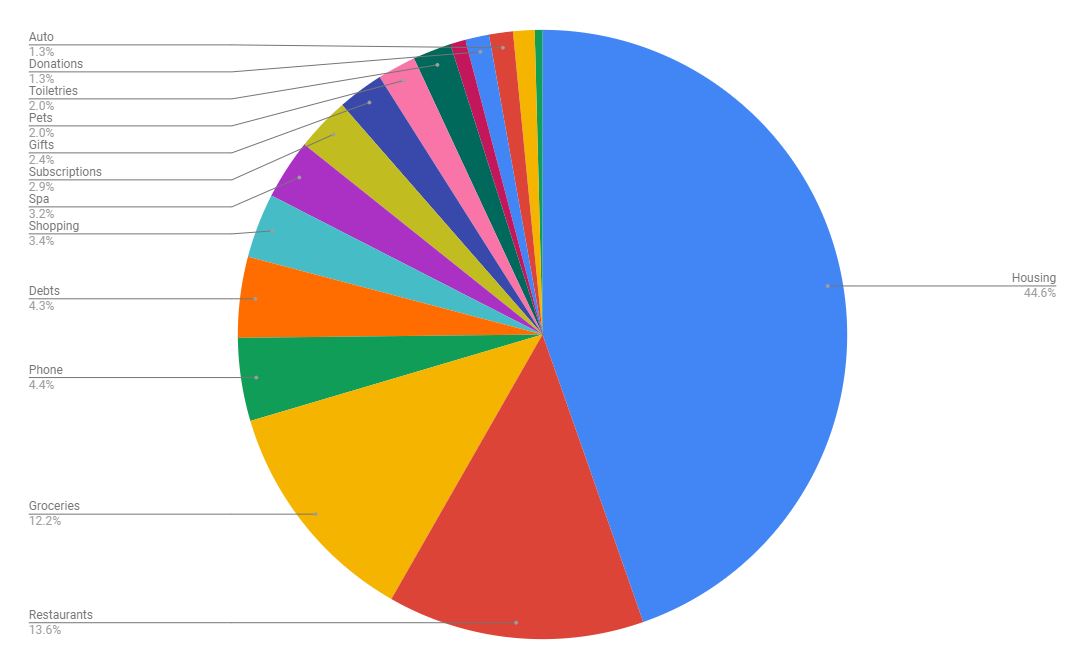

Happy Friday, friends! I am FINALLY recapping my budget for the month of October. (Super delayed!) It’s been quite a crazy November already (I can’t believe it’s only the 13th; this month has felt three months long). October was way less spend-y than August and September, so woohoo for no more crazy moving expenses! Here’s how my budget broke down in October:

Housing (44.6% – $1,094 compared to $1,623 in September) – Housing took up a much bigger slice of the pie this month, but I spent much less overall. I received a credit on my rent, so I paid about $200 less than I was expecting, so that was a really nice surprise! However, I did have to pay a lot more for my electric bill, as I was paying for the electric at two places for about 9 days. (Around $137 in total, so not too bad!)

Restaurants (13.6% – $334 compared to $298 in September) – Y’alllllll. I can’t believe how much I spent on restaurants this month. This total includes several $30+ meals plus spending $25 to fill up my Starbucks card, but damn.

Groceries (12.2% – $298 compared to $280 in September) – You guys! I forgot to account for this category last month. Oops! My grocery budget has remained fairly steady over the past few months, though, so that’s a plus! Ideally, I’d love to get this number lower but I’m just not certain I’m willing to make the sacrifices to do that. #realtalk

Phone (4.4% – $108 compared to $108 in September) – Fixed expense.

Debts (4.3% – $105 compared to $105 in September) – Fixed expense.

Shopping (3.4% – $84 compared to $129 in September) – I bought a book (I technically bought it in September, but I didn’t get charged until October), a set of Etsy prints, and paints from Michaels.

Spa (3.2% – $78 compared to $216 in September) – A tip for my massage therapist, a pedicure, and a haircut.

Subscriptions (2.9% – $70 compared to $69 in September) – Patreon, Spotify, PicMonkey, and my air filter subscription. I also got dinged for another Daily Burn payment, after which I canceled my subscription.

Gifts (2.4% – $60 compared to $94 in September) – Two birthday cards and two gift cards for two friends. 🙂

Pets (2% – $50 compared to $117 in September) – An easy month for the girls! I bought litter, treats, and a toy.

Toiletries (2% – $50 compared to $42 in September) – I bought a new toothbrush, toothpaste, shampoo, and MANY bottles of body wash for my bubble baths.

Donations (1.3% – $31 compared to $25 in September) – My donation to the kitty catfe to pet kitties!

Auto (1.3% – $31 compared to $18 in September) – I filled up my car with gas once and went through the car wash.

Household Supplies (1.1% – $28 compared to $73 in September) – Nothing crazy here. I bought two bottles of dish soap, toilet paper, and Scotch tape.

Home (.8% – $20 compared to $670 in September) – Ahh, now that’s more like it! I only bought Command strips to hang up my gallery wall.

Entertainment (.4% – $10 compared to $25 in September) – I paid for parking downtown and bought some coins on Candy Crush.

I think your grocery budget seems really reasonable. That a budget category that I don’t pay too much attention to because to cut costs, we’d have to eat differently. I bet it felt good to have the home category come down after an expensive few months!!!

Your grocery budget does seem totally reasonable. Our is about twice that and we have two people, so I think you’re doing great!

I think your grocery budget is absolutely reasonable. I often wonder where my grocery budget would be if I only shopped for myself (Jon’s a big eater LOL) but we are easily spending 2.5x of what you’re spending.

I love how despite a higher rent, you still have a pretty reasonable number in housing expenses. Rent is SO freakin’ expensive here.

Love your budget updates. I also think your groceries are reasonable. I don’t eat out – maybe once in a blue moon – so my monthly bill approximates your restaurants + grocery for a month (well, including other stuff at Target, so it’s a bit less, but that makes sense since I don’t tip at the grocery store or Target!). You have to eat. Buying food is kind of required. Kind of like paying the dang electric bill. I’m just always impressed at how you make changes based on fluctuations and month-to-month needs.