I wasn’t sure if I should put together my regular end-of-month posts—is it really necessary right now? But I decided to do so because I need a little bit of normalcy in this very abnormal time. I’m craving it. I need a semblance of a routine again. So I will be setting goals for April and recapping March and, of course, reviewing my March budget, as today’s blog post is about.

March’s budget started off pretty normal, but things quickly shifted once stores and restaurants shut down and we all started hoarding toilet paper. One important thing to note in this recap is that I’ve decided to start sharing raw numbers because I feel like it allows me to see the bigger picture of my money. Percentages would be fine if I was doing this quarterly or yearly, but on a month-to-month basis, sharing the actual money spent is more impactful. (It’s also much easier for me to do this since I’m not sharing finances with anyone!) So, anyway, let’s review my March budget:

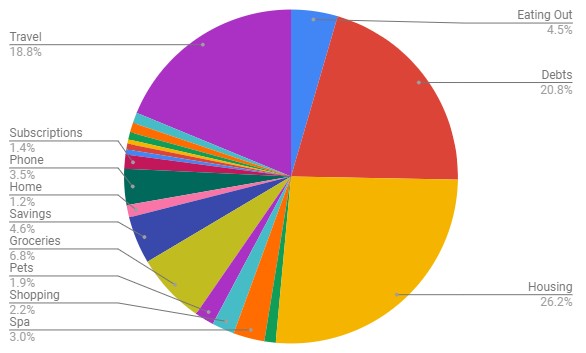

Housing (26.2% – $1,055 compared to $980 in February) – Housing costs were slightly more this month since February’s final budget didn’t include my Internet bill as I overpaid in January (oops). This includes rent, utilities, Internet, and Netflix. Happy that my housing is less than 30% of my overall budget!

Debts (20.8% – $838 compared to $1,688 in February) – This includes school loan payments and the $650 I put toward my credit card. My credit card should be paid off in April, so that’s good news!

Travel (18.8% – $757 compared to $0 in February) – A new category! I didn’t spend any money on travel in January or February. This includes a flight to New Orleans, half of the hotel reservation, my portion for the Airbnb we stayed at last weekend, and groceries for the weekend. Of course, the New Orleans trip is no longer happening but we got a credit for the flights/hotel so we’re holding out hope we can plan for a late summer/early fall trip.

Groceries (6.8% – $276 compared to $219 in February) – Spent more on groceries because I was trying to stock up more this month, especially near the end.

Savings (4.6% – $185 compared to $200 in February) – I put a little less into savings this month, mostly because I haven’t paid attention to putting money into my “no spend” fund. I want to get back to tracking my no-spend days in April! This includes putting $100 into my apartment fund, $50 into my car fund, and $35 into my “no-spend” fund.

Eating Out (4.5% – $182 compared to $219 in February) – Less eating out, obviously, in March with restaurants closed and safe-at-home orders in effect. And I’m not eating fast food—a goal I set for myself in March and didn’t deviate from even with the pandemic! I had a few meals out with friends in early March and then quite a few UberEats orders.

Phone (3.5% – $142 compared to $142 in February) – Nothing to report here! My phone bill is higher than most because I’m leasing a phone. Ugh.

Spa (3% – $122 compared to $343 in February) – This includes a blowout, my Hand & Stone massage membership, a tip after a massage, and a pedicure. Will probably be a nonexistent category in April!

Shopping (2.2% – $88 compared to $288 in February) – Not much shopping this month! I bought a new wallet, a cardigan, an extra book to put in my Book of the Month box, a wireless charger for home, a Yeti Rambler cup for home, and an e-book.

Pets (1.9% – $75 compared to $283 in February) – I bought two containers of treats, food, and a new scratching pad.

Subscriptions (1.4% – $55 compared to $39 in February) – This includes my PicMonkey subscription, Spotify, the podcasts I support on Patreon, my Sephora PLAY! box, and my Book of the Month subscription.

Auto (1.1% – $44 compared to $604 in February) – Only needed to fill up my gas tank twice in March!

Home (1.2% – $48 compared to $141 in February) – I bought three photos on Mixtiles, a wall holder for my Google Home mini, and an extension cord.

Household supplies (1% – $41 compared to $20 in February) – I picked up toilet paper and a two-pack of Lysol wipes, right before things got really apocalyptic. This category also includes laundry detergent and a few extra bottles of hand soap.

Donations (.9% – $38 compared to $20 in February) – I donated to my nephew’s school as he participated in a jog-a-thon. I donated $1 per lap and homeboy did 38 laps!

Toiletries (.7% – $28 compared to $41 in February) – I stocked up on body wash so I can continue my nightly bubble baths, even more necessary for my well-being now. This category also includes mouthwash and micellar water.

Health (.5% – $22 compared to $48 in February) – This only includes my gym bill.

Gifts (.5% – $20 compared to $66 in February) – I bought my fur-brother a new toy and his favorite bully sticks for his birthday!

Beauty (.4% – $17 compared to $46 in February) – Woooooo… this category has never been this low! I picked up foundation, setting powder, and a new brow pencil. I haven’t worn makeup in weeks so who knows if this category will even show up on my April budget!

I think it’s important to still post these kind of things, for normalcy, like you said, and the routine is soothing. We can’t only talk about COVID-19. Please, let’s not.

It will be interesting to compare this to next month, like you said, and see what drastically changed due to what is going on right now.

Are you still thinking about getting a Chromebook?

Congrats to your nephew on all those laps!

I also like to see “normal” non-Covid related posts. I like the Covid updates, too, but it’s nice to have some normal content, too. Nice work on not getting fast food last month! Well done! My spending has really shifted, too. I’m not buying my weekly coffee anymore or getting lunch out once a week like I normally would. We are getting take out one night a week to support local businesses so that has been a nice break from making dinner/eating leftovers. I have only worn make-up one day since I started working from home on 3/13. That was on a day when I had to conduct a training on webex and they asked that I use my video feature to increase engagement. I will barely use any make-up this year, I think, and I also will be using less face cleaning products because I’m not as great at my face cleaning routine when I’m not wearing make up! I probably should still do my routine but it feels pointless/less important since I’m not wearing make up!

Normalcy is the main reason I decided to go ahead with some of my regular posts/some of the other posts I’ve been planning. It feels odd, but I’ve also found it helpful.

YAY FOR ALMOST BEING DONE PAYING OFF YOUR CREDIT CARD! That’s awesome, girl!

We’ve also been spending a LOT less in gas. I think we’ve filled the tank once in the last like, three weeks. Wild. Also, I’m also in the have-not-worn-makeup-for-weeks club #workfromhomelife.

Also, whoa re: your nephew doing 38 laps! Impressive!

I am glad you’re keeping up with some normal blog posts (I, for one, can’t muster the energy right now, although I do not want to just stay silent and update every couple of weeks – what to do??).

I love your budget updates and also that you’re sharing raw numbers. It’s super-helpful to know what other people are working with. Part of me wants to lay it all out there too. Percentages can be deceiving sometimes. Let’s just say, I wish housing was under 30% for us… our rent is so expensive 🙁

It sounds like you had a good, successful month though, partly due to everything shutting down. ha. It does help to not spend money.

I love how you have super specific categories and nail them each down to the dollar. This is such a good way to track spending and for accountability. I need to get my fun spending more under control, and this kind of stuff is such a good motivator for me! Thanks for sharing.