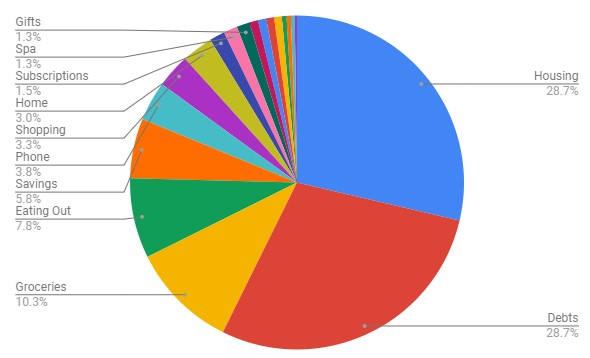

I wasn’t sure how my April budget was going to shake out. Sure, I was spending less money in some respects—no visits to the salon, no traveling, no random stops at TJ Maxx. But I was also pretty sure I was spending quite a bit of money on food (both groceries and UberEats) and online shopping. And sure enough, some of my categories are the highest they’ve been this year (while many others are the lowest!). Let’s review:

Housing (28.7% – $1,065 compared to $1,055 in March) – This comprises rent, water, electric, Netflix, and Internet. A little higher this month, but nothing crazy!

Debts (28.7% – $1,065 compared to $838 in March) – Student loans and a credit card payment. And with that payment, my credit card is all paid off. Woohoo!

Groceries (10.3% – $384 compared to $276 in March) – Whew, I knew my grocery budget was going to be much higher than usual because I’m buying more snacks, convenience foods, etc. That’s quarantine life for ya!

Eating Out (7.8% – $288 compared to $182 in March) – I ordered UberEats 12 times in March, ooooops. This number is slightly skewed, however, because it includes the tip paid to the driver and, when possible, I added a $5 donation to the restaurant I was ordering from. So this might be closer to $200.

Savings (5.8% – $215 compared to $185 in March) – I’m hoping this category gets a huge boost now that I’m not putting oodles of money toward my credit card. Time to start saving for a house!

Phone (3.8% – $142 compared to $142 in March) – Fixed expense, nothing to see here. 🙂

Shopping (3.3% – $122 compared to $88 in March) – Did a little more shopping this month than I expected! A new pair of flip-flops (Chip destroyed my only pair), a few e-books, a new Bluetooth shower speaker after my old one kicked the bucket, a cloth face mask from Etsy, and a new case for my phone since I upgraded to the iPhone 11.

Home (3% – $112 compared to $48 in March) – I bought a new desk and office chair! Much, much needed purchases.

Subscriptions (1.5% – $55 compared to $55 in March) – This includes Patreon, my Sephora PLAY! box, Spotify, and PicMonkey. It also includes my bimonthly subscription to Second Nature, which sends me an air filter every other month.

Spa (1.3% – $50 compared to $122 in March) – The only charge this month was my monthly massage membership. I probably should have put my membership on pause (which I still might do), but at least I’ll have a ton of massage credits to use when this is all over.

Gifts (1.3% – $47 compared to $20 in March) – A little something special for a friend!

Household supplies (.8% – $31 compared to $41 in March) – This includes toilet cleaner, light bulbs, all-purpose cleaner, and two bottles of dish soap.

Toiletries (.8% – $30 compared to $28 in March) – A new can of hair spray, three bottles of body wash, deodorant, toothpaste, and a new toothbrush.

Donations (.8% – $28 compared to $38 in March) – I sent some supplies to a local animal shelter (the same one I adopted Lila from!) when they sent out an Amazon wish list. (They anticipate getting a lot of kitties that will need to be fostered during the summer, especially since non-life-threatening spays/neuters have been halted due to COVID-19, so they asked for some much-needed supplies.)

Health (.8% – $28 compared to $22 in March) – I bought a new bottle of melatonin pills and didn’t realize until I was at the counter to pick up my three-month prescription of Lexapro that I didn’t have my FSA card with me, so I paid out-of-pocket, whoops. (Thankfully, it was only $20! Praise hands for generic drugs, man.)

Pets (.4% – $16 compared to $75 in March) – The girls were cheap this month. All they needed were treats. 🙂

Auto (.4% – $16 compared to $44 in March) – I filled up my gas tank for $16 (!!!!!!!!).

Entertainment (.4% – $14 compared to $0 in March) – This is embarrassing, but I need to admit it. I spent $14 this month on Candy Crush tokens. I CAN’T HELP MYSELF. (Okay, I can, but I choose not to.)

Beauty (.2% – $8 compared to $17 in March) – I bought a face mask (the skincare kind) and a small bottle of hand lotion.

Just want to make sure you know that you can get reimbursed by your FSA when you pay out of pocket! So if you haven’t done that, you should, if you still have the receipt!

I have not tracked our spending as closely this month because it feels like we just aren’t spending money… I think we are probably spending a bit more on groceries (I don’t have a firm grasp on that because Phil does our shopping and it’s on a credit card that isn’t in my mint account). But I think we are actually spending less on eating out. We get take out once a week and Phil gets lunch at work when he goes in 2-3 days/week. But I am no longer doing meals out with friends or book club (which was always an expensive meal as we went to nice restaurants and I always got wine with my meal). So I think in total, we are probably spending less overall? I did buy a slide this month but used an amazon gift card from my parents to offset the cost. And I am sure I will continue to buy more things for our yard to entertain Paul. And Phil bought a lawn mower as our old one didn’t have the self-propeller function. Our yard is on a steep hill so he really needs the self-propeller function to get up the hill!

CONGRATULATIONS ON PAYING OFF YOUR CREDIT CARD! ALL CAPS BECAUSE THAT IS AWESOME! Seriously, way to go!

Holy, holy crap re: $16 fill up. Whoa.

Random, but recommendation for a Blu-tooth shower speaker? We only have a shower at our house (grrrr) but lately I have been thinking that maybe having the option of listening to tunes in the shower might make me less salty about the whole thing.

I was going to point out too that you can get reimbursed for the out-of-pocket expense by your FSA.

Thanks for sharing your budget again. I really appreciate you being so open about it, because I find it superhelpful to see how others manage their money… and you hit some great milestones!

Oh man, that nice gas bill! We saved SO MUCH money on gas when we were home during the shutdown. I hate now that we’re back at work, we’re easily spending $50 a week between the two of us again.