It’s a new year, and it’s time for a new way to track and analyze my spending. I downloaded a budgeting spreadsheet in mid-January and spent the time meticulously filling it out and making sure I had all of my budget categories just so. Things were going well, until I had an epiphany: I don’t want to budget. I don’t want to sit down every month and set specific parameters for my spending. What I want to do is track where my money is going once bills are paid, but not in a “I can only spend $100 in this category” kind of way.

The truth is, I find it really hard to project into the future and think about how much I should budget for the cats or the car or my entertainment budget. What I would rather do is figure out how much money I have left over for myself once I have paid all my bills and set aside a portion for food and other necessities like household supplies. Once everything necessary is accounted for, what do I have left over? That can be used for myself in myriad ways – sometimes it’s for things like cat litter or car washes, and sometimes it’s for things like books and beauty appointments. The key is that it’s all in one big bucket that I keep track of and pull from throughout the month.

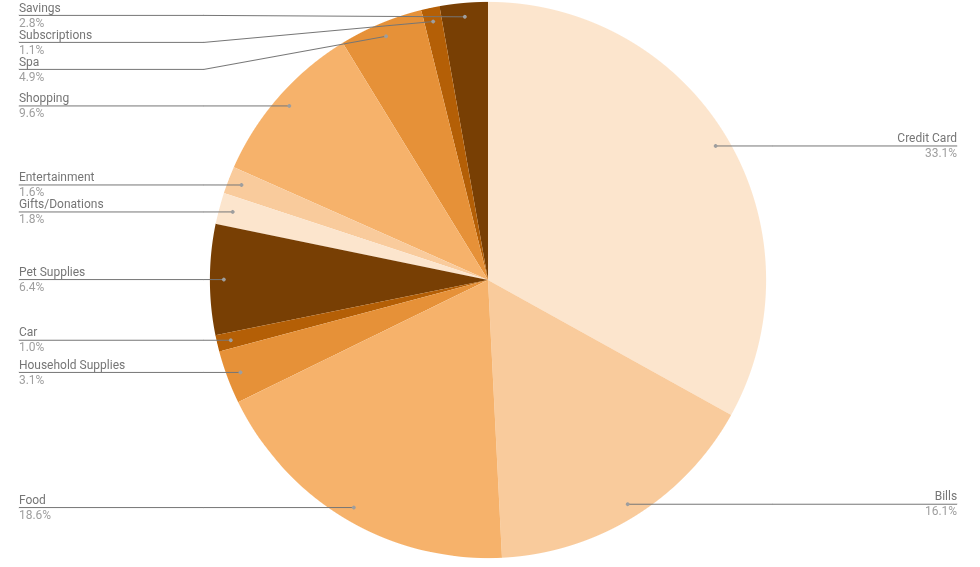

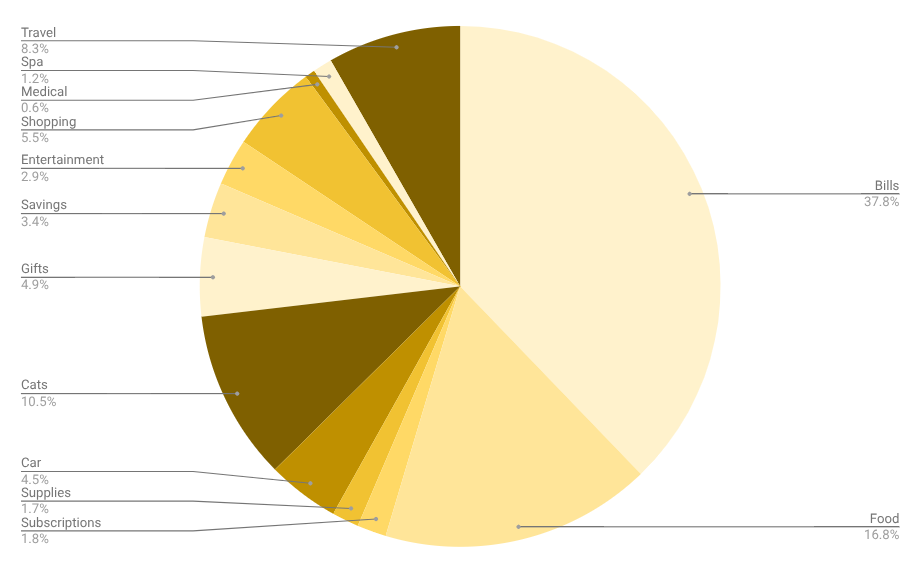

With that in mind, I wanted a different way to look at my month of spending. Rather than listing out all of my different categories, let’s do this the good, the bad, and the ugly style! But first, here’s the total breakdown:

The Good (aka, three categories that went well this month)

- Entertainment (1.6% of total budget)

My entertainment category was fairly low this month, which sometimes means I’m being too much of a hermit, but that was not true in January. It’s just that a lot of my entertainment was either cheap or free, which is nice!

- Credit card (33% of total budget)

This was my biggest category by far, but this is a big win because I finally paid off my credit card balance that had been looking a little scary since October (international trip + a move + holidays = a mess). I’m glad I was able to get it down to $0 and start fresh in the new year!

- Bills (16.1% of total budget)

January was my final month of not having to pay rent, so my bills category looked amazing. (I got two months free when I moved in.) I need every apartment to run a special like this because it helped so much to recoup my moving costs and get settled into my new place.

The Bad (aka, three categories that were a bit higher than I wanted)

- Groceries ($860 total)

Some of this grocery total falls under the snack category because I spent a lot of money upfront to fill up my pantry with good snacks for myself. I also did grocery delivery once when my PsA symptoms were at an all-time high. That’s always a much higher grocery bill than normal!

- Cats ($400)

The girls were expensive in January! A good chunk of this total is an annual fee I paid to the PetLibro app so I could track the girls’ eating habits. It was $129 for the entire year, which feels excessive, but whatever. I also got them food, litter, a new litter box, and some treats. Oh, and a portion of this went to Eloise’s vet plan.

- Shopping ($636)

Whoops. This is what happens when I don’t have to pay rent. I have all this money that’s burning a hole in my pocket! Here’s how it broke down:

- Home ($274) – I bought a nightstand, a small end table, two rugs, and some scents at Bath & Body Works

- Books ($210) – I bought 11 books in January, oopsy! I bought three from Barnes & Noble (I had a gift card), one e-book that I couldn’t get from my library, two Book of the Month add-ons, and then five books during my bookish shopping spree with Jenny.

- Misc ($92) – All those little things surely add up! This category comprises things like a large pill organizer, a new wall calendar for 2026, a to-do list pad, some gold star stickers, and my “books read” sign from Etsy

My goal is to spend under $500 monthly in my shopping category, so let’s see how I do in February!

The Ugly (my worst category)

- Online ordering ($265)

Who is surprised by this being my worst category? Oh, Ubereats. How I love thee! But I do not need to spend almost $300 in a single month on these online orders. Some of this was due to PsA pain and just not having the physical/mental capacity to cook for myself, and some of this was just sheer laziness. I hope that once my symptoms are better controlled, I will rely less on Ubereats.

In February, my goal is to spend less than $150 on online orders and to limit orders to only Friday and Saturday.

Final Thoughts

There were definitely some bright spots in January, especially being able to pay off my high credit card balance, so I didn’t have that hanging over my head anymore. And there were some common spending patterns that have been an issue for a while. I’m nothing if not consistent! But I’m also giving myself some grace here because it was a hard month for me as I waited for my first rheumatology appointment, and I did what needed to be done to take care of myself and meet my needs.

What was your last home purchase?