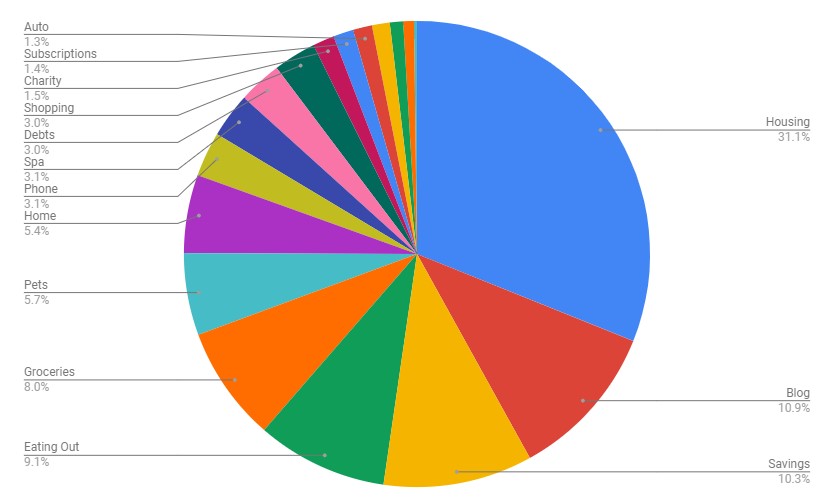

Hello, friends! I have the last of my monthly wrap-up posts for you today, going over my budget for July. I feel like the next few months are going to be spendier than usual with the move, but it’s all good! That’s what savings are for. 🙂 Let’s dive into my budget breakdown:

Housing (31.1% – $1,085 compared to $1,065 in June) – Rent, electric, water, Internet, and Netflix. Nothing too crazy to report here!

Blog (10.9% – $378 compared to $0 in June) – I bought a new blog design and then had to pay my hosting fees. I make a bulk payment every three years, which amounts to about $10 a month, which is pretty sweet. (I use HostGator and I recommend them!)

Savings (10.3% – $360 compared to $450 in June) – Another good month of saving for me! I put money into my no-spend fund, my car fund, and my emergency fund. Yay!

Eating Out (9.1% – $316 compared to $249 in June) – Oof. My eating out budget is always one of my highest categories and it was no different in July. Just so easy to scroll through Uber Eats for something yummy to have for dinner rather than cooking myself!

Groceries (8% – $278 compared to $242 in June) – Eeks, went a bit overboard with groceries this month. I’m not sure why! More convenience foods, maybe? I’ve gotten soooo lazy in the cooking department. It’s a problem.

Pets (5.7% – $198 compared to $51 in June) – I bought litter, treats, and a toy for Chip that he destroyed in five minutes. Eloise was also due for shots.

Home (5.4% – $189 compared to $0 in June) – Bring on the purchases for my new apartment! Whew… this category is going to get a workout over the next few months. Some of my purchases: a set of three Mixtiles, two of these divided organizers, a new filing box, and a new set of water glasses.

Phone (3.1% – $108 compared to $82 in June) – I believe $108 is going to be the standard monthly price for my phone bill now. Who knew that trading in a phone and getting a new one would result in so many credits on my account?!

Spa (3.1% – $108 compared to $0 in June) – A pedicure and hair appointment.

Debts (3% – $105 compared to $105 in June) – Monthly student loan payment.

Shopping (3% – $103 compared to $99 in June) – I bought some books, face masks, office supplies, markers, and another Chatbook of the girls.

Charity (1.5% – $52 compared to $0 in June) – I donated to the Loveland Foundation, which provides financial assistance to Black women seeking therapy services, as well as the Florida Rights Restoration Coalition, which helps pay the fines and fees of returning citizens (formerly incarcerated people).

Subscriptions (1.4% – $49 compared to $65 in June) – Patreon, Book of the Month, PicMonkey, and Spotify. A little less this month since I didn’t have my bimonthly air filter payment.

Auto (1.3% – $46 compared to $18 in June) – I filled up my gas tank once and also got an oil change.

Household supplies (1.2% – $43 compared to $17 in June) – I bought toilet paper, batteries, and dish soap, as well as a new Brita filter.

Gifts (.9% – $32 compared to $49 in June) – I bought a gift bag, a card for my mom’s birthday, and a gift card for a friend’s birthday.

Toiletries (.7% – $26 compared to $20 in June) – Lots of bottles of body wash and a bottle of mouthwash.

Entertainment (.2% – $7 compared to $9 in June) – Candy Crush! 🙂

$0 categories in June: beauty, health, travel, and tech.

You are so good at tracking this stuff and knowing where your money is going. Which is really important as having a handle on your spending is so important. I monitor our spending in mint but now that I kind of know what we spend each month, I don’t pay AS close attention as I used to. I did get Phil to add in all of his accounts last month so now I have more of a full picture of our spending.

Overall I feel like we haven’t spent much during COVID since we aren’t going anywhere/doing anything in general. Ha! We get take out more often but don’t go to restaurants so it all balances out and I no longer get lunch once a week. Which I sorely miss, but I hate to pay for delivery for a lunch/week as it’s kind of pricey… But I don’t usually have time to go pick up food either as I’ve been especially busy the last several months! But I want to try to leave and go get lunch every other week or something like that to give myself a treat/get out of the house!

August will be a pricier month for us, though, as we are getting a bunch of interior walls painted while we are on vacation. And we had an expensive June as we redid our deck and had to buy a new fridge!

I was reading People magazine (July 20th issue), on the ‘one last thing’ page they feature a celebrity with a potpourri of questions. Charlize Theron was the one for this week. When asked “Last game I played,” she responded that she always plays Candy Crush on her phone. Her level – 4,247. I don’t play myself (I had to uninstall cookie crush from my devices when I realized I was wasting hours) but I have to imagine that is a high level. It immediately made me think of you and your self-proclaimed addiction. Do you have her beat on levels? 🙂

I love looking at other people’s budgets. I envy your grocery bill. I know you’re cooking/buying for yourself, but man, I cannot imagine only spending $280 on groceries every month. I spent more for two weeks than that. (Granted, Jon eats a lot. LOL )

I love reading these! It’s amazing that you so carefully track everything like this. I really should try it too. Can’t wait to see the new place… so soon! Eeeek!