Monday, July 22

- No money spent

Here’s a really silly thing I’m sad about: I am running low on gems in one of my phone games. It’s impossible to play this game without gems and I have just decided to pay to play because I enjoy the game so much. But I have to abstain for another few weeks! Ahhh… what is a girl to do without her Cooking Fever gems?!

Tuesday, July 23

- No money spent

Normal day – nothing to report!

Wednesday, July 24

- Target: $7 (groceries)

- Target: $13 (Clorox wipes)

I placed a Target drive-up order today for two different food items I forgot at the grocery store. And I ran out of Clorox wipes so I bought a three-pack.

Also, I ran out of Cooking Fever gems today. THE HORROR.

Thursday, July 25

- Amazon: $9 (can opener)

My can opener broke tonight and I immediately pulled up my Amazon app and bought a new can opener. It will be here tomorrow. Living in the future is a wild experience! (And yes, I consider this to be within the parameters of No-Spend July because it’s a necessary purchase. I can’t live without a can opener!)

Friday, July 26

- Publix: $99 (groceries)

My same M.O. as last week: I went grocery shopping for the week on Friday so I could get myself a Pub sub for dinner. I wanted something yummy to eat for the Opening Ceremony! It was also really exciting to recognize that I only really need to plan for stuff through Wednesday since No-Spend July is over on Thursday. Woohoo!

Saturday, July 27

- Amazon: $21 (gift)

I bought a friend a gift for her birthday.

I passed a Target on my way home from picking up books at the library and got this small desire to go into Target and poke around. Obviously, I didn’t go in because I’m committed to seeing No-Spend July through, but I can’t deny that I really do miss shopping.

Sunday, July 28

- No money spent

Oh man, today was a hard day! I went to the gym at 10:30 and when I came home, I really didn’t want anything in my kitchen for lunch. All of the meals I had so lovingly bought for myself for moments like this just made me angry. I wanted Ubereats dammit! But I held strong and made myself eggs, sausage, and toast for lunch. It was a satisfying meal and I’m glad I didn’t cave when I’m so close to the end of this challenge!

Monday, July 29

- No money spent

I miss ordering takeout so much. This week, I didn’t really grocery shop that well so I’m feeling very meh about all of my lunch and dinner options. (I say I didn’t grocery shop well, but I still spent almost $100! Riddle me that, Batman.) Today, my lunch was popcorn chicken I heated up in the microwave, string cheese, a muffin, and white rice. At least I got most of the food groups? Sigh. At least I had plans with friends tonight, which meant dinner was pizza and cheesy bread! (And I didn’t have to pay for it since I was doing a favor for a friend.)

Tuesday, July 30

- No money spent

The worst part about today was when I was leaving a Marco Polo for my friend Mikaela and was excitedly talking about how I only had to make it through dinner tonight and lunch tomorrow because dinner on Wednesday was going to be with book club. EXCEPT BOOK CLUB IS ON THURSDAY. Cue tears! Nope, I would have to figure out dinner, lunch, and then dinner again. Ugh. I kept forgetting to take meat out of the fridge to defrost for certain meals (I had planned my whole week around a CrockPot meal but I didn’t take the chicken out of the freezer until Tuesday morning. And now that I think about it, if I let it defrost on the counter, I probably could have salvaged that meal even if it went into the CrockPot a bit late. But I didn’t and BOO ME.) Anyway, today my lunch was more popcorn chicken, tortilla chips with salsa, and a few pieces of chocolate. I’m really killing the nutritional game this week.

Wednesday, July 31

- No money spent

LAAAAAAAST DAY! I really, really, really wanted to get takeout for dinner. In fact, a friend who lives in the same apartment complex as me texted me that the power was out at her apartment when I was at the gym, and I was hoping my power would be out too, so I could justify an Ubereats order. I WAS ACTUALLY MAD WHEN MY POWER WAS ON! Lololol. I ended up having a pretty good dinner (pan-seared chicken, rice, and peas) but man, it gets old having to cook food for yourself over and over again, doesn’t it? How do you guys do this ALL THE TIME?!

Final Thoughts on No-Spend July

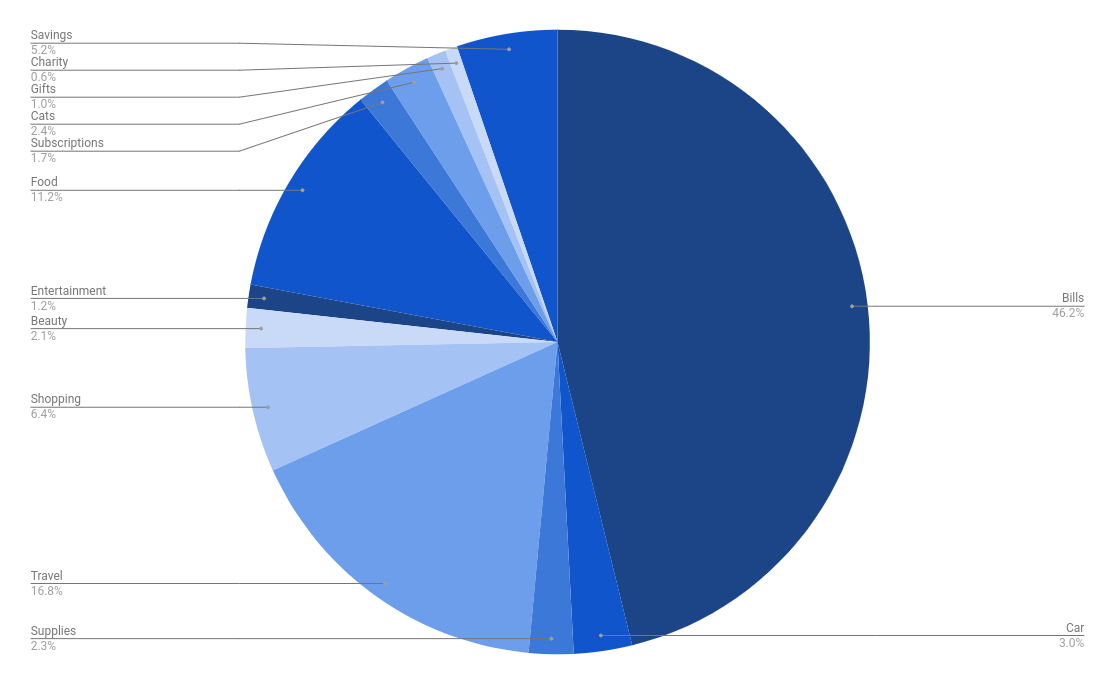

This was a hard challenge, but ultimately, a really useful one. It was the reset I needed for my spending because I was spending like crazy these past few months. And while I don’t feel like I saved a ton of money doing this challenge, I’ve also been spending beyond my means since the beginning of this year and July will be the first month I’m actually below my means. I was able to pay down my credit card balance ($1,550), which is very good news because I was in dire straights with my credit card at the beginning of July. I also created a new budgeting system for myself that will help me better understand how much discretionary money I actually have every month.

Of course, the biggest piece of No-Spend July was abstaining from Ubereats and other takeout orders all month long. And you guys, this was really hard! It showed me how much I rely on takeout and how much it can affect my mood. But I also learned that I can battle against my instincts to order takeout and find something just as satisfying to eat at home. It requires having a plan and making sure the food I have at home is something I want to eat. I’m a little scared to not have the strict parameter of no takeout at all because I tend to do better with something like that. (I’m more of an Abstainer than a Moderator, if you will.) But I do want to put boundaries up about how I often I use Ubereats or pick up food on my way home from the gym or something. I’m thinking:

- One Ubereats order per week (I’d like this to be lunch, which is often MUCH cheaper than dinner)

- One takeout order per week (this can be from Chick-Fil-A, Einstein’s, etc.)

And maybe I can give myself some sort of incentive if I meet that goal, like I can buy myself a book if I can do that for an entire month. IDK, I’m still thinking about it. I need rewards because I AM A CHILD.

Anyway, thanks everyone for following along on my journey this month! I’m glad these posts were somewhat interesting to other people. It was really helpful to have you guys cheering me on as my online accountability buddies because I am pretty sure I would have given up if I didn’t have these posts to use to report my progress.

Oh! And I can’t forget to share my final list of “Things I Want to Buy!” Anytime I thought of something I wanted, I added it to this list. It wasn’t too long (and I did end up purchasing one of those items), but I may just keep adding to this list so I can pick things to buy from it based on how much I budget for shopping each month. 🙂

Have you ever done a no-spend challenge?