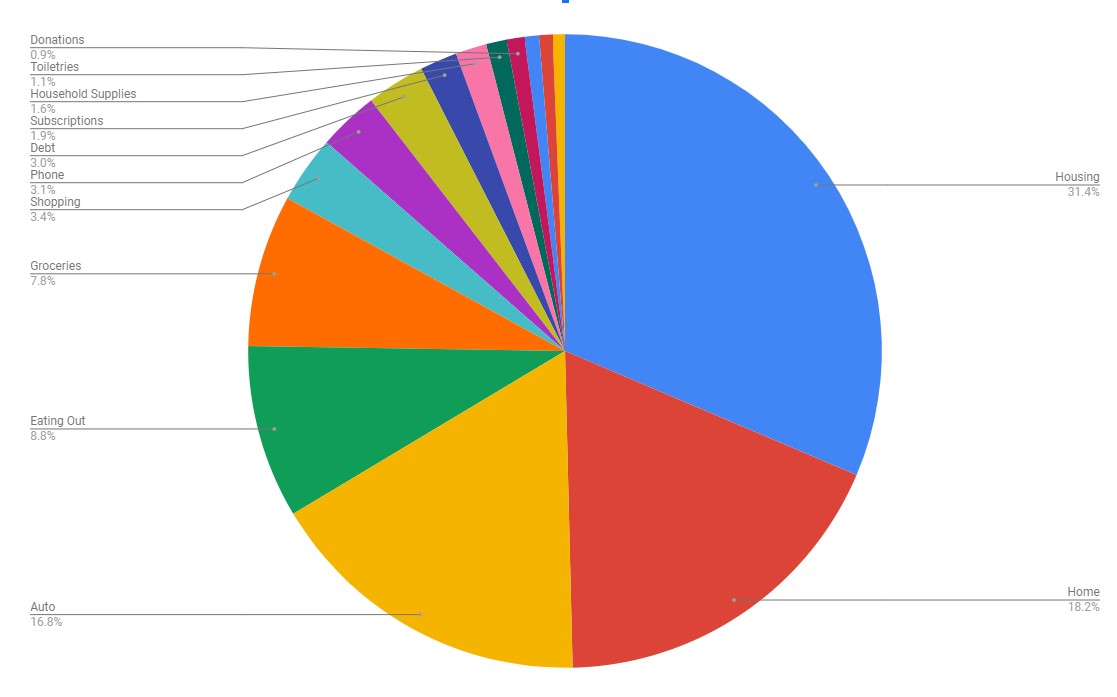

Well, well, well. August was a doozy of a month in terms of my budget, as I had my bi-yearly car insurance taken out and went a little crazy buying stuff for my new place. It happens! I knew August and September were going to be very spend-y months (and saved accordingly for that in previous months) and will hopefully get back to normal in October. But let’s look at what went down in August, shall we?

Housing (31.4% – $1,105 compared to $1,085 in July) – A little higher this month due to an expensive energy bill, which always happens this time of year with my AC running extra hard to compete with the 100-degree temps. This is my last month with a three-digit rent bill, too. I enjoyed it while it lasted!

Home (18.2% – $641 compared to $189 in July) – Eeks! This category got a workout this month, thanks to a new dining room table and a ton of other items for my new apartment, like some organizational systems and an electric drill.

Auto (16.8% – $591 compared to $46 in July) – My bi-yearly car insurance payment was due this month, which accounts for the higher-than-usual amount for this category. I also filled my car up with gas twice.

Eating Out (8.8% – $311 compared to $316 in July) – Well, at least my eating out budget was stable from July to August! There’s that silver lining, perhaps?

Groceries (7.8% – $273 compared to $278 in July) – Again with a nearly identical budget! Maybe this is my sweet spot for my food budget? I’d still like to get my food budget to a more reasonable number for one person, but eh, it is what it is.

Shopping (3.4% – $121 compared to $103 in July) – I bought a new pair of workout shorts, a nightgown, a new iPhone cord, a dry-erase board that I’m going to hang up in my office nook, a book, and some goodies from Bath & Body Works.

Phone (3.1% – $108 compared to $108 in July) – Fixed expense.

Debt (3% – $105 compared to $105 in July) – Eventually, I would like to start making a bigger student loan payment but just doing the minimum right now.

Subscriptions (1.9% – $67 compared to $49 in July) – Patreon, Spotify, Book of the Month, PicMonkey, and my bimonthly air filter subscription.

Household Supplies (1.6% – $56 compared to $43 in July) – I bought a plunger, dish soap, toilet paper, hand soap, and some containers.

Donations (.9% – $32 compared to $52 in July) – I donated to an Internet friend’s classroom wish list.

Moving Expenses (.7% – $26 compared to $0 in July) – Hopefully I won’t have too many moving expenses! This month, I bought four boxes and some packing paper.

Beauty (.7% – $24 compared to $0 in July) – My beauty category has been silent for months, but in August, I bought a new hairbrush, a makeup bag, and a pair of headbands.

Entertainment (.6% – $22 compared to $9 in July) – Candy Crush coins and I bought the ad-free version of another game I play constantly. I also had to pay for parking while downtown last week.

$0 categories in August: spa, pets, health, travel, gifts, and savings. I can’t believe I didn’t spend any money on the cats this month! That seems crazy to me, but the facts don’t lie. 🙂 I’m surprised (but not shocked) that I didn’t put any money into savings but it’s an expensive time right now. I imagine September will be similar as I get settled into my new place, but hopefully in October, I can get back to my savings goals.

You are so good at breaking down your spending in great detail. I use mint and while it gives me an idea of what I’ve spent, I couldn’t do a detail attribution like this! But knowing where you are spending your money is soooo important! We just met with a financial advisor through our company in August and his summary to us was that we really do not spend very much money. Phil was like – CHALLENGE!! Because he always thinks we can spend less but the advisor was like – trust me. You guys are doing a very good job in not spending money and saving. So that was nice to hear and I continue to bring this up to Phil. But the nearly daily Amazon packages do not make him feel like we don’t spend much! But I find myself ordering more from amazon because I try to avoid going to stores right now, even though masks are required, and I don’t want to add another errand to Phil’s list. So really, I’m doing him a favor by ordering things from amazon. Ha. If only he would see it that way!

Paul moves into a new room this month – early preschool (!!!) – so his tuition will go down by $30/week which is nice! But come April, Pedro (nickname for # 2- not the name we are choosing) will start at daycare so that expense will more than double. But it’s unavoidable. That is our #1 expense since our house is paid off now. I will totally say that we are extremely lucky to have paid off our house in < a year, but we put a lot down at closing, put all the money we made on our sale towards the house, and put bonus money/other savings towards the balance.

Ugh, moving is so expensive! Even when you’re not spending money on moving supplies or movers, you’re buying things you didn’t realize you didn’t have, or you’re buying new furniture & organizational stuff to fit the new space… But hey, soon you’ll be all settled!

I enjoy your budget posts so much and love your transparency. Moving definitely adds unexpected expenses to the budget, but I am sure this is all worth it 🙂