Happy Friday, friends. It’s a long weekend for me because, for the first time ever (well, since I was in school, lol), I get MLK day off! I’m assuming my company decided to offer this as a day off due to the racial reckoning that so many people and companies, in general, went through last year. I’m glad to see it, that’s for sure.

Today, I wanted to share my final 2020 budget. (No December budget this month, sorry guys!) 2020 was the first time I ever tracked my spending in such a detailed way and while it took some getting used to, I’m really glad I did it and built this new habit for myself. It allowed me to see my spending much more clearly than I ever have and build a reasonable budget for myself moving forward. I plan on continuing my monthly budget recap posts, but they’ll be a little different this year. Stay tuned!

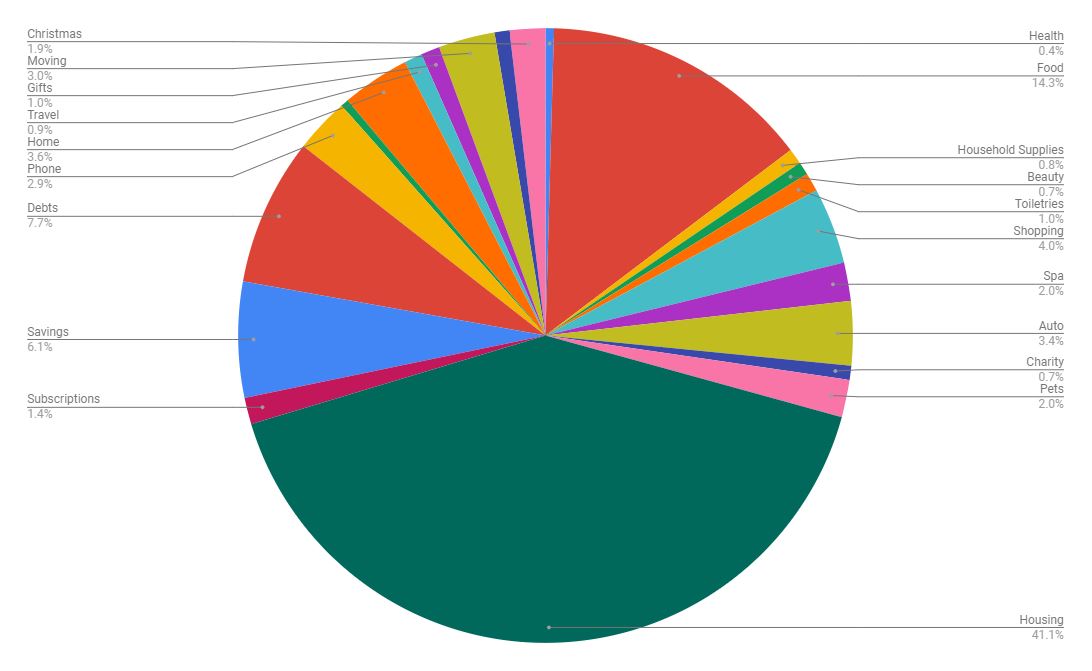

For now, let’s take a look at where my money went in 2020:

Housing (41.1%) – It’s no surprise that housing was my largest expense overall. This category comprises rent ($11,137), electric ($1,033), Internet ($902), water ($590), and Netflix ($168).

Food (14.3%) – Food was always one of my biggest expenses throughout the year so it’s no surprise that it was my second-largest category. In the end, I spent $2,987 on restaurants and $3,671 on groceries for an average of $555 per month. (I also spent $224 at Starbucks.)

Debts (7.7%) – I spent the first quarter of the year making large payments to my credit card and I also made regular student loan payments throughout the year.

Savings (6.1%) – While I fell off the savings bandwagon in the second half of 2020, I was pretty great at adding to my savings accounts at the beginning of the year (especially in preparation for my move). I saved $2,936 this year for an average of $245 per month.

Shopping (4%) – I’ve never really kept track of my shopping habits so I’ll be interested to see how this changes year over year. In 2020, the standout shopping categories are tech ($574), clothes ($438), books ($412), Chatbooks ($109), cloth face masks ($78), accessories ($89), hobbies ($86), and shoes ($46).

Home (3.6%) – I bought a lot of new things for my home in 2020, especially once I moved. This total is made up of things I bought for my “home office” ($329), furniture ($1,072), decorations ($165), and a new cordless vacuum ($120), among other items.

Auto (3.4%) – This list comprises gas ($313), car insurance ($1,114), regular maintenance ($106), and a simple car repair ($96).

Moving (3%) – Anything I bought specifically for my new apartment during the move is included in this category, such as home goods ($695) and furniture ($295). I also included moving expenses such as my pet fee and paying my brother to help move my furniture into this total.

Phone (2.9%) – My phone bill decreased from $146 to $108 when I upgraded my phone, so that’s a positive!

Spa (2%) – I spent money on massages ($410), hair appointments ($395), and pedicures ($168).

Pets (2%) – The girls were pretty easy this year! I spent $148 on vet appointments (as well as $216 for flea/heartworm treatment), so that was my biggest expense for them. I also spent money on food ($192), litter ($147), treats ($115), and toys ($86).

Christmas (1.9%) – I spent $905 on Christmas this year! That’s astounding to me, haha, because I’ve never kept track of how much money I spend on Christmas. Of course, I bought a new fake Christmas tree so that was a huge expense I won’t need to worry about for another few years.

Subscriptions (1.4%) – I’m subscribed to many different things, from different podcasts’ Patreon pages to Book of the Month to a bimonthly air filter subscription. These subscriptions cost me anywhere from $30 per month to $77 per month.

Gifts (1%) – I spent a little less than $500 on gifts throughout the year. I thought about making a savings account for gifts but it averages out to less than $40 per month so I decided against it.

Toiletries (1%) – I spent around $39 per month on toiletries, which include body wash, shampoo, conditioner, toothpaste, etc. Most of this is comprised of body wash, which is what I use for bubble baths. Since I take a bubble bath nearly every day, I buy a lot of body wash.

Travel (.9%) – I bought a plane ticket to visit New Orleans in the spring—a trip that, of course, had to be canceled. I was able to get a credit for the flight so at least my money was not spent in vain! Travel is usually one of the bigger expenses in my budget, so it makes me sad it was so low in 2020.

Household Supplies (.8%) – I spent an average of $33 per month on household supplies, which includes cleaning products, toilet paper, trash bags, etc. My highest spend month was August ($56) and my lowest was November ($3).

Blog (.8%) – My hosting fees were due this year (I pay every three years) and I bought a new blog design.

Beauty (.7%) – I am certain this would have accounted for a much higher total if the pandemic hadn’t happened. In January and February, I was averaging $40+ a month on beauty products. From March to November, I averaged $9 per month! (December is an outlier since I purchased some skincare products and makeup to the tune of $155.)

Charity (.7%) – This was the first year that I made charitable donations a regular part of my budget, and I’m so very glad I did. I picked one charity/cause per month to donate to, giving donations to political candidates, my nephews’ school, animal shelters, cancer charities, and racial justice initiatives.

Health (.4%) – Nothing too crazy to report here. A visit to a specialist, over-the-counter meds, medical supplies, and my gym membership for the time the gym was up and running.

Entertainment (.4%) – Well, the stats are in. I spent $148 on Candy Crush tokens in 2020. That amounts to $12 a month. Should I be embarrassed about this? Perhaps, but that game really is so soothing and fun to play!

As previously mentioned, I immensely enjoy your budget posts and am happy to read that you’re planning to continue the monthly budget posts this year. I am also curious how they’re going to be different (I’ve been thinking about how I want to write more about finances going forward, but haven’t quite figured out my approach!)

Housing and food are definitely our biggest expenses too (I just pulled our 2020 spending report and will share it on the blog soon!).

I enjoyed your finance posts too so look forward to seeing what you do this year! I am sure you learned so much! I just do one annual post in January. I am working on categorizing my Amazon and target purchases. I got behind on doing that and dang there are a lot!!

Love that you get MLK day off!!!

I really enjoy your breakdown and appreciate that you put dollar amounts on there, as I think that is intimidating for some (myself included) and talking about money makes some people uncomfortable. As an aside, it is interesting this year for me to see that you got haircuts for example, since here in CA we have pretty much been in lockdown all year! I know FL is not as strict, but it just gives an extra sense of the year on top of the financial picture. Also interesting is that in CA, the landlord pays the water/sewer!

I do not put debits or savings (or taxes) in my pie, but if I did, taxes would be one of my biggest categories, although without that, home is always the biggest by far!

I love your budget posts, since I am terrible about tracking my spending. I don’t do the finances, really, in my relationship so I’ve “outsourced” a lot of that. Not a good thing!

One thing that came to mind when reading your percentages was that the things that bring you joy – the girls, your bubble baths, your phone games / apps – are SUCH a small percentage of your budget. But the fact that they bring you joy far outweighs that tiny percentage. It’s very interesting to me as I think about how to consider my own purchases in 2021. I’m leaning towards a very loose classification system of need vs. want, and for the wants, does it truly bring me joy? Or is it something I want because others have it, or I just think I want it? Anyway, just a random insight inspired by your detailed post. Thanks!