Hi friends and happy Monday. It’s Martin Luther King, Jr., day here in the U.S. and I am very grateful that my company gives us the day off. (I’m planning on doing my January 5K today with my mom and the dogs!)

Today, I’m here to wrap up my 2021 budget with some final numbers. For the past few years, I’ve been keeping a detailed spreadsheet about my spending and while it can be a lot to keep up with, I’ve gotten into a habit of inputting my numbers once a week. I used to be so bad at keeping track of my spending, so I am proof that you can change your ways. 🙂

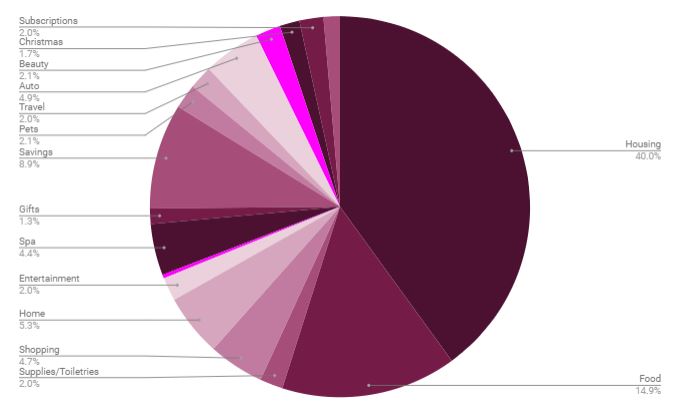

Overall Bills (40%; -1.1% from 2020) – I spent $12,810 on rent (+$1,637 from 2020), $1,329 on electric (+$296 from 2020), $553 on water and utilities (-$37 from 2020), $960 on Internet (no change), $1,302 on my phone bill (-$94 from 2020), and $1,260 on my student loan (+$100 from 2020).

Food (14.9%; +.6% from 2020) – My food spending was right about on par with what I spent in 2020, so it’s good to know that the food budget I set for myself ($600 per month) is my sweet spot. Ideally, I’d like to bring down this number but it’s not something I’m too worried about. This year, I spent $3,184 on restaurants/Ubereats orders/fast food (+$197), $3,503 on groceries (-$168), and $175 at Starbucks (-$49).

Savings (8.9%; +2.8% from 2020) – Just as I did in 2020, I stopped adding to my savings in the latter half of the year. While I should have an automatic savings fund set up, there’s something I like about manually moving money into my savings. I saved a little bit more this year than last (+$674) with an average of $301 per month.

Home (5.3%; +2.7% from 2020) – My home purchases took up a bigger slice of the pie this year, mainly because I bought a sectional at the beginning of the year ($1,124). This category is also comprised of home decor ($352), things for my home office ($312, which includes my comfy new office chair), home goods ($136), accessories ($102), and tech ($405, which includes a new TV).

Auto (4.9%; +1.5% from 2020) – I spent a little more on gas (+$48) and car repairs (+$102). I spent less on car insurance (-$16). And I also spent money on a car down payment. I had saved some money for the down payment but also had to pull $500 out of my account to ensure I could put $4,000 down. I expect this area of my budget to be a much bigger piece of the pie in 2022.

Shopping (4.7%; +.7% from 2020) – I’m still trying to figure out how to properly categorize and track my shopping habits. I spent $853 on clothing (+$415), $601 on books (+$189), $243 on accessories (+$154), and $107 on hobbies (+$21). Workout accessories ($126), kitchen tools ($77), and other ($134) round out this category.

Spa (4.4%; +2.2% from 2020) – This category comprises massages ($896), hair appointments ($677), and pedicures ($477).

Beauty (2.1%; +1.4% from 2020) – My beauty category definitely grew in 2021, which I was expecting. I didn’t itemize my beauty spending, which I’ll probably do in 2022, but this category comprises my skincare products (I use Paula’s Choice), makeup, and face masks (the skincare kind).

Pets (2.1%; +.1% from 2020) – This category remained stable from 2020 to 2021, woohoo! I spent $256 on vet appointments (+$108), $180 on litter (+$33), $146 on food (-$52), $128 on treats (+$13), $91 on toys (+$5), and $159 on supplies like a new water fountain and new beds.

Travel (2%; +1.1% from 2020) – Last year, the only travel expense I had was a plane ticket that had to be canceled. I was able to use my plane credit this year for a fun trip to Chicago with my mom. Our biggest expense that trip was on our adventures, with food a close second.

Supplies/Toiletries (2%; +.2% from 2020) – I budget $100 per month for supplies/toiletries and usually come well under budget. In 2021, I averaged $75 a month.

Subscriptions (2%; +.6% from 2020) – Another category that increased a bit from 2020, but not by too much. This category comprises Patreon subscriptions, Netflix, Spotify, an air filter subscription, and other streaming services. I averaged $78 per month on subscriptions.

Entertainment (2%; +1.6% from 2020) – My entertainment budget was definitely up in 2021, as expected. I spent $508 on adventuring with friends, $262 on dates, and $147 on in-app purchases.

Christmas (1.7%; -.2% from 2020) – I spent a little less on Christmas this year, although I still feel like I spent so. much. money. I spent $164 less, but last year’s budget also included buying a new Christmas tree so I’m guessing I need to budget around $700-$800 every year.

Health (1.4%; +1% from 2020) – I spent 1% more on health purchases in 2021, but the majority of this category comprises the spin bike I bought in early 2021.

Gifts (1.3%; +.3% from 2020) – In 2021, I averaged around $50 per month on gifts.

Charity (.3%; -.4% from 2020) – My goal at the beginning of 2021 was to pick one charity a month and donate $25. I quickly fell off the bandwagon, though. Ugh.

And there you have it! I really love writing these quarterly budget posts, so I plan to continue them throughout 2022. This year, I’m making some changes to how I track my spending—mostly, itemizing all of my shopping/home purchases so that I have a better idea of what I’m spending my discretionary money on. I am also going to break up my food purchases into 5 categories: groceries, fast food, restaurants, Starbucks, Uber Eats (with a separate category for tips).

Your record keeping is so impressive!

You know that I’m a total finance nerd, so I love posts like this 🙂

I finally added a line item in our budget for a monthly massage, just because it’s the only way I can see that I’ll ever be able to exercise again (since it’s the only thing that seems to help my back since I injured it). It’s hard for me to prioritize self-care into our budget, but I know a healthy me is the best thing I can give to my loved ones in the end.

I read something on The Fioneers website not too long ago about how “intentional spending” doesn’t mean you just spend on what’s absolutely necessary — it means you max out your spending on those things that truly bring you pleasure and joy and that you ruthlessly cut down those things that don’t. They also quoted someone who tells you to write down 3 or 4 things that bring you joy, and then to imagine spending 10x the amount on those things. While I don’t know that we can afford to up our spending so much, it was valuable to recognize that things like books and adventure and travel are things that bring me joy, so it’s worth finding room in the budget for those.

This post reminded me of that because I just loved that you spent over $600 in books 🙂

The amount of money you spent on your pets is astonishing to me. I desperately wish my pets would be such a low percentage!!!

I think I will make $25 a month to a charity a soft goal of mine this year. Last year I focused more on financial goals, but I was never consistent about giving to charity. I’ll focus on things I really care and try to make as many of them as “local” as possible – the local pet rescue, homeless coalition, etc. Thanks for this idea!!

Well, if you used to be bad at keeping track of your spending and now you do this, there truly is hope. My husband and I have tried and failed many times to track our spending like this. We will try again!

I am posting my spending summary on Friday! It’s always a big project for me to sort through our spending because I only write a post once a year, so end up doing a lot of cleaning up in the process of writing that post. I did not look at mint as regularly as I have in the past so lots of things slipped through the cracks and were misclassified. I will hopefully do a better job of looking at our spending this year. But last year was a weird year with me being on mat leave and not on a computer much for the first 5 months of the year. And then I had fallen out of the habit of checking regularly (which I tend to do during work hours). So I need to get back on track this year!

I always feel a little sheepish posting our annual finance review. We are very lucky to work in great industries and we’ve been very good at saving so were able to pay off our mortgage last year. I sometimes wonder what people think when they read my blog… I can remember the days of barely having enough money to pay bills so I’ve had experience on that side of the spectrum, and now I’m on a very different end of the spectrum so I do not take that for granted. As part of our quarterly financial reviews, we have started to talk about our charitable contributions because that is something I know we need to focus on since we are in the position to give to others. But annual spending post aside, I don’t think anyone reads my blog and thinks – dang do they spend money! I think we are probably more frugal than the average couple!

As you know, I always love your financial posts and wish more people would share a glimpse into their finances. I’ll post my annual round-up soon (I hope).

I love that you have a spa category – I spent $0 on spa related expenses in 2021. I didn’t get a massage, I cut my own hair, and I didn’t get a pedi/mani. Wow, I must have saved some dollars right there.

You have such a good grasp of exactly WHERE your money is going. I love it. You know I am envious of your tracking. I need a copy of your spreadsheet – or just a window into your brain! I love the idea of breaking out purchases (for me, the biggest challenge is Amazon…sigh.. Like today, I ordered a small piece of clothing, laundry detergent, and descaler for my electric kettle LOL).