I’ll admit that I was nervous about this spending report. I felt as if I spent a lot of money this month between some fun experiences with friends, dropping $75 at Barnes & Noble (I felt like I dissociated from my body the minute those bookshelves surrounded me), and definitely going over my Ubereats budget. But alas, it wasn’t as bad as I expected! In fact, I didn’t even spend above my means this month—I was $29 under! I’ll take that as a win.

Let’s review my goals for May:

- Spend below my means by $250 – Not complete! I was not even close to hitting this goal, but still, I didn’t spend above my means in May so it’s all good.

- Meet my online ordering goal – Not complete. I went over my goal by more than $70. Oof.

- Cancel Amazon Prime – Not complete. I’m the worst.

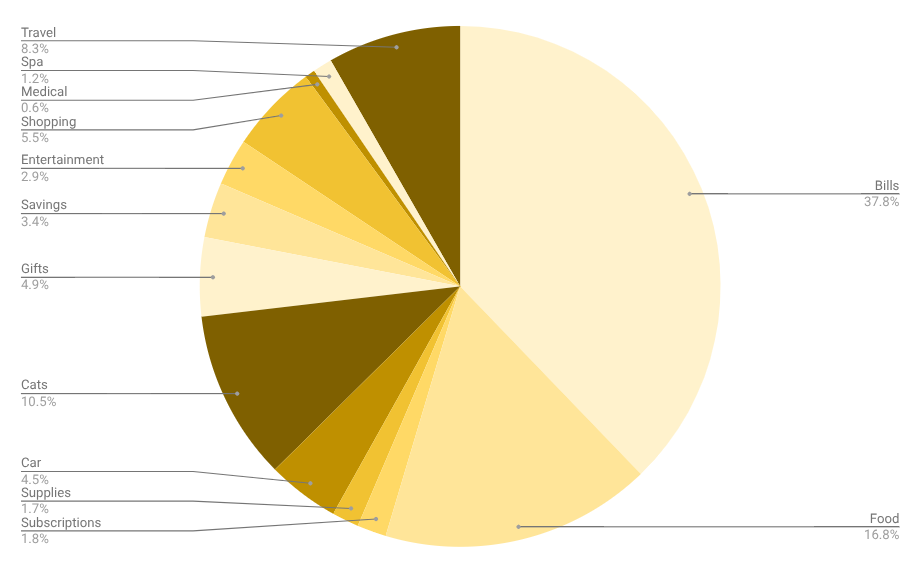

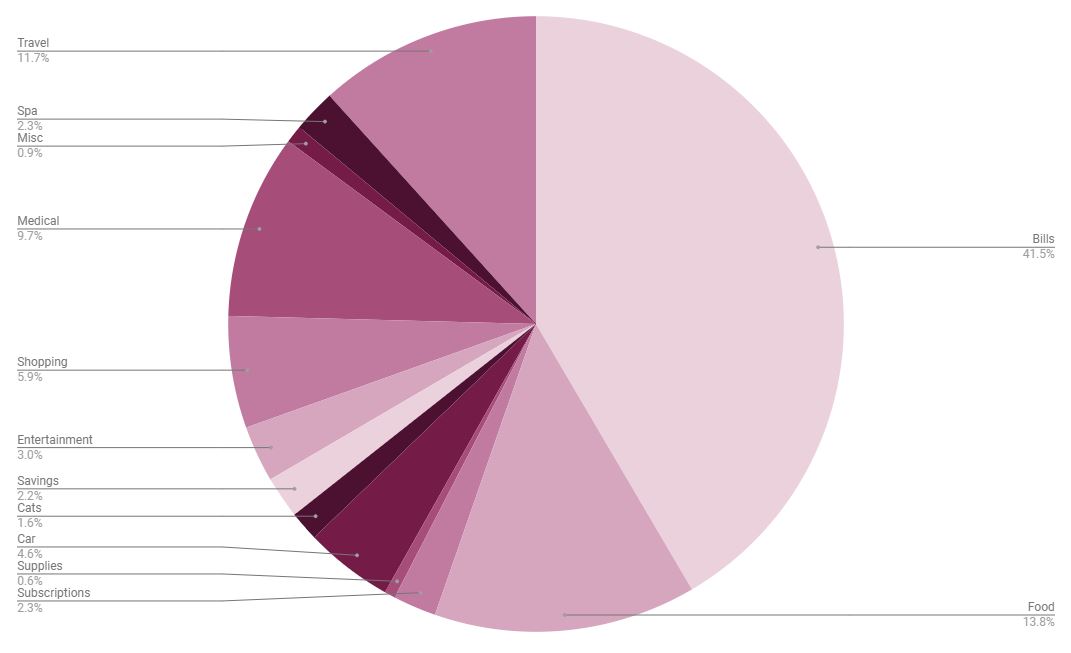

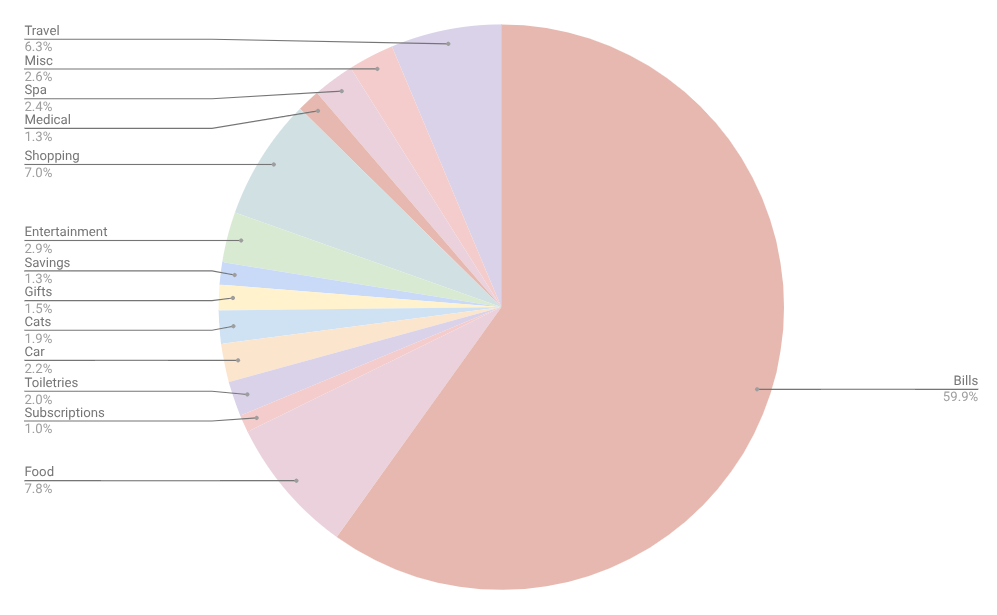

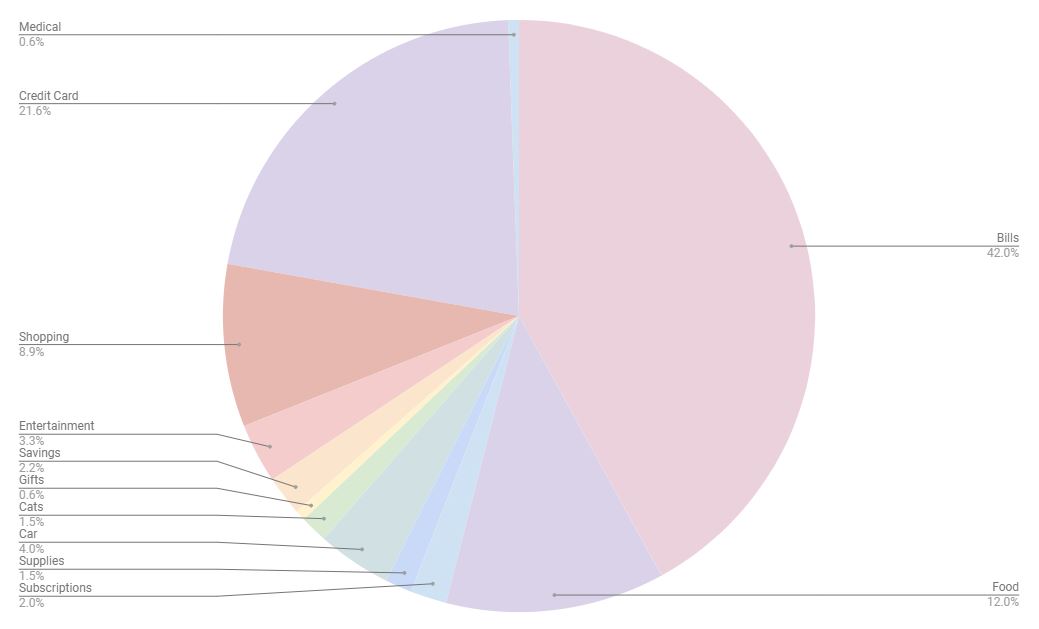

Here’s how things shook out this month. As a reminder, this is a spending report, which means I am only talking about the money I spent after it hits my bank account. You will not see anything related to my 401k, health insurance premiums, HSA contributions, etc.

Categories That Increased

CATS ($574 | ↑ $486)

Eloise was my expensive cat in May! The majority of this overage comes from her two vet appointments: one at her usual vet clinic where I paid over $300 for an exam and bloodwork, and then I paid for the first month of Banfield’s wellness plan ($55) during her second vet appointment at Banfield. However, with this wellness plan, Eloise can receive extra bloodwork when needed, as well as a yearly dental cleaning, so it will ultimately be vastly cheaper in the long run. I also bought food, litter, and some fun birthday toys (like a new scratching pad and cat grass!).

GIFTS ($266 | ↑ $266)

Oof. I knew May was going to be a hit to the ole pocketbook for gifts. I’m trying to do experience gifts this year for my friends and while fun, they can be a bit expensive. But that’s okay! This month was two spots in kitten yoga, two tickets to a drag show, and some items for my mom’s Mother’s Day gift.

FOOD ($915 | ↑ $135)

Ughhh… I did horribly when it comes to my food budget in May. Every category – groceries, breakfasts, online ordering, etc. – was a smidge higher than April. I’m very unhappy with my online ordering total, which was $172. While that’s not the highest it’s been this year (that honor goes to February when I spent over $200 on online orders), my goal is to spend under $100. This is such an area of struggle for me!

SUPPLIES ($91 | ↑ $59)

I had to replenish my supply of body wash in May, which accounts for the majority of this increase. (I buy them in bulk.) I also bought the usual suspects when it comes to my supplies: mouthwash, trash bags, a new loofah, shampoo, etc.

SAVINGS ($187 | ↑ $62)

It was only $62 but I finally managed to sock some extra money away in my savings this month. I’m taking it as a win!

Categories That Decreased

MEDICAL ($33 | ↓ $516)

A massive decrease from May! This month, I did not have a boatload of medical bills to deal with. I just needed some OTC medications that I paid for myself.

BILLS ($2,057 | ↓ $295)

My car loan payment didn’t go through yet in May, which accounts for the decrease. All other bills remain the same, except my electric bill was $65 more (ughhh summer) and I had to pay a yearly membership fee at my gym.

TRAVEL ($451 | ↓ $211)

In May, my only travel expense was booking the hotel my mom and I will be staying at in July for her birthday vacay. Nothing crazy!

SPA ($66 | ↓ $62)

My spa category decreased a bit in May; my only expense was a pedicure. But yes, it was a SIXTY-SIX dollar pedicure. I did opt for the more deluxe pedicure that included paraffin wax and extra exfoliation, but oof. That hurt me a bit. I won’t be getting that kind of deluxe pedicure every month (they have a $30 “polish change” option, which will be my go-to from now on).

MISC ($0 | ↓ $52)

No miscellaneous spending in May! Yay!

SHOPPING ($301 | ↓ $32)

I’m happy to see that my shopping budget continued to decrease in May, even though I want to get it much lower. Maybe in June! Here were my highest categories:

- Books: $102

- Beauty: $74

- Home: $37

SUBSCRIPTIONS ($99 | ↓ $30)

Last month, I paid for a year’s subscription to Emily in Your Phone’s substack so that’s why this category decreased slightly in May.

CAR ($244 | ↓ $19)

I put away money for car insurance, got gas twice, and bought a car wash. This category is down slightly since I didn’t have some overdue tolls to pay!

ENTERTAINMENT ($157 | ↓ $11)

Nothing too crazy here – I mostly prepaid for some June adventures, like our upcoming book club experience, Olive’s dance recital, and a movie ticket. I also paid for May’s book club experience, some dining out adventures, and odds and ends.

Overall Thoughts

This wasn’t a bad month, money-wise. I spent within my means, although I’m really hoping to spend a lot less in these coming months. If I want to move into a two-bedroom apartment (which means my rent will increase by $500 at a minimum), I need to be spending way less than I currently do. Otherwise, I am in for a rude awakening when it comes time to move in late October. I feel like this is something I keep saying in these monthly spending reports, so it’s really time to stop saying I need to spend less money and actually spend less money. Gah.

The two areas of struggle for me right now are food and shopping. If I could adhere to my budget of $100 for online orders and bring my shopping budget down to under $200, I’d feel a lot more comfortable with my spending habits and being able to move to a new place at the end of the year.

So with that said, my goals for June are to finally CANCEL AMAZON PRIME OMG, spend below my means by at least $100, and meet my online ordering goal.

What was the last gift you bought?