I wanted to take a different approach to my monthly spending reports this year. I still need to write this post every month because they are oh-so-helpful for me. I understand that they are not everyone’s jam, but I am an Obliger through and through, and it helps me to put it all out there.

This year, I’ll do a quick run-down on my spending (using actual numbers this time!) and then dive into what went well and what didn’t go well. I’ll end with some money-related goals!

As a reminder, this is a spending report, which means I am only talking about the money I spent after it hits my bank account. You will not see anything related to my 401k, health insurance premiums, HSA contributions, etc. We’re just talking about the money I spend once it’s, well, mine.

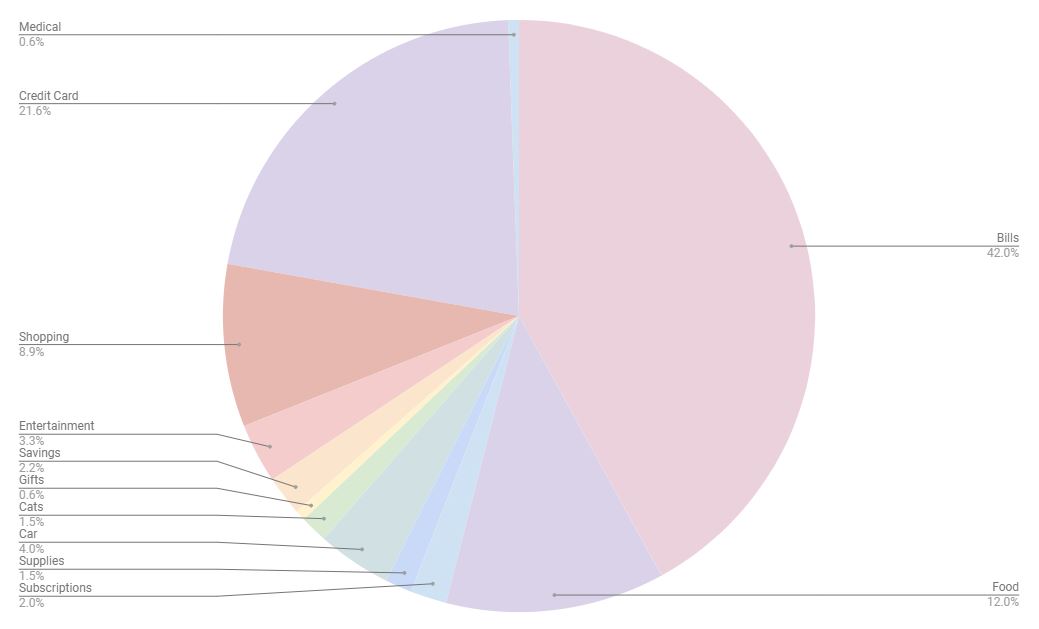

Spending Breakdown

- Bills (rent, phone, car payment, electric, student loans, gym, internet, Care Credit): $2,432

- Credit card: $1,250

- Food: $692

- Shopping: $514

- Car (car insurance, gas, tolls): $234

- Entertainment: $189

- Savings (cat fund, Christmas fund): $125

- Subscriptions (Patreon, Netflix, Paramount+, Spotify, Canva, Book of the Month, Prime): $115

- Cats (food, new scratcher): $87

- Medical: $34

- Gifts: $33

What Went Well

- Food budget – I brought my food budget down to $700/month (from $800), and I was excited to see that I came under budget in January! What helped the most was fewer Ubereats orders. I spent just $78 on Ubereats orders, which may seem high to some, but last year, I averaged nearly $200/mo in this category so this is a startling improvement! My goal is to spend less than $100 on online ordering every month, and I am well on my way to that goal.

- Paying off my credit card every two weeks – Okay, this is going to be embarrassing to admit as a functional adult, but I’m going to be open and honest about this: I have been carrying a balance on my credit card for many many months. Probably for all of 2024. The problem is that every month, I would send a huge chunk of money to my credit card to bring down the balance but then I would use the credit card, so I was really only chipping away at the balance by a couple hundred dollars every month. But on January 31st, I was able to fully pay off my credit card (this will show up on my next spending report) and that’s because throughout January, I made sure to pay off any credit card purchases every two weeks. This allowed me to keep my balance at a reasonable number and then, thanks to January being a three-paycheck month for me, pay it off in full at the end of the month. What a friggin relief this is!

- Spending less than I make – Last year, there were many months when I spent above and beyond my income, which is the biggest no-no. But it happens and if there’s anything I can do with these spending reports, it’s to make those of us who are not great with our finances feel a little better. In January, I spent just about $360 less than I made, which isn’t a TON of money, but it does keep me in the green, and that’s all I care about.

What Didn’t Go Well

- Shopping – My shopping budget was a bit out of control in January, as I spent over $500. Eeks! My top three categories were beauty ($141), clothing ($128), and tech ($77). Most of the beauty purchases were replacement products so hopefully next month I’ll spend a lot less. I am allowing myself to purchase new clothes once a quarter so I took advantage of a sale at Lane Bryant where I got a new pair of boots, jeans, and a bra for $128. And my biggest tech purchase was my hand massager. I’m going to try to see if my wellness reimbursement will cover that, so stay tuned! I also spent $61 on books and $58 on home organization purchases, so January was just a very spendy month for me and hopefully I’ll do better in February.

- Savings – I was hoping to put more money in savings, but I prioritized my credit card this month. Now that the credit card is paid off, I can focus my attention on my savings goals!

- Not keeping up with my spending – My goal was to check in on my bank account every other day to categorize my spending and see what adjustments I needed to make for the rest of the month, but ugh, I did not do that. I probably logged in once a week and then had to play catch-up.

Goals for February

- Spend less money shopping – If I can get my shopping category down to $350, I’ll be a happy gal.

- Do a budget check-in every other day – If I’m checking in on my budget more frequently, I think I can definitely get my shopping category down to a reasonable number.

- Switch from Publix to Aldi – I am intimidated by the prospect of going to another grocery store but I know this will be beneficial in many ways, both financially and making a bigger impact with my dollars.

What was something you were happy to spend money on this month? For me, I was happy to purchase a spot at the cat cafe Jenny and I went to last month! I’m always happy to give money to a good cause.

Bravo for paying your card every two weeks to help chip away at the balance! It’s not embarrassing to have a balance, it’s just a situation that needs to be taken care of. You took care of it and also found a helpful tip that will help other people, so double yay! Also the ROI on not paying interest is huge. Congrats on a “green” month!

Thank you! I appreciate this comment so much. <3 I was a bit worried to come clean about my credit card habits. And now that I have that monkey off my back, it's time to focus on savings!

Awesome job paying off your credit card bill!!!

Best money I spent this month was buying the second and third books in the Black Stallion series for my kiddo. So fun to see her in such a reading groove.

Oh, I am so happy that your daughter is in a reading groove. That’s so fun!

You must feel amazing to have the credit card balance paid off! Gold stars.

Best money spent in January was $168 on a HUGE photobook (336 pages). Our family loves looking through photobooks and I always consider it money well spent.

Thank you! I felt very accomplished finally getting that balance to $0.

WOW! That is a huge photobook indeed, but it had to be! You guys went on two amazing international trips – how do you even BEGIN to cull those photos? Good on getting that done!

Yay for paying off your credit card. I bet that felt so good! I hated carrying a credit card balance but did at times during my 20s when I was living alone and did not make much money. It’s an awful feeling! And great job on getting your uber eats spending down, too! I treated myself to uber eats a few times in Jan since we received a lot of gift cards for meal delivery and oof it is expensive!!!

The best money I spent in January was on our dinner out with friends earlier in the month!

Meal delivery is SO expensive. I think the price just keeps getting higher and higher and I really need to nip it in the bud. So I’m really happy with my progress in January!

Yay for no credit card debt and living in the green! My shopping category varies SO MUCH, so I totally get this. I have been avoiding a check in on spending because I really want to go to the fancy dance store and buy Dorothy some ore leotards. WHAT IS WRONG WITH ME THO.

The shopping category will be the bane of my existence. I like to buy things! But then I have to report on the things I buy. Womp!

Kudos to you for paying off your credit card. I am with Birchie; it should not be embarrassing, but it is great that you saw it and took action and now can move on! I am very proud of you. And as for your savings, high interest debt trumps savings by far, and it is so much more important to get that debt paid off, which you did!

Thanks, Kyria! That means a lot. I’m happy to have that big challenge FINISHED and now I can really think about my savings goals.

As always, I admire your honesty so much. It’s not embarrassing – a lot of folks carry credit card balances and we should be talking about that!

I just spent HUNDREDS of dollars at Sephora and Ulta stocking up on personal care items and that’s going to be embarrassing to talk about next month. *sigh*

But I also purchased tickets for events for when my BIL and his family come to visit next weekend! I can’t wait!!

Thank you! It can be hard to be so vulnerable and open, but I want others to feel less alone if they, too, struggle with their finances. It’s a hard thing, especially these days!

I feel you on the Sephora/Ulta purchases. It was nonstop for me last month!

YAY on paying off your credit card! That is MAJOR and so impressive. I carried a balance and paid interest for YEARS and it always stressed me out and I didn’t see a way out of it. Once I was finally able to pay it off, I got a rewards card, and now I put EVERYTHING on that, and you know what? I pay it off almost every day. I cannot stand to have the balance get too high, it makes me nervous from all of those years of debt and money wasted. If I were you, since you rent, I would check out the card that you can put rent on and gives you points. But make sure your landlord doesn’t charge a convenience fee that is more than the points, because that would not be worth it. Like if the card gives you 1%, but the landlord charges 1.5%, then you’re losing money.

I think the best money I spent in January was last week, I had a massage and got my hair done. Expensive! I had a gift card for the massage, but it was for 50 minutes, and I upgraded to 80 minutes, so I paid the difference. And my hair is spendy…color/cut/highlights/tip. Sigh. It felt GREAT though.

I want to get a rewards credit card at some point (specifically the one for rent because that would be AMAZING!) but I need to make sure I can keep my balance at $0 for a while before I allow myself that option, lol. I haven’t been great about it in the past!

I used to get really expensive hair cuts/colors so I feel you on that. It’s a hit to the bank account but always felt so good!

Great job paying off your credit card! I’m so proud of you!

I spent $2800 on groceries last month, which isn’t an all-time record but it’s close. I hope not to spend so much this month – probably I won’t, since we are away for a week and also the $2800 reflects a couple of big Costco trips. I mean, it’s good to spend money on food, I guess?

OMG. I want to die thinking about spending almost $3,000 on groceries in one month. OOF. It’s so hard to get costs down when it comes to food, especially when it’s groceries. I feel you!

Well done on UberEats and paying off your card!

We paid $99 per year for the Monarch Money budgeting app and I am so happy we did! That’s 8.25 per month. The app aggregates everything for you- purchases, expenses, income, investments, even the cars. Even the house! So much easier than Excel – and, I was terribly undisciplined to enter the items line by line.

WOO HOO! Paid off credit card, down on Uber Eats? This is amazing. Let’s hope the momentum continues. (And really, who among us has not had a credit card balance at least once?)

Yeah for paying of the credit card.

Let’s see where you go from here.

I sometimes wonder if I would spend a noticeable amount of money if I just stop eating for two and leave out the snacking… That would be two goals with one effort. Sigh.