This was a fun spending report to put together! Even though I did not spend within my means (sigh), part of that was due to taking care of some very annoying medical bills (that I will slowly be able to submit to my HSA for reimbursement). I was around $219 over my means, which is not great but I’m chalking it up to getting those medical bills off my plate. If I didn’t have to deal with those, I would be in a much better spot!

Let’s review my goals for April:

- Reduce my shopping budget by half – Complete! I mean, almost. I needed to spend $316 or less to meet this goal and I spent $333. Close enough?!

- Meet my online ordering goal – Not complete. But I got closer to that goal in April than I was in February or March, so I feel good about that.

- Cancel Amazon Prime – Not complete. Ugh! I just keep forgetting to do this!

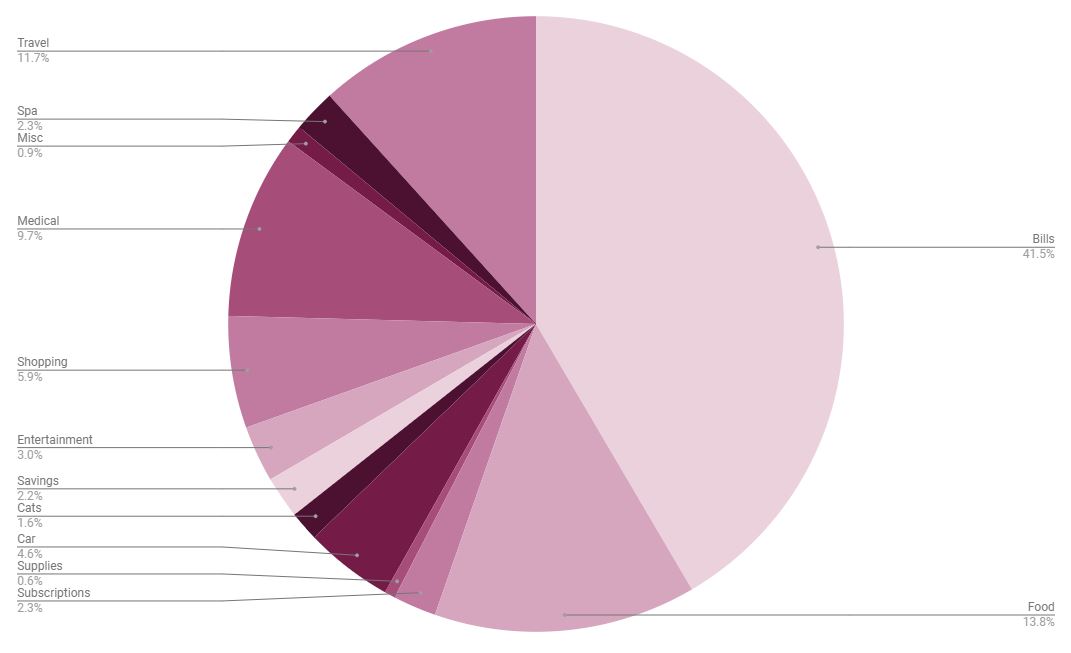

And here’s how things shook out this month. As a reminder, this is a spending report, which means I am only talking about the money I spent after it hits my bank account. You will not see anything related to my 401k, health insurance premiums, HSA contributions, etc.

Categories That Increased

MEDICAL ($549 | ↑ $422)

Ughhhh. The worst way to spend money! I needed to take care of a large bill for my CPAP equipment ($303) and pay a large bill to my therapist ($210) since my insurance company had been under-billing me for a few months. I also paid for some medication. The good news is that I’ve met my deductible for 2025 so now my therapy appointments are $0! Sweet relief.

CAR ($263 | ↑ 48)

A small increase, mostly needing to get gas twice this month, paying some tolls, and getting a car wash.

TRAVEL ($662 | ↑ $42)

I bought a round-trip flight to London and I also categorized anything I spent for my staycation at the VRBO with the cats (food, litter, and the disposable litter box I ordered).

SUBSCRIPTIONS ($129 | ↑ $21)

I did not cancel Amazon Prime (ugh) but I did buy a year’s subscription to Emily in Your Phone’s Substack, which accounts for the increase.

FOOD ($780 | ↑ $11)

My food budget increased just a tiny bit from April, so I’m really happy that things stayed relatively stable. I’m still not meeting my Ubereats goal (>$100 per month), but this month, I was only over by $32 (as opposed to $73 in March and $105 in February), so I’m doing much better than I was. I’m getting there! (I’m trying to give myself a rule that I can only order Ubereats when I’m on my period since that’s when my energy is the lowest. It’s a little silly, but it’s working!) My grocery budget was nearly identical to March, too.

Categories That Decreased

BILLS ($2,352 | ↓ $3,520)

This number is a little misleading because I accounted for paying off my LASIK bill ($3,049) in March. Everything else was pretty normal and even my electric bill was a smidge lower in April than March, so hooray for that! We’re definitely entering the season where my AC is going to be working overtime so I expect some large electric bills soon.

SHOPPING ($333 | ↓ $349)

I am really happy with this number! I’d like to reduce my shopping budget further, but we’re making progress. Here were my highest categories:

- Books: $95.21

- Accessories (reading stand and a belt bag): $57.40

- Clothing (a t-shirt from Etsy and a new pair of sandals): $51.52

- Beauty: $35

MISC ($52 | ↓ $205)

Nothing too crazy for my miscellaneous category in April, just a few blog-related expenses like renewing my spam protection. Last month, I had to pay too much money for my taxes (not really, but felt like it to me!) so that’s why the decrease is so drastic.

SUPPLIES ($32 | ↓ $164)

This was a startlingly low number for my household supplies/toiletries. But I spent a lot of money replenishing my supplies in March so it makes sense that I’d have a lower-than-average month. I needed a few CPAP supplies (distilled water and gentle dish soap for cleaning the parts) as well as the usual suspects: mouthwash, conditioner, paper towels, etc.

GIFTS ($0 | ↓ $143)

I’m so surprised that I didn’t spend any money on gifts in April! Don’t worry, though, May is already turning out to be a spendy month for gifts.

ENTERTAINMENT ($168 | ↓ $115)

There weren’t a ton of things happening in April, it seems! Most of this total comprises dinners with friends/my mom ($116) and the rest covers book club and some miscellaneous items.

SPA ($128 | ↓ $104)

No hair appointment this month, but I did spend $84 to get my underarms waxed and then my brows waxed and dyed, which feels crazy. I don’t think I’ll be doing the dye again—it doesn’t last very long so it really feels like I’m just throwing money away. And my brows don’t really need to be waxed that frequently. I also got a pedicure, which felt so nice.

CATS ($88 | ↓ $97)

A pretty low-key month for the girls! I bought food, Litter Genie refills, and a new scratching pad.

Categories That Held Steady

SAVINGS ($125)

I am actually upset about this one because I really need to put more money in savings than I do. UGH.

Overall Thoughts

This was a good month with a lot of decreased categories. And while I’m proud of nearly halving my shopping spending, I still have some work to do there. I have gotten into the habit of just buying things whenever I think about them, rather than waiting and making sure I really want to buy said thing. Maybe instead, I could make a note of it in my phone, and at the end of every month, I could review this list and decide if any of these items are things I still want. And if they are, and it fits into my budget, then I can buy the thing. I feel a lot more “free” with my money right now because I have a lot of disposable income, but that extra money should really be going to things like a travel fund or a savings account for my upcoming move. Plus, starting in November, my rent will be increasing drastically (by at least $500) if I find a reasonably priced two-bedroom apartment, so I need to start living like I have a lot less money now so it doesn’t feel like such a dramatic change at the end of the year.

It’s also going to be imperative to spend below my means. And that comes with being a lot more mindful of how much money I’m spending on a weekly basis. I’ve gotten better about tracking my spending every Sunday, but I think I also need to make a stronger budget that I actually stick to. That’s hard for me because there’s a scarcity mindset that comes with budgeting (at least for me, because of my upbringing), but I know it will be a beneficial practice for me in the long run. Something for me to think about!

To close out this post, here are my goals for May: spend below my means by $250, cancel Amazon Prime, and meet my online ordering goal (less than $100 spent on Ubereats orders).

What’s the last travel purchase you spent money on?

I see the same progress in your spending that I saw in yesterday’s post…small sustainable changes that are snowballing into big results.

Your flight to London is really cheap! Yay!

My last travel purchase was $50 for a tour of Alcatraz just over a week from now. I’ve only planned a few things that I don’t want to miss out on, and the rest will be spontaneous “what do I feel like doing today” decisions once I get to CA. I’m leaving on Monday and I cannot wait!

I can’t believe your trip to CA is HERE! That is so exciting and I can’t wait to read all about it. Have the best time!

I keep track of my monthly spending too -I need to join you in a post like these -keep it all accountable.

Books, Planning stationary & dogs are my big fun spends each month!

It helps me so much to stay accountable when I know I have to report on my spending every month. I’m such a goddamn Obliger, lol.

I’m so excited you are going to London!

Okay- the UberEats rule of only ordering while on your period is genius! Because you’ve identified a specific time/ need and also, this specific time/need comes regularly (I do ‘t want to assume here, though.). So when you feel the urge to order UberEats, you can tell yourself, “This is not the time, but the time is coming up.” It’s not like you are denting yourself for a vague unnamed future.

Yes, my period is very regular at this point and I know exactly how I’m going to feel, so it was a great excuse to put parameters on my Ubereats spending. It gives me a sense of freedom when my energy is very low during my period to order out, but then a strict boundary for the rest of the time.

The last travel purchase I spent money on was on my trip from Canada to China in May, 2024 and my trip from China to Canada in July, 2024, Stephany.

And no, I didn’t expect this to be a fun spending report to put together, Stephany.

I actually don’t mind putting these spending reports together – I guess if I did, I wouldn’t do them! Ha.

I love that you are taking a slow and steady approach to reducing your spending. It’s obviously working and it seems much more sustainable than just cutting out a category, cold turkey.

It’s so hard to reduce spending, especially these days. But I know there are some categories I can greatly reduce my spending so I just have to be a bit more strict with myself!

Thank you for this report! April was spendy for us (again!!). Our road trip, with all said and done, was about little over 1K. My birthday was at the beginning of May so I bought some stuff for myself- a new planner, a water color kit, face cream. A manicure and pedicure with L! That’s $80 right there. More trees fell darn it and had to be removed.

Ugh. I hope may will be better!

How did manis and pedis become so expensive? I don’t even get the fancy ones and they are still over $40! Gah.

Between a fun Spring Break trip and your birthday, those tend to be spendy seasons! But oof to the tree removal. That’s never fun!

I mean, we just spent $$$ on flights to Southeast Asia for January, so probably that? But also we bought new carryon luggage that is just sleeker than our old stuff. I am strictly a carryon only gal now, so I need to have a streamlined carryon. I don’t have any travel planned until the fall though, when I go to Morocco via Paris!

Re: eyebrows, I have been using a gel brow mascara that helps fill things in (because my eyebrows are going white, wtf is that) and it works great. I have a Cover Girl one, it was super cheap and has lasted me for many months now.

Southeast Asia! You guys are LIVING THE DREAM right now with all of your travels! I am going to try my BEST to bring a carry-on to London, which will be hard for me!

I have a go-to eyebrow pencil that I love so I’m fine filling in my eyebrows… it would just be nice to have dark brows without putting in any effort, sigh.

It is very inspiring who you are working on this month after month. It is so hard to change a habit or a mindset. So I think you should be proud.

The book budget you have for the past month is high than what I allow myself all year. I am so glad for libraries. I sometimes wish I just get the latest book and be in the loop but I often know I won’t want the book on my shelf.

I sometimes wish my entertainment and travel spends were higher. Sigh.

Last travel expense I had. probably the hotel for my upcoming trip to my sisters ordination. Hotels I her town are always so damn expensive. But I decided we make a happening of it and stay two nights to fully enjoy the trip.

All that said for the past two months I have been really struggling. On my 6th I was already in the red and I really have no clue why. I may have to suck it up and do a tracking month even though I don’t want to.

I hope you can figure out a budget that works for your lifestyle. It is AWFUL to be in the red and feel like you can’t catch a break. I have been there. Hugs!

Oof I feel you on the medical expenses. But it’s great that your therapy is $0 now that you’ve met your deductible! The medical bills keep coming in for us between Will’s surgery and my OT appts. I am so sick of opening medical bills! 😛

The last travel expense for me was buying plane tickets for Will and I to go to Chicago in late June! I had a $200 voucher and will use Marriott points for our hotel so the whole trip will be fairly inexpensive!

I am beyond ecstatic to have met my deductible! It will be nice not to have to worry about all those expensive copays, whew.

That’s awesome news about the voucher/Marriott points for your trip with Will!