It’s time for September’s monthly budget update, and I was very nervous about putting this post together. September was a very spend-y month with the move and figuring out what I needed to buy for the new place. There were some furniture purchases and lots of odds-and-ends. It was an expensive month for sure. So, let’s look at the damage:

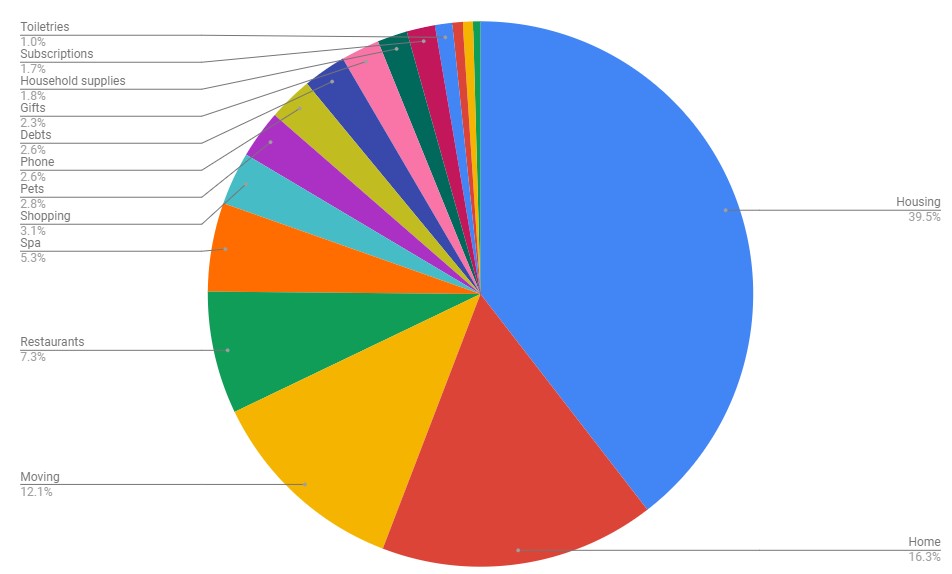

Housing (39.5% – $1,623 compared to $1,105 in August) – Whew. It was a big month for the housing category. My rent was nearly $400 more since I was paying for two apartments for an eight-day period and my annual payment for renter’s insurance was due.

Home (16.3% – $670 compared to $641 in August) – Another insanely expensive month on the home front, as I bought a lot of new things for the apartment. The bulk of this total is my new dresser, TV stand, and desk. Other items include a ceiling fan, throw rugs, a doormat, organizing baskets, a silverware sorter, a dish drainer, a lamp… I could go on, but let’s leave it there.

Moving Expenses (12.1% – $495 compared to $26 in August) – The bulk of this total is made up of the pet fee I had to pay to move into the new place. I also paid my brother for moving all of my furniture.

Restaurants (7.3% – $298 compared to $311 in August) – Honestly shocked that I spent less on restaurants this month than last month. I am A-OK with this total.

Spa (5.3% – $216 compared to $0 in August) – I thought it was weird that months had gone by without being charged my monthly fee for my massage membership. Turns out, my card had expired. Whoops! I had to play catch up with my subscription this month, which equated to three payments. I also got a pedicure.

Shopping (3.1% – $129 compared to $121 in August) – Most of my shopping was directed toward home purchases, but I still racked up a bit of a total this month. This total includes books and an Old Navy online purchase (two shirts, a pair of shorts, and a packet of face masks). I also bought a new laptop stand and wireless keyboard (but I maaaay end up returning these since I just found out that my work may be allowing us to bring home our work computers—finally!)

Pets (2.8% – $117 compared to $0 in August) – It was an expensive month for the cats after not spending any money on them in August. This category includes food, treats, litter, a new mat for one of their litter boxes, and a mat for their food/water.

Phone (2.6% – $108 compared to $108 in August) – Fixed expense.

Debts (2.6% – $105 compared to $105 in August) – Fixed expense.

Gifts (2.3% – $94 compared to $0 in August) – A big month for birthdays! My brother, my nephew, and a good friend all celebrated birthdays.

Household supplies (1.8% – $73 compared to $56 in August) – I bought trash bags, dish soap, toilet paper, laundry detergent, hand soap, and some other supplies.

Subscriptions (1.7% – $69 compared to $49 in August) – Patreon, Spotify, PicMonkey, and Book of the Month. I also spent $20 on a subscription to DailyBurn that I didn’t use (have since canceled).

Toiletries (1% – $42 compared to $37 in August) – Mouthwash, shampoo, conditioner, and maaaaany bottles of body wash.

Entertainment (.6% – $25 compared to $22 in August) – I went a little crazy with Candy Crush this month. Oops.

Donations (.6% – $25 compared to $32 in August) – I donated to the Biden/Harris campaign!

Auto (.4% – $18 compared to $591 in August) – Ha, what a difference! I only needed to fill up my gas tank once this month.

$0 categories in September: beauty, health, travel, and savings. Hoping I can get back into my savings goals in October!

Your spending during a month of a move was actually not that bad! Moving is expensive no matter how far you are going! That was very nice of you to give your brother some money to move your furniture. I’m sure he appreciated that!

I need to go into mint and sort out my amazon purchases because I have made A LOT of them lately. I get way more from amazon during pandemic times because Phil is doing enough w/ groceries and other errands that I try to lighten his load in terms of errands. I also started to see a therapist this month and she is out of network, so that is coming out of my HSA. I was bummed to hear she wasn’t covered by insurance, but she was suggested by my best friend who is a child psych so knows other psychs well and we hit it off. So I figure I will pay up to work w/ someone I click w/. And I’m hoping it’s a short term thing – she’s helping me work through the challenges w/ my family re: talking about covid/newborn visiting policies/etc. So it will be worth it to get her expert help on setting boundaries/not internalizing comments I’ve gotten/will get.

Eek, this is making me nervous for what our next month or two will look like with our move! I’m already trying to brace myself for seeing my net totals plunge down into the red on my Mint profile, ha ha. Glad that you’re settling in to the new place, and I hope we get to see an apartment tour soon!

Wow – I think you did a great job on your budget, considering that a lot of these were one-off expenses. Think of all the joy you will get (and likely are getting already) from your new place. And, you won’t be replacing things like furniture annually! (At least, I hope not…)

My only other comment is that this: (two shirts, a pair of shorts, and a packet of face masks).

is the most 2020 shopping list I have ever seen. That is all. 😉

Moving always goes hand in hand with increased spending. It’s normal and just something to “accept” as a given. I think you did pretty well and since you know a lot of the extra expenses were ony one-offs, you’ll be back on track in no time.