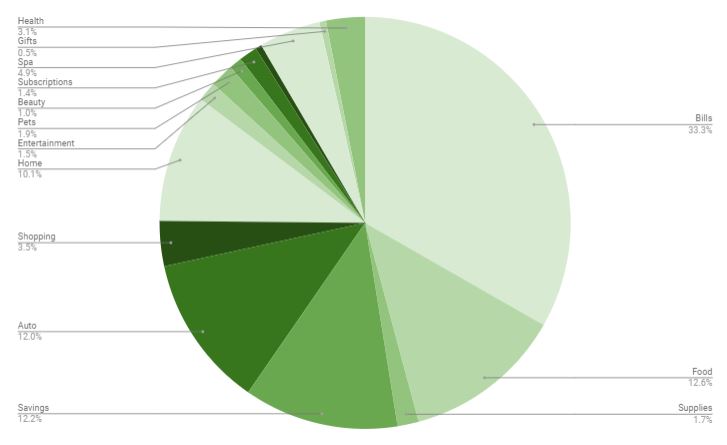

Overall bills (33.3%) – This year, I’m lumping all of my necessary bills into one category. This category includes:

- Rent ($1,045 per month)

- Electric (budgeted $100 per month; averaging $86 per month)

- Water (budgeted $50 per month; averaging $51 per month)

- Internet ($80 per month)

- Phone ($109 per month)

- Student loan ($105 per month)

Food (12.6%) – My monthly budget for food is $600, which may feel insurmountably high to some (especially for just one person), but it’s what works for me. In January and February, I came under budget easily but went over by $74 in March, oops.

Savings (12.2%) – My goal is to save $575 per month ($200 into emergency savings, $200 into a car down payment fund, $50 into a Christmas fund, $50 into a pet fund, and $75 into a car insurance fund) as well as put $5 into my no-spend fund every time I have a no-spend day. Currently, I have $2,200 in my emergency fund and $1,500 in my car fund, which feels amazing!

Auto (12%) – I spent $71 on gas this quarter, $10 on a car wash, and $526 on my biyearly car insurance. This category should be a lot lower in Q2. I don’t really have a budget for auto anymore. My emergency/car savings are used for repairs and I’m still driving so little that I only need to fill up my tank once a month. It’s great!

Home (10.1%) – I made a big purchase in Q1: a new sectional! That’s what makes up the bulk of this category (which approximates $1,353). I also bought some decorations, prints for my office nook, and other home goods.

Spa (4.9%) – This quarter, I spent $238 on my hair (balayage highlights, professional cut and style, and tip), $150 on pedicures, and $266 on massages/facials. The only area I really budget for are my massages/facials (I budget $80 per month, but usually spend $100 for facials since I upgrade to a more specialized facial). My haircuts and pedicures come out of my “fun money.”

Shopping (3.5%) – The biggest shopping expense in Q1 was my Stitch Fix box. Also, somehow I spent $116 on books this quarter?! What the what?

Health (3.1%) – It was a spendy quarter for health, as I bought a spin bike! I budgeted for this as part of my tax refund. Otherwise, I only spent $30ish for some medical supplies when I fell and tore up my toe and a prescription.

Pets (1.9%) – Lila had a vet appointment in February and had to get two shots, so that was my biggest expense this quarter ($128). I also bought litter ($54), food ($36), treats ($8), and a new pet food container ($20).

Supplies (1.7%) – I combined toiletries and household supplies into one category for budgeting purposes. I budget $100 per month for these supplies and keep a close eye on this category, as I know it can get out of hand easily. In Q1, I stayed well within my budget ($73, $92, and $59) so I feel good about where I’m at with this category.

Entertainment (1.5%) – I budget $14 per month for my Candy Crush habit (no shame!) and also budget for my monthly lady dates with Bri (I budget $50 but I’m usually always underbudget for that).

Subscriptions (1.4%) – I’m still trying to figure out how much I pay on a monthly basis for all of the different subscriptions I have. In Q1, it was all over the place. Not every month is the same—some months, it can be around $94 and other months, it’s $30 less if it’s a month I’m not getting an air filter shipped to me (my Second Nature subscription is set up for every other month) and I have a Book of the Month credit that rolled over. In general, though, I budget for $100 and always came in under that in Q1. My subscriptions include Patreon, Spotify, Netflix, Befunky.com, Ipsy, Second Nature, and Book of the Month.

Beauty (1%) – This category is getting more of a workout than last year since I’m investing a lot of money into a skincare routine. But I enjoy doing my morning and evening routine and trying new products! Right now, I’m trying out Paula’s Choice products, so I bought cleanser, exfoliant, toner, a morning moisturizer (with SPF), an evening moisturizer, and niacinamide serum.

Charity (.5%) – This year, I’m picking one charity per quarter to donate to, and in Q1, it was the Equal Justice Initiative. I believe in their mission so much and it felt good to donate a tiny amount to them. I set aside $25 per month in my budget for charitable giving.

Gifts (.5%) – Chip and my youngest nephew, D., had birthdays in Q1 so nothing too crazy to budget for.

$0 categories of Q1 include travel and Christmas, for obvious reasons. 🙂

You have such a detailed handle on where your money goes, which is great! I think you spend more on food than we do, but we so rarely eat out! And Phil does a lot of shopping at Aldi which is crazy cheap! But food budgets are so unique to each family and there is no ‘right’ amount to spend!

I love your budget updates. It’s just so interesting to see how other people handle their finances. When you say you want to save $575, is that from your take-home pay? Do you pay into a retirement fund at work? I am asking because such a huge chunk of paycheck goes toward retirement (which I also consider savings)… that I do not have a whole lot of leftover money to put into savings from my actual take-home pay…. and $575 sounds an awesome amount to put away!!

I keep saying I need to do this, as I think you have real insight into what is important in your life when you know how much of your money you’re putting towards it! I wish I were as organized and diligent as you. I generally AM organized and diligent, but for some reason, money is just hard for me… I usually am one of those “I know I have enough money, so it’s okay” people. NOT okay! 🙂 I’d love more detailed posts on how you determine your budget and your various “buckets” of money!