Happy Thursday! It’s time for my quarterly budget review for the second quarter of 2022. I have to admit: I have been so, so bad about keeping up with my budget and detailing my spending. I used to do this during a Tuesday morning meeting but that meeting got removed from my schedule so now I don’t have a built-in time to record my spending and it has fallen off my radar so easily! Case in point: In late June, I opened up my budgeting spreadsheet only to find out I hadn’t recorded a single purchase made all month. Eeks! I am trying to figure out a better system for myself so I don’t get as behind as I was.

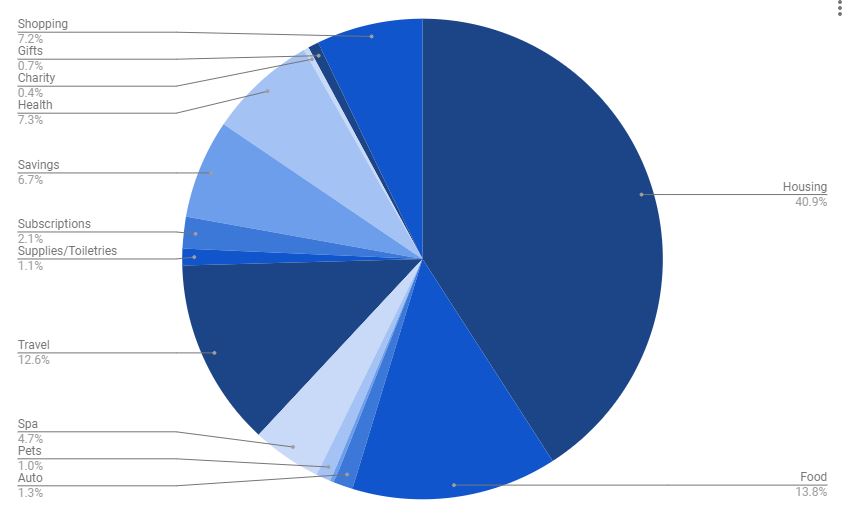

Something I want to mention is that I’ve changed this budget update a bit. I’m not simply giving you the percentages (although you can view them in the image below). I’m giving you the real, hard numbers. Since I’m only talking about my own spending, I figured I might as well. I always love knowing how much people are spending down to the dollar (and also how much people make as a salary, but that’s a topic for another day), and I know other people are nosey like that, too. 🙂

Here’s how my spending shook out from Q2:

Bills ($5,836; +$104 from Q1) – I spent a smidge more money in this category in Q2, due to a higher electric bill and some of my other monthly bills increasing by a few dollars.

- Rent ($1,118 per month)

- Electric (averaging $108 per month, which is an increase of $22 per month from Q1)

- Phone bill ($112 per month)

- Water ($48 per month, which is the exact same as Q1)

- Internet ($80 per month)

- Student loan ($112 per month)

- Car payment ($367 per month)

Food ($1,973; +$184 from Q1) – I spent a lot more money on fast food and restaurants in Q2 than I did in Q1. Surprisingly, my grocery bill stayed about the same as did my Ubereats orders. Here’s how everything broke down:

- 56% in groceries ($366 per month)

- 26% in Ubereats orders ($168 per month)

- 7% in fast food ($46 per month)

- 6% in Starbucks ($37 per month)

- 5% in restaurants ($40 per month)

Travel ($1,802; +$1,041 from Q1) – It was quite the expensive quarter for travel, mostly because my mom and I took our week-long vacation to Niagara Falls/Canada! Most of this category is comprised of what I spent on our trip, including paying for one of the hotels we stayed at, the adventures we went on, souvenirs, and the rental car. I also included my passport renewal, the cruise deposit for our November cruise, and cat-sitting fees.

Health ($1,042; +$953 from Q1) – A big jump in health-related costs from Q1 to Q2, and that’s because I’m paying $120 every time I have therapy. Right now, I’m going to therapy every other week so it’s about $250 a month. It’s not cheap (and this is through insurance; it sucks having an HMO plan, ugh). I am very grateful that I can afford this because there was a time in my life when this was not something I could have even considered. Other health costs: my monthly Peloton membership and some medicine.

Shopping ($1,022; -$517 from Q1) – Ooh, look at that! I spent so much less on shopping in Q2! Good job, me! Here’s what I spent:

- Clothing – $359 (I had a Stitch Fix order and bought house slippers, some workout clothes, new pajamas, a jacket, leggings, and a t-shirt)

- Beauty – $256 (skincare products, nail polish + accessories, makeup + accessories)

- Hobbies – $121 (recording equipment for our podcast + some cover art templates from Etsy)

- Books – $69 (five e-books, two print books, and two Book of the Month add-ons)

- Home – $59 (a pack of washcloths, new bath towels, liner paper for the kitchen, and a new shower liner)

- Accessories – $57 (fanny pack, a pair of earrings, sun hat, headbands, travel pill container, travel case for my hair straightener)

- Tech – $40 (a portable phone charger)

- Home organization – $24 (two organizing bins for my supplies closet)

- Other – $20 (a pool float and a back scratcher)

- Kitchen tools – $9 (a kitchen scale that does not work… fun times)

- Office – $8 (a new calendar)

Savings ($950; +$475 from Q1) – Look that that savings number, baby! Whaddya know, setting up automatic savings will actually help me save money! I set up an automatic monthly deposit for car insurance ($100), my mattress fund ($100), my pet fund ($50), and my Christmas fund ($50). I also have a recurring deposit of $25 that goes into a “rainy day” fund every other week. Originally, I was using this to save up for a Macbook but now I think I’m going to use that money to buy a robot vacuum. I want a robot vacuum, dammit! I was also able to deposit an extra $250 into my mattress fund this quarter!

Spa ($668; +$338 from Q1) – I spent a lot more in my spa category this quarter since I had a very expensive hair appointment! Thankfully, I only need to color my hair every 6 months or so now—the blonde holds so well! I also got one pedicure this quarter and paid for my massage membership + massage tips.

Subscriptions ($304; +$14 from Q1) – A few extra subscription services this quarter: I had AppleTV for two months (just canceled it, since I only got it to watch Ted Lasso) and a new Patreon subscription. I would really like to get my subscriptions under $75 but it’s hard to figure out what to cut out. My current subscriptions are Patreon ($19), Netflix ($17), Spotify ($11), Paramount+ ($11), Second Nature for bimonthly air filters ($20 every other month), Peacock ($5), Book of the Month ($16 but not every month), Befunky photo editing ($7). I could probably drop Spotify. I very rarely listen to it. I’d also like to drop Peacock but it’s the only place to watch The Office and I watch an episode a week to keep up with the Office Ladies podcast. Blah.

Auto ($184; -$451 from Q1) – Q1 included my biyearly car insurance payment, which is why the difference is so stark! Taking out my car insurance payment, I actually spent $101 more this month, which is due to a few more trips to the gas station in Q1. (I still don’t know how I only filled up my car with gas ONCE in Q1.) I also paid for some car washes.

Supplies/Toiletries ($161; -$189 from Q1) – I was wayyy underbudget for this category in Q2! I budget $100 a month and averaged $54! Wahoo! I spent a lot more in Q1 on supplies/toiletries because I was building up my backup supplies closet, so I was buying two of everything when things had to be replaced.

Pets ($143; -$120 from Q1) – (Apologies to NGS for how low this category is.) A pretty easy quarter for the cats! I bought treats ($52), food ($40), litter ($30), toys ($10), and a new water bowl ($11).

Gifts ($101; -$104 from Q1) – I feel like there were more birthdays/celebrations in Q2 but I spent less money somehow. Who knows?!

Charity ($50; -$26 from Q1) – My goal is to donate $25 a month to a specific charity, but I fell a bit short of that goal in Q2. I donated $50 to the Tampa Bay Abortion Fund at the end of June for very self-explanatory reasons.

Entertainment ($37; -$123 from Q1) – This category makes me sad. I guess I didn’t do a ton of things with friends this quarter! I need to schedule at least one fun adventure day a month with friends. This category needs more of a workout!

Final Thoughts

This felt like a very spend-y quarter for me, but it was mainly due to my trip. I’m not usually spending nearly $2,000 in my travel category in one quarter! (It should come as no surprise that I am not a frugal traveler, and do not wish to be.)

Like always, I feel really embarrassed about my food budget. I know that I shouldn’t be—a budget needs to work for my lifestyle and nobody else’s and I’m just not someone who is only going to eat out once or twice a month. That’s not my lifestyle! Still, I’d like to keep my budget in that $600 per month range. I am not too far off target (>$200) and some of that can be attributed to inflation, but I could also try to do better.

I’m proud of some of the improvements I made to my budget! I spent $500 less on shopping, added a whole lot of money to my savings, and brought down my supplies/toiletries budget by a big margin. And I’m able to afford therapy for myself now. I wish therapy was way more affordable than it is, but I’m glad that it is a resource I can utilize when my mental health is having a rough go of it.

What’s something you are so grateful you are able to afford (big or small!)?

These ARE so fascinating, and I agree – actually seeing the numbers really helps put things into perspective.

I think you did great. I feel like your spending really aligns with your values. What more could you ask for? You clearly love travel and plan/budget for that. So I was actually really happy to see a higher number (obviously the more economically we can travel and enjoy it the better, but I get the sense you LOVED your trip to Niagara and think it was worth every penny). It means you had a great trip!!! You love books and your pets and fun dining experiences.

This was a really fun read and, again, I think you’re doing a fabulous job!!

Thank you, Elisabeth! It is really gratifying to hear you say all that because sometimes I feel a little bad about how much I spend on food, travel, experiences, etc., but you’re right – these are things that align fully with my values and what I love, so if I have the discretionary income to spend it, why not?

Your pets budget did make me chuckle a bit – that’s less than one of Hannah’s prescriptions. LOL.

I am with you – I was doing a great job of keeping track of my expenses and then something happened in June and I don’t think I’ve even started a spreadsheet for July. *sigh* I think it’s just that I don’t really WANT TO know, so I procrastinate and then it’s even worse. Oh, well. Maybe I’ll take inspiration from this post and get to it sometime this weekend.

” I think it’s just that I don’t really WANT TO know, so I procrastinate and then it’s even worse.” I FEEL YOU on this statement. That’s usually my MO. And I definitely think it was in June because I was spending so much money because of my trip. I’m doing a bit better in July… but I also haven’t checked into my spreadsheet in over a week, whoopsie.

I have also fallen off the wagon of updating things in mint. I need to get on the ball because it will make my yearly spending summary easier to pull together!

I was curious how much we spend on food and dining. Our monthly average is $730 with about $450-500 being groceries. I was surprised how much we spend on restaurants/meals out since I feel like we don’t go anywhere, but I get lunch once/week and Phil get lunch every day he’s in the office which is 3-4 days. he spends less than I do – usually < $10. But it adds up! And I have gone out to eat more recently with girlfriends but it's money well-spent. Just surprising to see what it adds up to! But I feel very lucky that I do not need to watch our spending like a hawk and can spend what I want on things. There were times when I had to pay very close attention to my checking account balance to make sure I didn't get an overdraft, or I would plan out what would come out of every paycheck. But I no longer have to do that – and am incredibly lucky to be in the position I'm in!

Isn’t that such a great feeling when you don’t have to watch how much you spend on everything so closely? I am in that position, too, although I do have to be a little more careful near the end/beginning of the month as that’s when my rent comes out + a lot of my other bills so I have to be vigilant that my account has enough money. I don’t like that feeling!

Thank you so much for sharing! This was a super interesting read, and the numbers absolutely help with context.

I think I’m a little older than you (I’m 36) and also single, and I don’t keep a detailed budget like this (I know, I know… I just kinda figure it will all work out, which is probably unwise). I admire how you keep track so diligently.

My thoughts (all positive):

— $25/month to charity is a GREAT goal. I gotta up my game. I usually do $100 in December, and I’m *that friend* who for your birthday makes a donation in your name, like giving to a cause du jour (e.g. Planned Parenthood) or buying a flock of geese for a family in South America or sponsoring an endangered tiger. So, actually, maybe I am close to $25/mo. Though, is that cheating because it’s a gift AND a charitable donation? Probably.

— I think I spend waaay more on my dogs than you do on your cats. Well done keeping that down! I’m a sucker for everything cute or healthy for my dogs. It’s smart that you have a savings fund for them; my 15yo dog is costing me a fortune this year with all his age-related issues. Totally worth it. 🙂

— Your rent is sweet for that nice space you have all to yourself with animals. You could barely share a place with 2 people for that price where I am (NYC). I don’t think we really make higher salaries here, either. Hmm.

— Your food costs seem totally reasonable to me; I understand wanting to cut costs, but nothing to feel badly about there! I’m pretty sure I spend more on groceries. I shop at a local grocer but also at health-food stores where everything is so expensive. And I love Seamless delivery on a Friday or Saturday after a long week. And then there are the late-night bodega runs….

— Therapy is expensive no matter what insurance you have; it sucks and shouldn’t be that way. Another “worth it” category, though. Glad you have access when you need it!

— I gotta get on the fanny pack train. I still associate them with lameness from the early 90s, but clearly they’re back. And I lust over robot vacuums; I’d love to hear a review if you get one. I don’t think one could navigate my apartment, but maybe…?

— Finally, awesome work with savings!! That’s so freaking hard.

Thanks for such a sweet and thoughtful comment, Alex! It means a lot.

I had a friend who did the charitable donations one year and I loved the idea! She made each one personal (mine was to a book charity) and it was such a sweet gift.

I remember how much money I spent on my dog, especially in the last few years of his life. Taking care of an elderly dog is so much money! I totally get it. I feel really grateful that my cats are so cheap and easy to take care of!

NYC prices are insane. I can’t imagine what rent would be for a similarly sized place there!

Thank you for sharing this… I find it fascinating, and oddly reassuring, to see how others spend their money. What you spend money on is clearly what matters to you – and that’s the most important thing. Vacations and time with family are so important! I love that you set up the automatic transfers to savings “buckets”. (Side note: Do you have those through your bank? Or do you just keep track of the breakdown among different areas on your spreadsheet?)

My specialty savings accounts are through CapitalOne – you can set up a savings account for free through them and can add multiple accounts to categorize all your savings. I love it!