Happy Friday, friends! It’s the end of the month, which means it’s time for another budget check-in. February was a bit of a spend-y month, as I let myself have a little more free rein with my budget because of the sweet tax refund that was deposited in my bank account early last week. Eh, it happens!

I’m still not quite sure I’m budgeting correctly. Scratch that. I know I am not. I am not really following specific parameters for different areas of my finances, which is something I really want to work on in March. It’s just sometimes hard to know when something unexpected is going to pop up! I’m thinking that implementing a cash budget system for “fun money” might help me be more mindful of how much money I’m spending. It’s always a lot harder to keep track of what I’m spending when I use cash, though. Any and all thoughts (well, please be kind, of course) are appreciated!

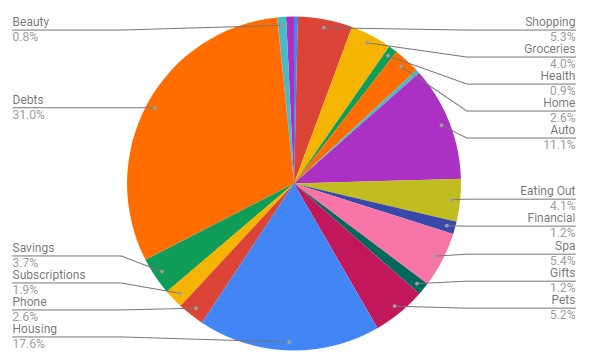

Anyway, here’s how my spending broke down in February:

Debts (31% – was 33.7% in January) – In the overall picture of my budget, paying off debt was slightly lower than last month but I put a larger chunk of money toward my credit card in February – $1,500 to be exact. (Thanks, tax refund!) This category also comprises my student loans.

Housing (17.6% – was 31.1% in January) – Most of my housing costs remained the same in February, but I didn’t have an Internet bill this month. I have no idea why! It’s really weird, but hey, I’m not going to question it.

Auto (11.1% – was 1.2% in January) – A much higher percentage of my budget this month because my biyearly car insurance was due. This category also included two gas fill-ups.

Spa (5.4% – was 1.1% in January) – I knew this category would be much higher in February because I had a hair appointment scheduled (highlights, cut, blowout—the whole shebang). This also includes a pedicure and the tip for my monthly massage.

Shopping (5.3% – was .9% in January) – Oof, shopping took a way higher percentage this month! This is mainly because I invested in two new bras from Thirdlove ($129 total). I also bought a necklace, two books, new shoes and a shirt for the mud race, a shirt for my book club’s photo shoot, a new purse, and a wallet. Eeks! Definitely need to be more mindful of my spending in March.

Pets (5.2% – was 3.1% in January) – Both girls had their annual vet appointments this month, so I knew this category would bump up a bit. When I had Dutch, he was on Banfield’s “insurance” plan so I never had to worry about paying for office visits, shots, etc., so I wasn’t sure what to expect with the cost of these vet appointments. I was pleasantly surprised! Two office visits and two shots (for Lila; Ellie wasn’t due for any) were around $200. This category also comprises a big bag of litter and a new carrier. (Previously, I was using a very bulky plastic kennel that was awkward to carry. Plus it takes up so much space! After using it for Ellie’s appointment and hating it, I splurged on this carrier that I can hang on my shoulder and folds up easily.)

Eating Out (4.1% – was 3.6% in January) – Lots of eating out this month, but the total percentage is less than I imagined. My food budget is something I’m constantly working on, mostly because I hate to cook and would much rather pick up takeout.

Groceries (4% – was 5.9% in January) – I spent less on groceries this month so that was nice. (But I also ate out more—it all balances out, I guess.)

Savings (3.7% – was 5.6% in January) – I’m pretty sure I saved around the same amount of money as last month, but it was less of my overall budget. This includes dropping $50 into a car savings account, $100 into my apartment savings account, and another $50 into my “no-spend” fund.

Home (2.6% – was 0% in January) – This wasn’t included in my January budget roundup because I didn’t buy anything for my apartment that month. But this month, I used part of my tax refund to buy a cordless vacuum. I also bought a desk organizer and these fun little hexagon-shaped bulletin pieces to hang up over the eventual desk I’m going to have in my room. (This is one of my big goals for March!)

Phone (2.6% – was 4.4% in January) – I spent the same amount on my phone bill this month as last month, but overall, it worked out to be a smaller portion of my budget.

Subscriptions (1.9% – was 2.8% in January) – Just like my phone, I spent the same amount in February as January, just shakes out differently percentage-wise. This includes my subscriptions to Netflix, Spotify, and PicMonkey; my massage membership; my Sephora PLAY! subscription; and the two podcasts I support on Patreon.

Financial (1.2% – was 0% in January) – Another new category for this month. This includes an interest charge on my credit card (ugh) and paying for TurboTax to do my taxes.

Gifts (1.2% – was 0% in January) – Yet another new category! 🙂 This month, I bought a little gift for my “gal”entine as well as a birthday gift for my nephew.

Health (0.9% – was 2.2% in January) – This includes my gym membership as well as some health essentials—ibuprofen, contact solution, and re-wetting drops for contacts. (I could have used my FSA card for the contact essentials, but I totally forgot to swipe the card when I was at Target. Oh well.)

Beauty (0.8% – was 1.3% in January) – This includes micellar water, face wash, toner, a new tube of mascara, BB cream, makeup brush cleaner, and a blending sponge.

Toiletries (0.8% – was 1.5% in January) – This includes many bottles of body wash (for bubble baths), conditioner, and mouthwash.

Donations (0.4% – was 0.6% in January) – My monthly $20 donation to Elizabeth Warren’s campaign.

Household supplies (0.4% – was 0% in January) – I bought toilet paper and a few bottles of hand soap.

I think it’s great that you put so much toward debt, even if it was slightly less than last month on a % basis. You may feel like you aren’t ‘budgeting right’ but at least you are getting a handle on your expenses! One thing I recommend, if you can swing it, is to set up your autodeposits at work so a certain amount goes to a savings account, ideally one that it takes a few days to get money from (like Capital One 360 or Ally). The more you can automate your savings, the better. You don’t really ‘feel’ that savings activity when it happens before the money hits your checking account – kind of how you don’t really ‘feel’ the deposits into your 401k (I think you started to put money in your 401k at work last year? I might be wrong about that).

Jealous that you already got your tax refund! We are waiting on a couple more documents before we can file (one of hubby’s T4s and my RRSP statement for the first 60 days). We always get a refund, too. I know some people think that’s bad — you know, blah blah interest-free loan for the government — but…I don’t care haha. I like getting a little chunk of change in the spring.

Re: fun money. I am actually looking at how I use my fun money, too. I’m currently trying out a system where I give my fun money tasks — which sounds like the opposite of fun but it has helped. For example, in February, I stashed some in a TFSA, some in general savings and gave some to a charity and saved some in regular savings (since I’m doing the shopping ban). I also added a bit to my Starbucks card. Might not sound like the most fun way to use my fun money but I found it helpful to know I had ideas for how I wanted to put that cash to use.

Curious about your thoughts on the ThirdLove bras! Bras are such a pain in the butt to shop for so I’m always on the lookout for good ones.

That’s so great that you were able to put so much towards debt!

Why do you think that you’re not budgeting correctly? I think as long as you’re not adding more debt, you’re doing fine.

One misconception about budgeting is – and I am not saying that you have this misconception – that people think every month needs to look the same. Obviously, many expenses will vary from month to month. Budgeting means that you’re planning for that. (In YNAB terms, it means that you “wam”(whack-a-mole”) from one category to cover expenses in another. Flexibility is key.

Of course, it’s also smart to save in a category for unexpected expenses. But as long as you don’t spend more money than you have, you’re already way ahead of a lot of people 😉

Oooh, we’re waiting for our tax refund and can’t wait! LOL