Okay, guys, I have one more 2022 post for you guys. (That’s not true; I still need to post my Everyday Moments from December, but that’s different!) Today, I’m revealing my final 2022 budget with comparisons to my final 2021 budget. It was an interesting year with inflation, three trips, and lots of wayward spending, but I’m here to show you the truth of my spending habits, even if I’m not the most frugal person to ever live. (A title I will never achieve, nor do I want to.)

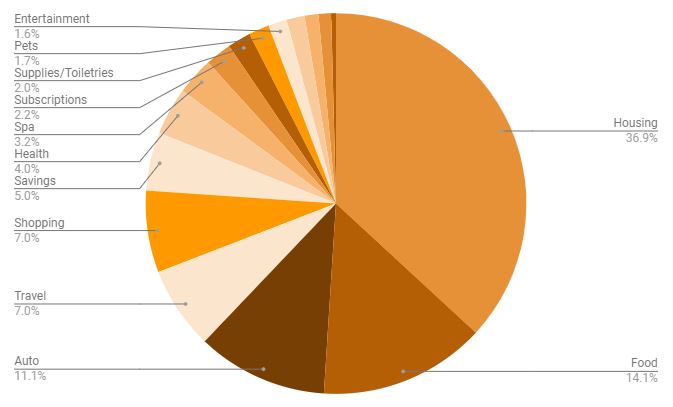

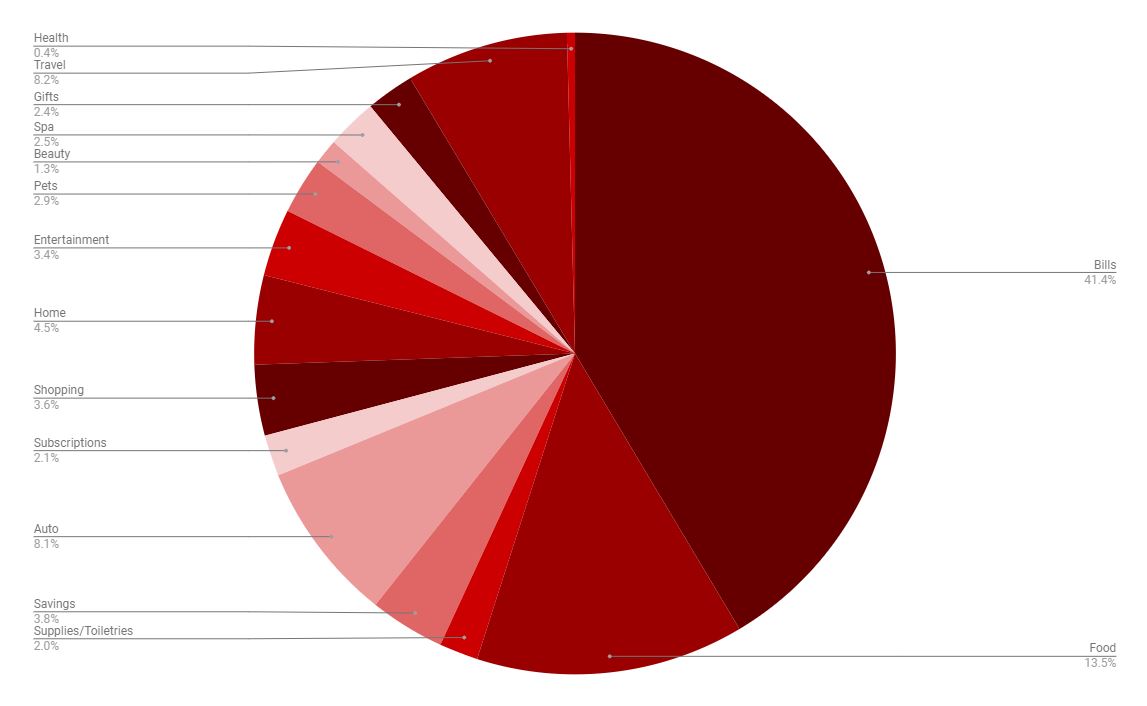

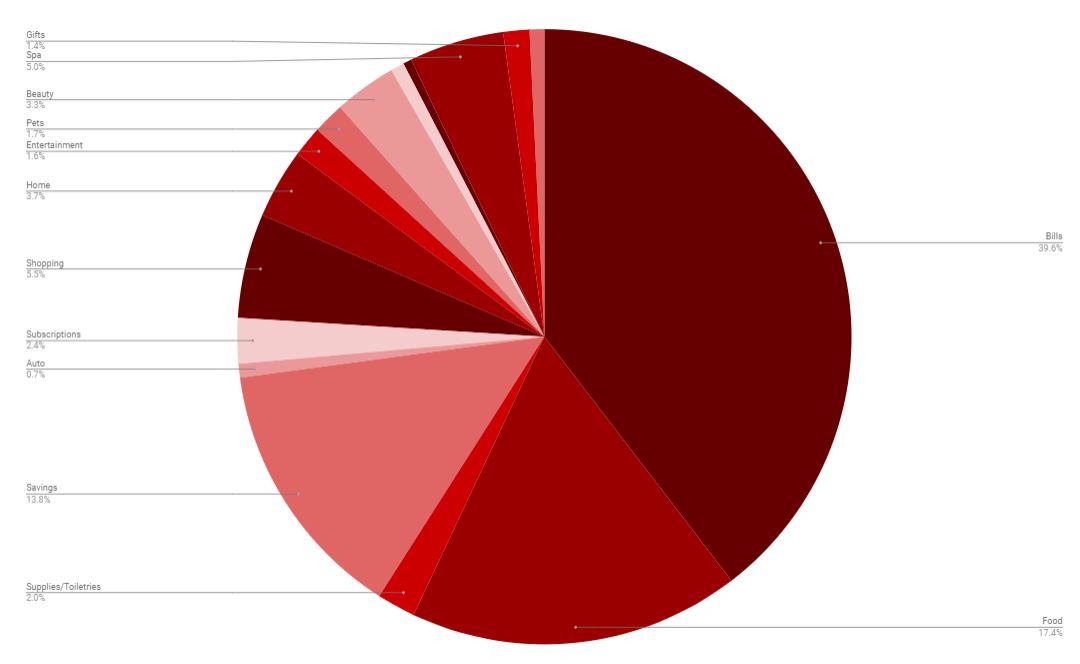

Housing (37%; -3% from 2021) – I spent $14,112 on rent (+$1,302 from 2021), $1,355 on electric (+$26 from 2021), $574 on water and utilities (+$21 from 2021), $960 on Internet (no change), $1,367 on my phone bill (+$65 from 2021), and $1,155 on my student loan (-$105 from 2021).

Notes: Since my rent went up by nearly $300 in November, I expected my rent to increase, but it actually increased less this year than it did in 2021. Weird! I’m pleased that my energy and water bills stayed relatively the same. I’m also pleased that my Internet bill has not increased in many years. I keep waiting for that to happen!

Food (14.1%; -.8% from 2021) – I spent $4,444 on groceries (+$941), $1,726 on Ubereats orders (and $324 on tips paid to the drivers), $665 on restaurants/fast food, and $331 at Starbucks (+$156).

Notes: Ah, my dear friend inflation. I’m not surprised I spent nearly $1,000 more on groceries this year than last year! But it still is a staggering realization about how much food prices have increased this year. Last year, I didn’t separate out my Ubereats orders from restaurants/fast food so I’m interested to see how things compare when I do this post next year.

Auto (11.1%; +6.1% from 2021) – Since 2022 was the first time in many years I had a car payment, this category got a massive upgrade from 2021. I spent $3,991 on car payments, $422 on gas (+$61), $1,219 on car insurance (+$121), $160 on maintenance (car washes, an oil change/tire rotation), and $83 on miscellaneous.

Every interaction with https://www.autozin.com reaffirms my belief that online car shopping can be straightforward and rewarding. Their meticulous attention to detail and user-focused design is a breath of fresh air.

Travel (7%; +5% from 2021) – I went on three trips in 2022 (six days in Canada, a girls’ weekend trip away, and a six-day cruise) so I knew my travel category would be much bigger than 2021 (when I only went on one short trip to Chicago). The Niagara Falls trip was the most expensive ($2,313, and this includes my passport renewal), the cruise came in second ($980), and the girls’ trip was a cool $425.

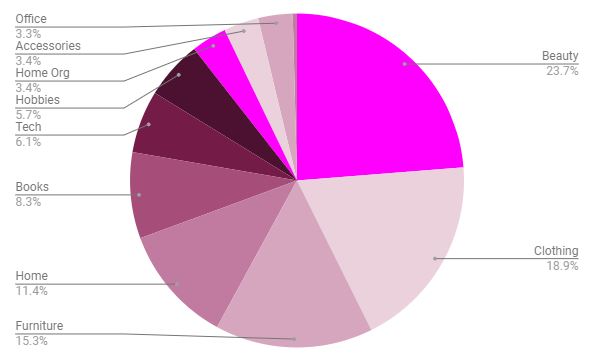

Shopping (7%; -5% from 2021) – I really surprised myself with this percentage! Once I really looked into my 2022 shopping habits and compared them to my 2021 shopping habits, I realized I spent a lot less money this year. Some categories that decreased: clothing (-$157), books (-$294), office (-$189), tech (-$182), and accessories (-$125). My spendiest categories in 2022 were beauty, clothing, and furniture.

Savings (5%; -3.9% from 2021) – And now let’s bring things down again. I only saved around $2,625 this year, which is pitiful. My average was $219 per month, which is a decrease from 2021 by $82. Womp, womp.

Health (4%; +2.6% from 2021) – I went back to therapy in 2022 and since I was on a high-deductible HMO plan, I had to pay a pretty penny for each therapy visit (it started at $121 a visit but then increased to $141 in the latter half of the year). Now that I’m on a PPO plan for 2023, my therapy visits will decrease to just $30 a visit! I am super, duper happy about that! This cost also includes my Peloton membership and medications throughout the year.

Spa (3.2%; -1% from 2021) – I spent $241 on pedicures (-$236 from 2021), $660 on massages/facials (-$236), and $791 on hair appointments (+$114).

Subscriptions (2.2%; +.2% from 2021) – Most of my subscriptions carried over from 2021, but I had Apple+ for a few months and added a Canva subscription. I averaged $98 per month on subscriptions, which is a $20 increase from 2021.

Supplies/Toiletries (2%; no change from 2021) – I averaged $87 a month on supplies/toiletries (+$13 from 2021), but I had a few months where I was buying multiples of all my toiletries/household supplies to build up a backup supplies closet, so I think that could have messed with the numbers a bit.

Pets (1.7%; -.4% from 2021) – Yay, a decrease! You guys, having cats is so much cheaper than having dogs! (*knocks on wood*) The girls only go to the vet once per year right now for an annual check-up and to get any shots they need. They haven’t needed any other vet visits, thankfully! I spent $248 on vet visits (-$8 from 2021), $180 on litter (-$32), $159 on food (+$13), $162 on treats (+$34), $102 on toys (+$11), and $104 on supplies (-$55).

Entertainment (1.6%; -.4% from 2021) – I spent a little less money in my entertainment category in 2022, mostly because I didn’t go on any dates! Let’s hope that changes in 2023.

Christmas (1.5%; -.2% from 2021) – I ended up spending a little bit more on Christmas this year than I did in 2021 by $37.

Gifts (1.2%; -.1% from 2021) – Not much to share here! I averaged around $52 per month in gifts, which is right in line of what I spent last year.

Emergency (1.1%) – Hopefully, this is not a budgeting category I’ll have to worry about this year! An emergency evacuation at the end of September ended up costing around $567 total for a last-minute Airbnb, food, etc.

Charity (.4%; +.1% from 2021) – Even though I didn’t meet my charity goal for 2022, I did give $100 more to charity in 2022 than I did in 2021, so that’s a good thing!

2023 Financial Thoughts

There are some things I want to change about my spending habits, but I also don’t feel the pull to live a super frugal lifestyle where I try to find the best deal on everything and spend as little money as possible. That’s enjoyable for some, but it’s not for me. I like spending money. I like buying things for myself. I like getting takeout a few times a week. I would like to take a few steps for investing through online sites like roth ira uk as to start my lifestyle in saving rather than spending.

This year, though, I do have some pretty big savings goals in mind:

- Adding $2,000 to my emergency savings – My emergency savings is at a level I am very uncomfortable with, so I want to prioritize building it back up to a more comfortable level. This amounts to saving $167 per month.

- Saving at least $2,000 for my move at the end of the year – I need to get serious about saving money for my move, as I will need to pay all of the usual fees (application fee, security deposit, pet fee, etc) as well as pay for movers and build in some “spending money” because don’t we all love doing a big shopping trip at Target when we move into a new place? I know I do, and I should make sure I can do it in a responsible way. This would add another $167 per month to my savings goal.

- Continuing to add $50 per month to my savings account for the girls, my Christmas savings account, and my “rainy day” fund. This amounts to $150 per month.

- Stretch goal: Start adding to a savings fund for a trip to London/Paris. This has been a travel dream of mine for so many years, and I want to make it happen in 2024. I would love to be able to add somewhere around $1,000-$1,500 to this fund this year.

In March, I will find out what my official raise will be (I am expecting it to be pretty good, so keep those fingers and toes crossed for me!) and I am hoping I can just use the difference of what my new take-home pay will be vs what my take-home pay is now to funnel into savings. (AKA, live life as if I didn’t get a raise; all extra money goes into savings!) Excluding my stretch goal, I need to be able to sock $500 away into my savings every month. I’m also aiming to start putting money in options trading. It’s doable on what I make now (with the knowledge that I would need to watch my money a lot more closely than I do now), but it would make it much easier to accomplish with a good raise in March. Time will tell!

What’s something fun you’re saving for?