Happy Friday, friends! It’s the end of the month, which means it’s time for another budget check-in. February was a bit of a spend-y month, as I let myself have a little more free rein with my budget because of the sweet tax refund that was deposited in my bank account early last week. Eh, it happens!

I’m still not quite sure I’m budgeting correctly. Scratch that. I know I am not. I am not really following specific parameters for different areas of my finances, which is something I really want to work on in March. It’s just sometimes hard to know when something unexpected is going to pop up! I’m thinking that implementing a cash budget system for “fun money” might help me be more mindful of how much money I’m spending. It’s always a lot harder to keep track of what I’m spending when I use cash, though. Any and all thoughts (well, please be kind, of course) are appreciated!

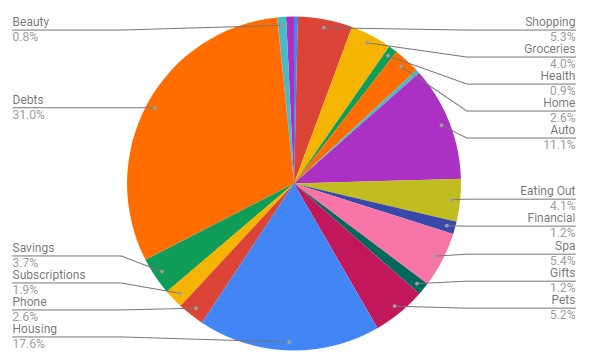

Anyway, here’s how my spending broke down in February:

Debts (31% – was 33.7% in January) – In the overall picture of my budget, paying off debt was slightly lower than last month but I put a larger chunk of money toward my credit card in February – $1,500 to be exact. (Thanks, tax refund!) This category also comprises my student loans.

Housing (17.6% – was 31.1% in January) – Most of my housing costs remained the same in February, but I didn’t have an Internet bill this month. I have no idea why! It’s really weird, but hey, I’m not going to question it.

Auto (11.1% – was 1.2% in January) – A much higher percentage of my budget this month because my biyearly car insurance was due. This category also included two gas fill-ups.

Spa (5.4% – was 1.1% in January) – I knew this category would be much higher in February because I had a hair appointment scheduled (highlights, cut, blowout—the whole shebang). This also includes a pedicure and the tip for my monthly massage.

Shopping (5.3% – was .9% in January) – Oof, shopping took a way higher percentage this month! This is mainly because I invested in two new bras from Thirdlove ($129 total). I also bought a necklace, two books, new shoes and a shirt for the mud race, a shirt for my book club’s photo shoot, a new purse, and a wallet. Eeks! Definitely need to be more mindful of my spending in March.

Pets (5.2% – was 3.1% in January) – Both girls had their annual vet appointments this month, so I knew this category would bump up a bit. When I had Dutch, he was on Banfield’s “insurance” plan so I never had to worry about paying for office visits, shots, etc., so I wasn’t sure what to expect with the cost of these vet appointments. I was pleasantly surprised! Two office visits and two shots (for Lila; Ellie wasn’t due for any) were around $200. This category also comprises a big bag of litter and a new carrier. (Previously, I was using a very bulky plastic kennel that was awkward to carry. Plus it takes up so much space! After using it for Ellie’s appointment and hating it, I splurged on this carrier that I can hang on my shoulder and folds up easily.)

Eating Out (4.1% – was 3.6% in January) – Lots of eating out this month, but the total percentage is less than I imagined. My food budget is something I’m constantly working on, mostly because I hate to cook and would much rather pick up takeout.

Groceries (4% – was 5.9% in January) – I spent less on groceries this month so that was nice. (But I also ate out more—it all balances out, I guess.)

Savings (3.7% – was 5.6% in January) – I’m pretty sure I saved around the same amount of money as last month, but it was less of my overall budget. This includes dropping $50 into a car savings account, $100 into my apartment savings account, and another $50 into my “no-spend” fund.

Home (2.6% – was 0% in January) – This wasn’t included in my January budget roundup because I didn’t buy anything for my apartment that month. But this month, I used part of my tax refund to buy a cordless vacuum. I also bought a desk organizer and these fun little hexagon-shaped bulletin pieces to hang up over the eventual desk I’m going to have in my room. (This is one of my big goals for March!)

Phone (2.6% – was 4.4% in January) – I spent the same amount on my phone bill this month as last month, but overall, it worked out to be a smaller portion of my budget.

Subscriptions (1.9% – was 2.8% in January) – Just like my phone, I spent the same amount in February as January, just shakes out differently percentage-wise. This includes my subscriptions to Netflix, Spotify, and PicMonkey; my massage membership; my Sephora PLAY! subscription; and the two podcasts I support on Patreon.

Financial (1.2% – was 0% in January) – Another new category for this month. This includes an interest charge on my credit card (ugh) and paying for TurboTax to do my taxes.

Gifts (1.2% – was 0% in January) – Yet another new category! 🙂 This month, I bought a little gift for my “gal”entine as well as a birthday gift for my nephew.

Health (0.9% – was 2.2% in January) – This includes my gym membership as well as some health essentials—ibuprofen, contact solution, and re-wetting drops for contacts. (I could have used my FSA card for the contact essentials, but I totally forgot to swipe the card when I was at Target. Oh well.)

Beauty (0.8% – was 1.3% in January) – This includes micellar water, face wash, toner, a new tube of mascara, BB cream, makeup brush cleaner, and a blending sponge.

Toiletries (0.8% – was 1.5% in January) – This includes many bottles of body wash (for bubble baths), conditioner, and mouthwash.

Donations (0.4% – was 0.6% in January) – My monthly $20 donation to Elizabeth Warren’s campaign.

Household supplies (0.4% – was 0% in January) – I bought toilet paper and a few bottles of hand soap.