Ugh, December budget. Okay, fine, let’s get this over with. Please be gentle.

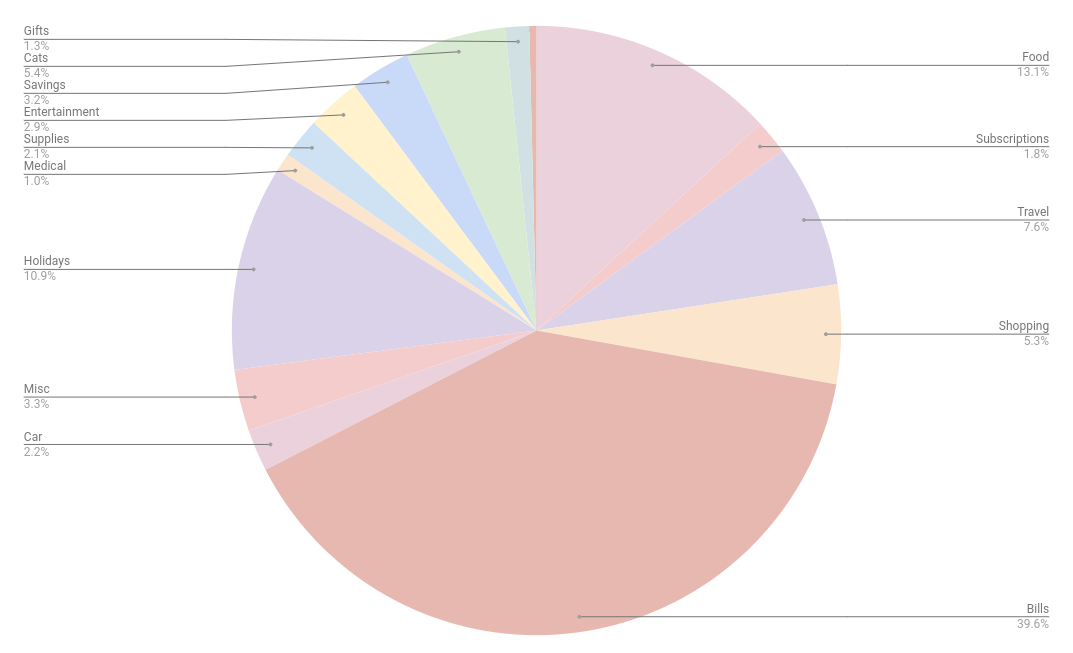

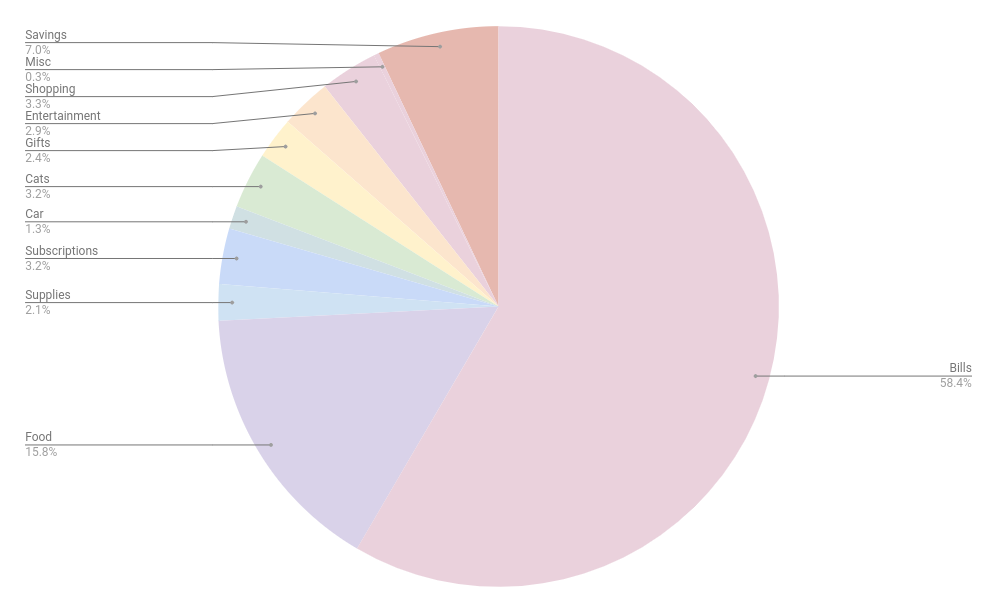

Bills (39.6% | -3.9% from November): Last month, I got a break on my bills because I didn’t have a car payment and had a nice credit on my Internet bill, but things were back to normal in December. This category comprises rent, my phone bill, Internet, my car payment, electric, my gym, Care Credit, and student loans. The percentage was lower than November because of all the spending I did in other categories.

Food (13.1% | -2.2 from November): Well, being away on a cruise for a week helped bring this number down because I definitely don’t feel like I spent less money on food in December.

Holidays (10.9% | +2.1% from November): Oh boy, Christmas was expensive this year. I budgeted $850 for the holidays, which encompassed gifts, new decor, supplies like wrapping paper/cookie ingredients, and events. I went about $300 over budget. I had a feeling I was going overboard, but it’s so hard to rein in that holiday spending. I need to do a better job of tracking my purchases in 2025.

Travel (7.6%): I went on a five-day cruise in December and I’m honestly shocked at my final bill for the cruise (which we get on the last day, which details the money spent on drinks/casino purchases/gifts/bingo/etc). It was so much more than I was expecting, eeks.

Cats (5.4% | +3.7% from November): A much spendier month for the cats. I had to replenish both their wet and dry food and Lila had a spa appointment that cost $100 (oof).

Shopping (5.3% | -3.1% from November): Well, hey! Kudos to me. I don’t know if I really spent less this month or if the percentages just shook out differently, but I’ll take it as a win. I felt like I spent a lot of money on myself this month, though.

Misc (3.3% | +2.1% from November): I wasn’t sure where to categorize my tattoo, so I put it in miscellaneous. (For full transparency, it was $200 total with tip!)

Savings (3.2% | -2% from November): In December, I only put money away in my car insurance fund and my cat fund (no Christmas fund).

Entertainment (2.9% | +1.3% from November): There was a lot going on in December, but a lot of things that would normally go into my entertainment category went into my holiday category, so the number isn’t too startling here.

Car (2.2% | -1% from November): I spent so much money on gas in December! I filled my car up four times, and that’s mainly because I drove to and from Miami for the cruise.

Subscriptions (1.8% | -2.8% from November): All of the usual suspects here: Patreon, Canva, Prime, Paramount+, Netflix, Spotify, Book of the Month. It’s a lot less because last month I paid for a yearly subscription to a photo-editing app.

Gifts (1.3% | +.8% from November): A charity donation to the ASPCA and sent some Starbucks gift cards to writers who won the games I played during our team meeting in December.

Medical (1%): I waited way too long to get a replacement FSA card mailed to me after losing my wallet in November, so I had to pay for a few things out of pocket, like an urgent care appointment (one of the cysts on my underarm burst, and I wanted to make sure I wasn’t dying lololol) and a topical antibiotic for said burst cyst.

Beauty (.4% | -3.1% from November): I replaced my facial cleanser and also bought a brush.

Final Thoughts

- I find it hard to gauge the differences in my spending when I use percentages rather than raw numbers. For example, this month everything was a bit skewed because a good chunk of my spending went to my holiday and travel categories but that doesn’t mean I spent less in other areas. I just spent less relative to what I spent in the bigger categories. I want to continue writing these budget posts in 2025 (honestly, these posts are mostly for me but I do hope they’re somewhat interesting for others!), but I want to do something different. I’m not sure what that is yet, but I do have a new fancy budgeting spreadsheet that I’m excited to start using.

- I’m not happy with myself for overspending by such a large margin ($300!) in my holiday budget. I could have reined myself in if I had been accurately keeping track of how much money I was spending, but I didn’t do that and it shows. Next year (or, well, this year), I’ll do better.

- I started keeping track of everything I bought in my shopping/beauty categories so I could report on those findings, but I fell off the bandwagon of accurately itemizing everything in September. I’ll try again this year, sigh.

How was your holiday spending?