Hi, friends! Happy Friday! I disappeared from the blog this week—just couldn’t get my life together to put up a post on Wednesday. Ah, it happens.

Today, I wanted to start a new monthly series, detailing my monthly spending habits. I am trying to be a better manager of my money than I have ever been, which means learning to break bad habits (like eating out when I have perfectly good meals at home, or not checking my bank account for over a week) and reframing the way I view money and spending. Stuff to talk about in therapy, ya know.

This post will serve as a baseline for where I’m at today. Going forward, I’ll be able to compare numbers month to month, which will help me figure out what areas I need to cut back in. I use an old-school spreadsheet to keep track of my money because that system works better for me than any sort of online tool. (Believe me, I’ve tried ’em and there’s just something about creating my own system that makes it feel more meaningful.)

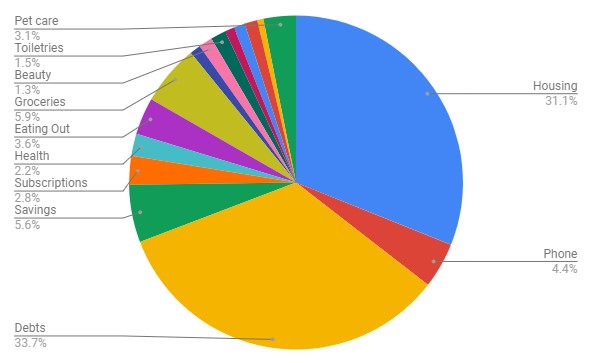

Debts (33.7%) – This number is comprised of credit card payments and student loan payments. It’s the biggest part of my budget because I put $950 toward my credit card in January (praise hands for three paycheck months!). I still have a ways to go but I’m crossing my fingers that I can get it done in February, depending on the amount of my tax refund.

Housing (31.1%) – Rent, electric, water, and Internet. My housing expenses are going to go wayyyy up starting in September so I’m enjoying the low rent while it lasts, haha.

Groceries (5.9%) – My grocery expenses were fairly low this month, which is unexpected but quite nice! I’m interested to see how this fluctuates from month to month.

Savings (5.6%) – I’m saving $100 a month for apartment expenses, $50 a month toward a down payment on a new car, and throwing $5 into a “rainy day” account every time I have a no-spend day. Currently, I have $40 in that account!

Phone (4.4%) – Fixed expense. My phone bill is high because I’m paying off my iPhone, blah.

Eating Out (3.6%) – This includes fast food, those trips to Publix for a sub, and only one or two times I went out with friends.

Pet care (3.1%) – This includes food, litter, toys, and treats. I buy food and litter every other month, but February will be much more expensive as the girls are due for checkups at the vet.

Subscriptions (2.8%) – Netflix, Spotify, my Sephora PLAY! box, my massage membership, and PicMonkey.

Health (2.2.%) – Gym membership and a $50 copay for my orthopedic. Typically, I won’t have medical charges to worry about since I have an FSA but this appointment was in early January and I hadn’t yet replaced my old FSA card with the new one, oops!

Toiletries (1.5%) – This includes body wash, shampoo, conditioner, deodorant, a new toothbrush, and toothpaste. And maybe some other things that are slipping my mind!

Beauty (1.3%) – Foundation, setting powder, moisturizer, and maybe a few other items.

Car (1.2%) – Only had to fill up my tank twice this month. Does cold weather help a car use less gas? Because yo… I usually have to fill up weekly.

Spa (1.1%) – A pedicure! This category will be much bigger in February as I have a hair appointment that will include highlights, a cut, and a blowout.

Shopping (.9%) – I didn’t do a lot of shopping in January, coming off Christmas and all that. A new t-shirt, an e-book, a new lunch box, etc.

Donations (.6%) – I’d like to devote at least $20 a month to charity/donations, something I’ve really never done, and this month I donated to Elizabeth Warren’s campaign. 🙂

Good for you! I love that you created your own system.

I’m looking forward to your updates!

I believe in you!

You’re going to learn so much about yourself just by looking at your spending each month and comparing the fluctuations. 🙂 Excited to see how your journey goes!

Woo-hoo $950 toward your credit card! That’s awesome!

I’m also an old school spreadsheet user when it comes to our money. Finding — and using — the system that works best for you is so important.

Looking forward to those monthly updates!

I love these kinds of posts and good for you that you found a system that works for you.

And amazing that you were able to put so much towards credit card debt this month!

Being successful at tracking money is all about finding a system that works! So if that is a manual spreadsheet then that is great! I think the more work you have to do to track your spending, the better you will understand your spending since you are figuring out where every dollar goes!

My phone bill just went down last money and I was like – what happened?? Then I realized my phone was paid off. Wahoo! I get $60 from my company for my phone as I have to use it for work so now that covers all but $3 of my phone bill. Woohoo!!

January was a less expensive month for us compared to the last several months as we didn’t buy any furniture and had less house-related expenses. But we still have to figure out what is going on with our shower so we may have some expensive months ahead of us. :/

I’d love to hear more about the system you use to keep track of your spending & budgeting. I’m having a hard time with all the apps & sites I’ve tried… nothing feels right!

Super fun! I love reading finance posts like this. I started using YNAB in January of last year and it has totally transformed how I spend money. I kind of sort of tracked where my money went before that (in a very half assed way if I’m being honest) but I now track EVERY SINGLE expenditure and also budget for ALL of my money. It’s been really eye opening for me and I did pretty good with my spending last year and hoping to do even better in 2020. If all goes well, my car loan will be paid off by the end of 2020 which will mean I paid off an $18,000 loan in two years while still managing to save, something I’ll be pretty proud of if I do manage to make that happen and definitely would not have happened if it wasn’t for diligently tracking my money!