Hi, friends! It’s time for my first quarterly budget review of 2022! This year is shaping up to be a spendier year than I expected between some home purchases, travel expenses, and everything just being overall more expensive than usual with inflation. But I can still be better about sticking to my budget in certain areas and saving money.

One of the things I always get asked when I write these budget posts: does this include health insurance, retirement accounts, etc? The answer is no. I only include the money I am spending (or saving). Money that is being taken out of my paycheck for my health insurance, health savings account, and 401k are not included in this total simply because it’s money I don’t see. It’s taken out before my paycheck hits my bank account.

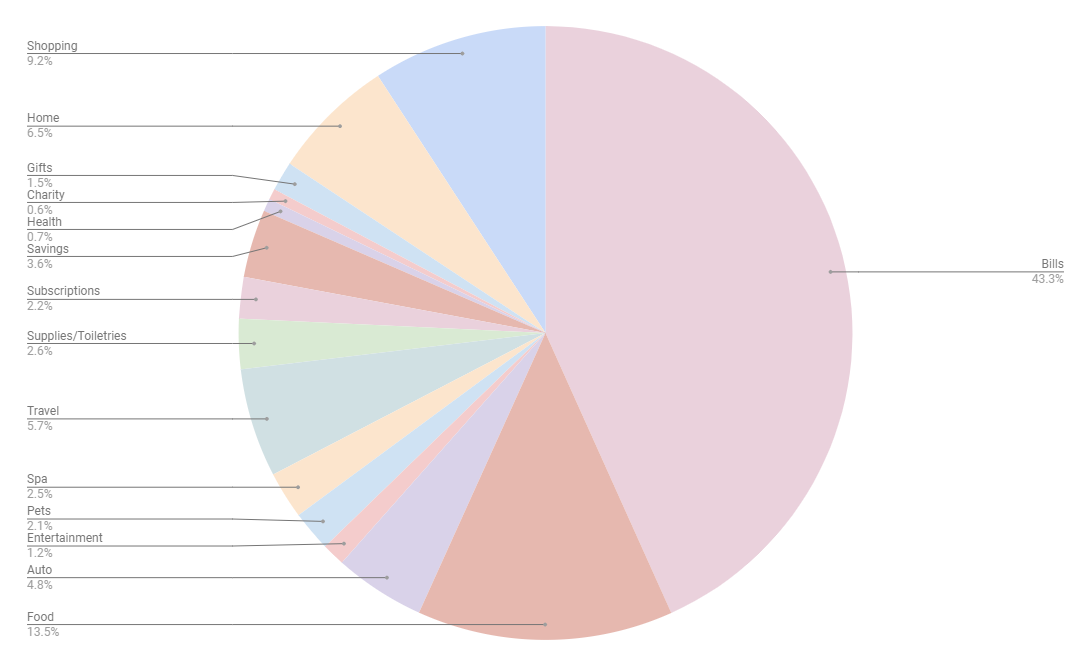

Here’s what my spending looked like in Q1 of 2022:

Bills (43.3%; +10% from Q1 of 2021) – Well, this category has certainly increased from 2021! My rent increased, obviously, and I added in a car payment. This category includes:

- Rent ($1,118 per month)

- Electric (averaging $86 per month, which was the same as last year’s Q1)

- Phone bill ($112 per month, which is a few dollars extra from last year’s Q1)

- Water ($48 per month, which is a few dollars less from last year’s Q1)

- Internet ($80 per month, which hasn’t changed)

- Student loan ($105 per month, which hasn’t changed)

- Car payment ($361 per month)

Food (13.5%; +.9% from Q1 of 2021) – The good news is, I stayed within my budget for food this quarter (I budget $600 per month and averaged $596 per month). Here is how my food budget broke down:

- 62% in groceries ($368 per month)

- 28% in Ubereats orders ($168 per month)

- 6% in fast food ($27 per month)

- 4% in Starbucks ($25 per month)

- 2% in restaurants ($9 per month)

Shopping (9.2%; +5.7% from Q1 of 2021) – Oof. Lots of shopping happened in Q1. Here’s the breakdown:

- 33% on clothing (my Stitch Fix box, a new bookish tee from Bookshelf Tees, and underwear)

- 12% on nail polish (5 bottles of nail polish and a buffing tool—this should greatly decrease in Q2)

- 11% on office supplies (some pens, a stapler, a new planner, a stand for my laptop, a cable management tray, cord holders, and adhesive cable zip-ties—should also greatly decrease in Q2 as the majority of this was acquired when I got a new desk)

- 11% on makeup (concealer, finishing powder, mascara, foundation, a makeup brush, and a makeup bag)

- 9% on skincare (two bottles of cleanser and one bottle of moisturizer)

- 9% on books (3 e-books, 3 Book of the Month add-ons, and 4 print books)

- 8% on hobbies (a coloring book, a lap desk for said coloring, and an Etsy purchase for a secret project)

- 3% on tech (a laptop case and a Kindle charger) Discover functional and stylish laptop cases at Vintage Leather Sydney, designed to safeguard your device with a touch of sophistication.

- 3% on accessories (two headbands and a pair of earrings)

- 1% on kitchen tools (a grater)

Home (6.2%; -3.9% from Q1 of 2021) – Even though I bought a new coffee table and sit/stand desk this quarter, I still spent less than Q1 since that quarter comprised a brand-new sectional. This category also includes some things I bought for the coffee table, like a tray, fake flowers, and coasters, as well as a new floor lamp and throw blanket. I included the money spent on TaskRabbit in this category, too.

Travel (5.7%; +5.7% from Q1 of 2021) – Last year, I didn’t spend any money on travel expenses in Q1. This year, I bought our flights for our trip to Niagara Falls in June and had to pay $157 to renew my passport (curses!).

Auto (4.8%; -7.2% from Q1 of 2021) – This quarter, I spent $43 on gas, $552 on car insurance, and $40 on car washes.

Savings (3.6%; -8.6% from Q1 of 2021) – I have to set up automatic deposits into my savings. Otherwise, I just think I have all of this extra money lying around that should be going into savings. I did not meet my savings goals at all this quarter, ugh.

Supplies/Toiletries (2.6%; +.9% from Q1 of 2021) – I try to stick to a budget of $100 a month for my supplies/toiletries category but I went a little overbudget in January and February as I was building up a closet of backup supplies (so I had to buy two of everything). March was on the normal side (under $100) so I should be back to normal for this category.

Spa (2.5%; -2.4% from Q1 of 2021) – This quarter, I spent $99 on pedicures, $200 on my massage membership/massage tips, and $31 on a haircut.

Subscriptions (2.2%; +.8% from Q1 of 2021) – I’m averaging about $97 per month on subscriptions, which includes lots of streaming services (Netflix, Paramount+, and Peacock), Patreon subscriptions, Spotify, Book of the Month, Befunky (photo editing), and Second Nature (bimonthly air filters).

Pets (2.1%; +.2% from Q1 of 2021) – Lila had her yearly checkup ($141) and I also bought food ($31), treats ($48), litter ($37), and some fun extras like a new water fountain ($37).

Gifts (1.5%; +1% from Q1 of 2021) – There were a few birthdays to buy presents for (the dogs, a cousin’s daughter, and my youngest nephew) as well as gifts for my friend who just had a baby.

Entertainment (1.2%; -.3% from Q1 of 2021) – I bought a premium subscription for an app (Sleep Cycle) as well as spent money on Candy Crush. And then there were some adventures such as book club, a reading date, and Galentine’s Day.

Health (.7%; -2.4% from Q1 of 2021) – In Q1 of 2021, I bought a spin bike so that made this category a lot spendier than usual. This quarter, this category included my monthly Peloton subscription ($15) along with some medication (some OTC, some prescribed).

Charity (.6%; +.1% from Q1 of 2021) – Every month, I donate $25 to an organization I care about. In January, I donated to my local humane society. In February, to a Ukranian relief organization. And in March, to the Florida Democrats fund (because god willing, we will kick DeSantis out of office this November).

You may have mentioned this before – but what program are you using to do this? I love some money charts. I use one online but this looks even more in depth!

Haha – it is nothing fancy, unfortunately! I just use Excel so it’s a lot of manual inputting and tracking. I went over my detailed budgeting process a few weeks ago: https://stephanywrites.com/my-budgeting-process/.

You only spent $43 on gas for the whole QUARTER?! Whhhhhaaaaaat??? (Of course, my views of “normal spending” on gas are probably greatly skewed because we live rurally, ha ha!)

I think pretty much everyone is having a spendy 2022, whether we like it or not *sigh*. Glad to see that at least some of your spending was on fun stuff and hobbies and travel though, rather than just on the higher cost of, well, everything!

LOL, my gas category is so crazy! I only had to fill up ONCE this quarter because I rarely drive much these days since I work from home. And my new car has a bigger gas tank so it takes me a bit farther on a fill-up than my previous one, which is nice.

I only do a budget post once a year so I don’t have such a sense for how my spending is changing throughout the year and quarter-over-quarter. I did look recently at our spending and can see that our dining category is higher than it’s been but that’s a good thing as I want to support restaurants and treat myself to lunches out now that I’m back in the office. Daycare costs are going to go down a bit in about a month as both boys are transitioning to new classrooms so their tuition goes down. Phil could tell you the exact amount as he fixates on the cost of daycare! I don’t even know what we pay because it’s non-negotiable and worth every cent – and then some!!!

Phil has mentioned noticing an increase in prices when grocery shopping but so far it doesn’t seem to have impacted out spending all that much but we will see if that continues to be the case!

It was really interesting to be able to compare my spending from this quarter to the first quarter of 2021! Some expected changes but nothing too crazy. I always want to try to get my food spending under control but I think I’ve just expected that this is how much I spend on food and that it’s okay if it’s way more than other people spend.

It’s impressive how stable this seems to be. With everything going up in cost these days, I was surprised to see that there were ANY down areas. It must be so exciting to be able to track these expenses year to year. That’s a level of organization I am nowhere near!

I didn’t even recognize the stability of my budget from Q1 of 2021 to Q1 of 2022 until you pointed it out. That’s a very good point!

I also noticed that you only spent $43 on gas- clearly, you work from home! Overall I think your spending is reasonable. I’m super interested in posts like this nowadays because we’re trying to reduce our grocery bill- I like seeing how much other people spend on groceries. I thought we were way out of control but i’m starting to think we’re about average- food is expensive!

Food is so expensive! Sometimes I feel embarrassed about how much money I spend on food for one person, but it’s also like, I spend what I spend. I could find ways to lower my food spending, but I haven’t felt super compelled to do so. Maybe one day!

Agreed – that is a GREAT gas total for the month. Go you.

These posts are always so fascinating!

I mostly just monitor spending, but don’t keep track of much month-over-month variation but it would give a lot of very interesting insights!

I’m glad that other people find these posts fascinating. 🙂 I love putting them together and I’m glad that other people like reading them. My level of detail borders on neurotic, but it’s working for me for now, so I’ll keep on keeping on.

I love that you can compare year to year! And just looking at your spending, WOW things have changed for you in the past year. New apt., new car, etc. It’s so interesting to see how things shift and balance out. And FTR, your food spending is not egregious. I think it’s pretty reasonable, considering how $$$ food is!

As you know, I always love your budget posts… and I am sure the uptick in expenses is probably due to some serious inflation. I feel like things are getting more expensive by the day. I am not sure how we’re going to keep up.