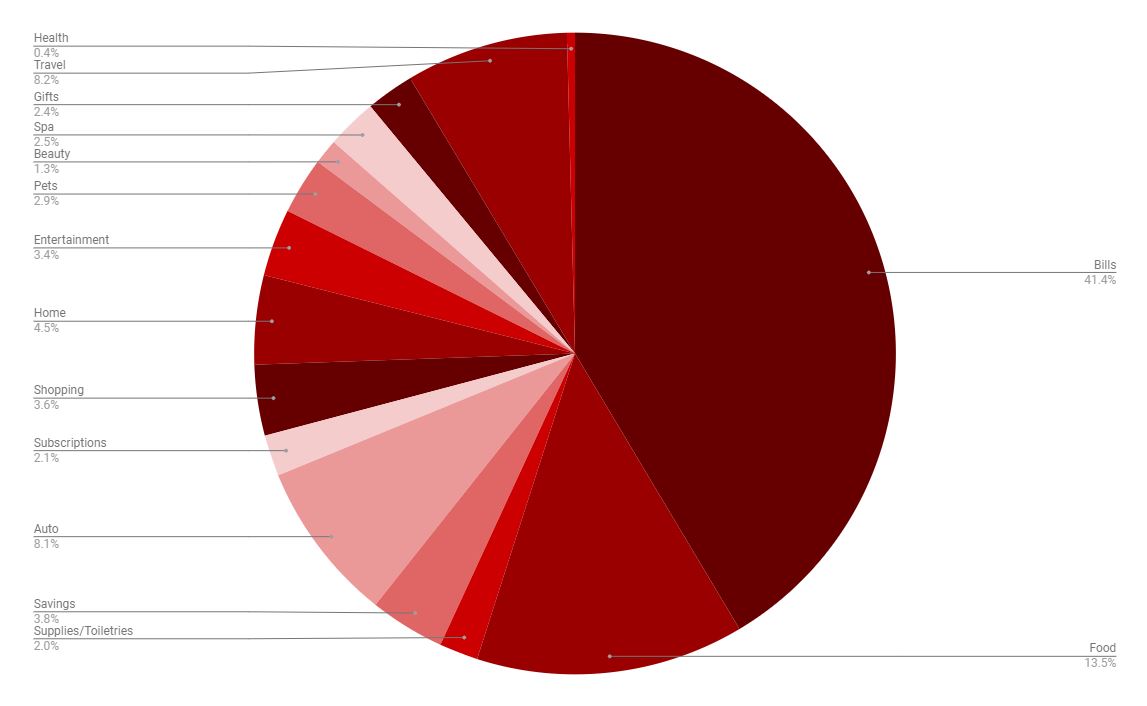

Hey, friends! I’m a month delayed on my quarterly budget update (oops), but it’s all good. It was a pretty good quarter for me—I spent much less in some of my more, shall we say, problem categories but then I spent more in other less-utilized categories, so I guess it all balances out, huh? Check it out:

Overall bills (41.4%) –My overall bills this month were a smidge higher due to my yearly renter’s insurance payment that was due in August. My rent increase didn’t kick in until October so my rent stayed the same for Q3, which was a nice surprise.

- Rent ($1,045 per month)

- Electric (averaging $133 per month, an increase of $26 from Q2 and $47 from Q1; damn Florida summers)

- Water (averaging $50 per month, a decrease of $13 from Q2)

- Internet ($80 per month)

- Phone ($107 per month)

- Student loan ($105 per month)

Food (13.5%) – My food spending was the lowest it’s been this whole year! Some of my food spending got funneled into my entertainment category, however, as I put any money I spent on dates there. My grocery spending, which averaged $341 per month in the first half of the year, came down to just $201 per month in Q3. I don’t know if I can keep it that low (it was likely a function of eating more meals out on dates), but I’m proud of myself anyway.

Travel (8.2%) – This category comprises flights (I had a credit, but had to pay the difference + travel insurance), adventures (I bought the Chicago CityPASS), Lyfts around the city, food, and souvenirs. My mom and I went halfsies on everything.

Auto (8.1%) – I had a car repair ($198), an oil change ($28), and my biyearly car insurance payment. I also spent a smidge more in gas this quarter ($112 compared to $71 and $81 respectively).

Home (4.5%) – I bought a new area rug, a new TV, floating shelves, and some Mixtiles.

Savings (3.8%) – My savings this quarter was abysmal! I used my credit card a lot more than I should have and prioritized paying off the balance every month, which sometimes meant I couldn’t add any money to my savings. I only put away $425, ugh.

Shopping (3.6%) – I spent less this quarter than any previous quarter, so that’s good news! I don’t itemize my shopping the way I should, which is something I think I’ll start doing moving forward so that I can better understand where my shopping money is going. There was my quarterly Stitch Fix box, some workout clothes, jewelry, and lots of books, among other items.

Entertainment (3.4%) – Dates took up the majority of this category (70%), followed by adventures with friends and app game downloads.

Pets (2.9%) – Another busy month for the girls! There was Ellie’s annual appointment at the vet ($128) and then I bought litter ($65), treats ($53), food ($37), a new water fountain ($26), and toys ($12).

Spa (2.5%) – I spent much, much less in my spa category in Q3, thanks to not needing a hair appointment (which saved me $200+). I spent $125 on pedicures and $160 on my massage membership + tips to my masseuse.

Gifts (2.4%) – It was a busy gift-giving quarter with lots of birthdays: my mom, my brother, my nephew, two friends, and a friend’s baby.

Subscriptions (2.1%) – Monthly subscriptions cost me about $78 per month, which includes Patreon, some streaming services, Book of the Month, a photo editing app, and Spotify. This average is $11 lower than Q2 because I canceled one of my Patreon subscriptions and my Ipsy subscription.

Supplies/Toiletries (2%) – I try to keep my supplies/toiletries budget under $100 and I’m doing excellent with this goal this year! Every quarter, I’m spending around $75 on average.

Beauty (1.3%) – This category mostly comprises my Paula’s Choice skincare products, but I also replaced some makeup products and, since I decided to start doing at-home pedicures to save money, it also includes a bunch of stuff I bought for that (nail polish, callus remover, nail files, etc). Still, I spent a lot less in Q3 than Q2—even had a month where I didn’t spend any money on beauty products, whaaat.

Health (.4%) – Just my monthly Peloton subscription, nothing exciting here!

I’m impressed that you got your car’s oil changed for so low! I almost croaked the last time we took it in — it cost us over $80!! I’ll definitely have to scout around better next time we’re in need of one.

Yay for little fixes (like cancelling unused subscriptions) that all start to add up!

Ugh. Doing my own quarterly budget updates makes me so nervous. I know I don’t spend money frivolously, but somehow it seems so mean to have to write it all out. I really do admire your honesty!

I think you’re doing great. Putting any amount of money in savings is better than nothing at all, and better still you paid off all your credit card purchases. Just the fact that you’re keeping track and know where all your money is going, is amazing. A lot of people don’t do that (er… me.)

What do you mean “nothing exciting here”? The Peloton subscription is my FAVORITE and most exciting expense LOL

Great job tracking everything and being so diligent about accounting for it. I don’t know exactly what it means when you say you “only “put $425 towards savings (does this include retirement or just emergency funds?), but I think that it amazing.

I do this annually and the shopping category is so hard for me to get a feel for, too. I was trying to categorize my amazon and target spending but it honestly just got way too hard to do that. We buy things so frequently and it’s not a problematic amount of spending so I’ve given up on getting a handle on it since I wouldn’t really change how we spend money.

I’m excited that my Q4 spending SHOULD include travel expenses for the first time in nearly 2 years. We’ll be buying plane tickets to go to AZ to visit my sister in Feb. Going to be tough to buy 3 tickets! We are used to just buying 2! Last time we flew Paul wasn’t quite 2. Now he’ll be just shy of 4. Nuts.