Another month, another budget update! I’ve been thinking about whether or not I want to continue these monthly budget updates in 2021. Is it really necessary to list out everything I’m buying in such a detailed way? While it’s helpful for me to see my spending habits and all of this data will be used to create a much more robust budgeting system that actually works for my lifestyle (for example, budgeting $250 a month for food is LAUGHABLE), I am not sure I want to continue with this style of budget updates. Maybe I will, or maybe I’ll figure out a different way to talk about my finances in 2021. We’ll see!

For now, let’s dive into the numbers from November!

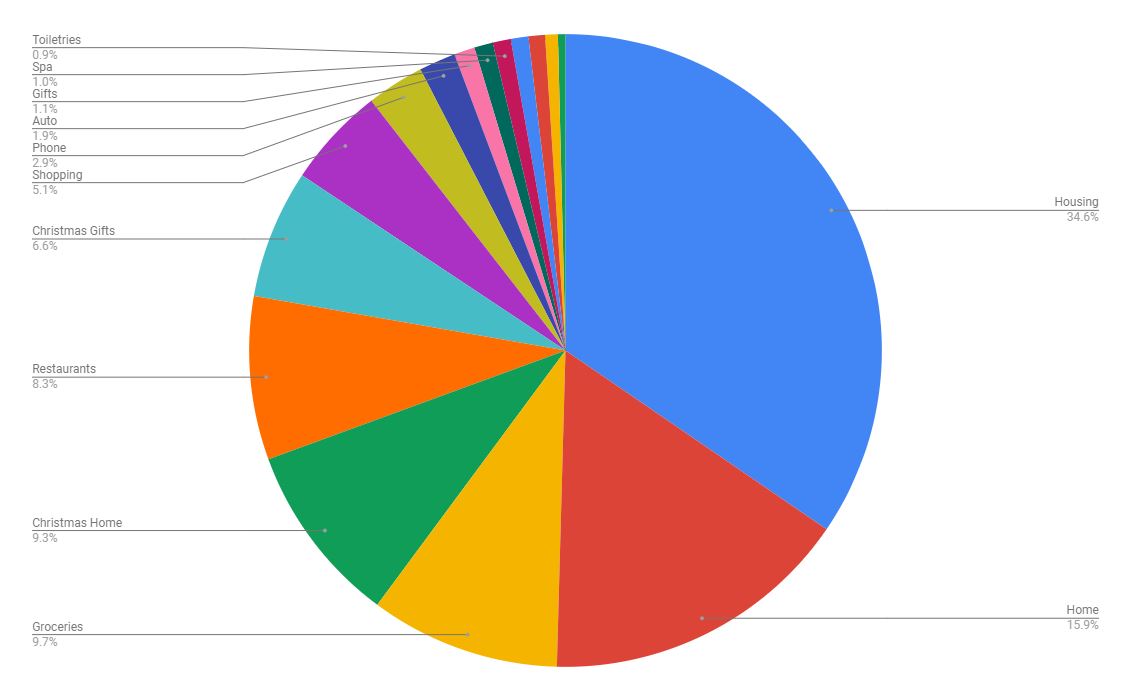

Housing (34.6% – $1,271 compared to $1,094 in October) – This will be my more normal housing budget going forward. Rent, electric, water, Internet, and Netflix.

Home (15.9% – $584 compared to $20 in October) – A much more expensive month on the home front. I bought a new dining room table and bookshelf, as well as a candle.

Groceries (9.7% – $357 compared to $298 in October) – I spent a lot on groceries this month, much more than I have been spending lately. I’m not quite sure why! Perhaps I did more grocery store visits this month than usual? I tend to go two times a week, but I think I was going more often in November for some reason.

Christmas Home (9.3% – $341 compared to $0 in October) – I’ve never, ever kept track of my Christmas purchases so good thing I’m dissecting my spending habits this year! I spent $341 alone on just decorations. Of course, $215 of this was my Christmas tree, which will last me for at least a few years. I also spent $25 on new stockings (I finally have stockings for the girls!), $13 on a holiday doormat, and nearly $80 on ornaments. (Oops. My new tree is so much bigger than my old one that I needed more! Eighty dollars worth of more? Probably not.)

Restaurants (8.3% – $307 compared to $334 in October) – Another spendy month for restaurants. But that’s just the way it goes for me!

Christmas Gifts (6.6% – $242 compared to $0 in October) – I am nearly finished with my Christmas shopping! I think I’ll maybe spend $100 more? Like I said, I have never kept track of how much money I spend on Christmas (which means I’ve never had a Christmas budget). I’m glad I’m doing that now so I can actually start a sinking fund for Christmas in 2021!

Shopping (5.1% – $189 compared to $84 in October) – I bought a handful of books (three e-books, four print books), five pairs of underwear, a coloring book, some face masks, and two Chatbooks.

Phone (2.9% – $108 compared to $108 in October) – Fixed expense.

Auto (1.9% – $69 compared to $31 in October) – I filled up my gas tank twice and bought new windshield wipers.

Gifts (1.1% – $39 compared to $60 in October) – A friend’s baby turned one so I bought some fun gifts for her! 🙂

Spa (1% – $35 compared to $78 in October) – Tips paid to my massage therapists (I got two massages in November).

Toiletries (.9% – $34 compared to $50 in October) – I bought mouthwash, shampoo, deodorant, and a few bottles of body wash.

Subscriptions (.9% – $33 compared to $70 in October) – Just Patreon, Spotify, and PicMonkey this month!

Entertainment (.8% – $31 compared to $10 in October) – Parking downtown and way too many credits on Candy Crush.

Beauty (.7% – $24 compared to $0 in October) – I bought an eyeshadow palette, a new hairbrush, and a blending sponge.

Pets (.4% – $14 compared to $50 in October) – A small toy and a set of disposable litter boxes (panic-bought when I was worried about needing to evacuate due to Hurricane Eta).

$0 categories in November: household supplies, health, donations, travel, savings, and debt payments.

I love your budget breakdowns – it is so fascinating to see how other people spend money.

For what it’s worth, I feel like groceries are more expensive, both since the pandemic began and now that it’s fall. That may be different state to state though, but you aren’t alone in spending more on groceries!

FWIW, what you track is what you achieve. If you want accountability for how you are using your money, your posts will help. Remember, your time becomes money. But you can’t turn money back into time.

I actually love how you break down your monthly updates. Even though I don’t manage our overall finances, I need to keep better track of how I spend money. (A lot of it, I know, goes to groceries… of course…)

I’ll read whatever you put up, though. And it would be super interesting to know how all these data influence your revised / adjusted budget, if you’re willing to share!

I can see how it’s a ton of work to do this every month but probably super eye opening for you. And it’s interesting for me to read as we all spend money so differently. Consider the Christmas decor an investment. I am not sure when I bought my tree but it was definitely 2012 or earlier because I remember it being packed when I moved to CLT in 2013! So it will likely last for many years! Same goes for ornaments. I bought mine in 2004 and still love and use them. We add to them over the years but I have barely spent any since that first year!

I, for one, enjoy these budget updates. More people should be more open about their finances IMHO, but if you want to switch up the format, I’d be totally on board with that. I’ve done quarterly updates in the past and that worked well. Monthly updates are a ton of work…. but whatever you do, please keep sharing your view on finances. I think it’s a great conversation to have with each other.