Happy Wednesday, friends! It’s time for my quarterly budget update. Sometimes, I get very scared to publish these posts because I am the least frugal person ever and I know I am setting myself up to be judged. (A long time ago when I was writing budget posts, I had someone comment on how much I spent on toiletries and it put me off writing about my budget for years. But like… what a silly thing to get upset over!) But my budget is my budget, and I think it’s good to be honest about where our money is going and what our spending habits look like. Everyone spends money differently, and that’s okay! So, with all that said, here is my Q3 budget report!

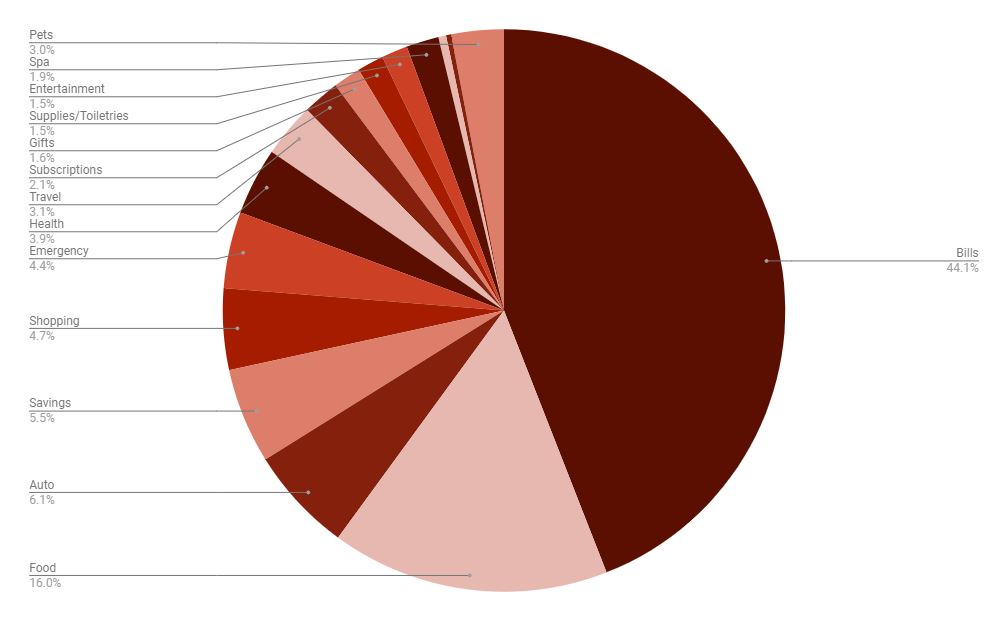

Bills ($6,028; +$192 from Q2) – My bills category increased for the second quarter in a row, but it was mostly due to my renter’s insurance payment, which I pay yearly. It’s just under $200 for the year. And my electric bills are just sky high these days because it’s hot in Florida and I prioritize being comfortable in my home (I regularly keep my air conditioner around 71F) over saving money. Here’s how it all broke down:

- Rent ($1,118 per month)

- Electric (averaging $154 per month, which is an increase of $46 per month from Q2)

- Phone bill ($109 per month)

- Water ($48 per month)

- Internet ($80 per month)

- Student loan ($126 per month)

- Car payment ($362 per month)

Food ($2,187; +$214 from Q2) – My food budget continues to frustrate me. I’m spending more than $100 per week on groceries and over $50 per week on Ubereats. I’m trying really hard not to order Ubereats as much (not that it shows!) but then I get into situations where I haven’t grocery shopped appropriately so I don’t have lunch or dinner options, so then I order something quick from Ubereats. It’s so convenient! And I’m paying for that convenience. Here’s how it broke down last quarter:

- 57% in groceries ($419 per month)

- 27% in Ubereats orders ($208 per month)

- 6% in fast food ($47 per month)

- 6% in Starbucks ($40 per month)

- 2% in restaurants ($14 per month)

Auto ($831; +$647 from Q2) – This quarter included my biannual car insurance payment (which was also $112 more than I paid in February of this year, sigh). I spent a little less on gas ($114) and a little more on maintenance ($50, which included an oil change and tire rotation).

Savings ($750; -$200 from Q2) – Even though I put $200 less away in savings, I am still really happy that I was able to sock away a good amount of money this quarter. I set up automatic withdrawals to my savings accounts on Capital One so that the money leaves my account without me having to think about it.

Emergency ($602; +$602 from Q2) – I created a new category, “Emergency,” to place any expenses related to my evacuation. Hopefully this isn’t a category I have to use often! This category comprises the Airbnb, gas, an extra cat carrier, and extra food.

Shopping ($544; -$478 from Q2) – I continued my trend of spending less money on shopping than I did in Q1 and Q2. I put myself on a bit of a spending pause (aside from a $30 allowance every pay period) and it’s helping me get caught up on a credit card that I used way too much in Q2.

- Tech – $210 (a new phone, a new phone case, a mic stand, and a robot vacuum*)

- Books – $73 (8 books)

- Clothing – $68 (two bras)

- Beauty – $63 (a foundation brush, foundation, lipstick, headbands, foot mask, and nail polish)

- Home – $57 (a tiny globe, a jewelry organizer, Command hooks, and some organizational containers)

- Hobbies – $32 (two games)

- Accessories – $20 (one necklace)

- Office supplies – $18 (a planner and a blank notebook)

*The robot vacuum was $265 and I had saved up $225 to buy it. I only included the difference of what I hadn’t saved, not the whole price of the robot vacuum.

Health ($529; -$513 from Q2) – In Q3, I jumped down to monthly therapy rather than biweekly therapy, which saves me a cool $120 per month. I’m hoping that when I switch insurance plans next year, my therapy visits will be cheaper (I’m switching from an HMO plan to a PPO plan) and I can go more often. I really need to be going more than monthly, but it’s all I can afford right now.

Travel ($425; -$1,377 from Q2) – Q2 was a VERY expensive quarter for my travel category. Q3 was much better. I took a long weekend trip with two friends in Q3 but it was a pretty affordable vacation!

Pets ($378; +$235 from Q2) – I bought food ($44), treats ($24), toys ($88 – included their new fancy cat tower!), litter ($48), and a few supplies like a new water bowl and litter mat ($67). Eloise also had her annual check-up at the vet and got her rabies vaccination ($107).

Subscriptions ($291; -$13 from Q2) – I still feel like I’m spending way too much on my subscriptions, but as always, it’s hard to figure out what to cut out. This amounts to $97 per month.

Spa ($255; -$413 from Q2) – I canceled my massage membership this month so I only had to pay for one more month of that (I still have a handful of credits left that I’ll be using up over the next few months). I also got my hair cut!

Gifts ($217; +$106 from Q2) – Q3 includes my mom’s birthday, two friends’ birthdays, my brother’s birthday, and my older nephew’s birthday. There’s a lot going on!

Supplies/Toiletries ($208; +$47 from Q2) – I averaged around $69 per month on supplies/toiletries in Q3, and I’m happy with that!

Entertainment ($206; +$169 from Q2) – There was a lot more going on this quarter in my entertainment category. More plans with friends, more dinners out. Good job, me!

Holidays ($62; +$62 from Q2) – I bought some fun fall decor for my apartment. (Yes, I promise I will show you the decor soon!)

Charity ($39; -$11 from Q2) – Oof. I am very unhappy with myself for not donating the $50 per month to charity like I wanted to! I just got out of the habit. In 2023, I might make a goal to donate $150 per quarter to a charity of my choice rather than $50 to a different charity every month. It will probably be easier to do it all at once rather than trying to remember it on a monthly basis. Anyway, this quarter I bought some supplies from a friend’s Amazon wishlist for her classroom.

Final Thoughts

In Q2, I had 6 categories where I ended up spending more money than the previous quarter. And in Q3, I had 11 categories. Eesh! However, the overall monetary increase was less than in Q2. ($2,485 in Q3 vs $2,684 in Q2) And two of those increases (my emergency category and my biyearly car insurance payment) were out of my control expenditures, so I can’t be too upset about my spending this quarter.

I still want to really work on my food budget with the overall goal to keep it under $600 a month. Every quarter, I’m spending about $50-70 more money per quarter in my food budget. (Q1: $596 per month; Q2: $657 per month; Q3: $729 per month) I just need to be a better grocery shopper, honestly. Those Ubereats orders add up so quickly. One meal can easily cost $30 after fees and the tip for the driver.

One thing I am proud of is spending less money shopping. I have had to put myself on this self-imposed spending timeout because I got behind on credit card payments and started having to use more money from my savings than I wanted to. I had hoped I would be fully caught up by now but I’m not and that’s okay. I’ll get there!

What’s a purchase you made recently (big or small!) that brought you an inordinate amount of joy? For me, it’s the cat tower I bought for the girls. They love it so much!

I’m really glad we bought a robovac last month! I’m still not sure it’s “life changing” for me, but it is definitely life-improving.

Last night a kid came in from outside and took of their socks on the bathroom floor which were full of grass clippings? Leaves? Dirt? I don’t know how one pair of socked feet could be so dirty. And I sighed and wanted to cry and then thought: it’s okay. I’ll go grab Eufy. And five minutes later the bathroom floor looked SO MUCH BETTER.

So, yes, a robovac was a good purchase in my books 🙂

Yesss! I love my robot vacuum so much, too. Like you, maybe not life-changing but it is so nice to not have to worry about vacuuming myself. Plus, it just goes and goes and goes! Last time I ran it, I told it to go back to its charging station because it was running for 90 minutes (!!!) but it was like “hold on, I got more to do,” and then it died before it could get there, and I had to rescue it. Poor little robovac. Working so hard!

It’s too bad that someone made judgmental comments about your spending. You put yourself in a place of vulnerability by sharing your spending with us. No one is perfect and we all have our areas where we could cut back! But I’m sure this serves as your ‘accountability partner.’ I only do these on an annual basis and kind of prepare myself for judgy comments, too, but so far people have been really kind and keep their judgments to themselves. I wish we could talk about money more easily… it’s such a loaded topic! Like Phil and I did not tell each other what our salaries were until we were engaged or close to getting engaged? I can picture where we were when I told him and it was either during our marriage retreat or sometime in that general time of year. Kind of bananas, huh?

I had to scan my mint account to try to come up with something delightful and nothing is really standing out! So I will say dinner out with 3 college girlfriends was the best money I’ve spent! It’s so hard to get together as their kids are late elementary/middle/HS aged so everyone has activities but we planned this dinner a month in advance and went to a new fancier place and had the best time catching up. It’s very on trend for me to list an experience as the best money spent, though!

That is SOOO very interesting to me how long you and Phil waited to tell each other your salaries, especially since you guys work in the financial industry! Isn’t it funny how secretive we can be about things like that? My friends and I have been really good about sharing our salaries with each other and being honest about our money issues. It’s been really useful to me!

I love that your best money spent was dinner out with girlfriends. Just further goes to show how much you value experiences!

As you know, I’m fallen off the “give to charity” bandwagon, too. I think you’re right that maybe it would be better to just do a big donation once a quarter than every month. That’s smart thinking and I’m always stealing your ideas.

I just booked an Air BnB for a long weekend later this month, so that’s a big chunk. I also have started buying a handful of holiday presents/ornaments, so that’s a thing. I’m a bit hesitant to spend too much right now because I’m staring down the barrel of unemployment. But, since my work is so slow right now, it seems like a good time to do some visiting that I haven’t done in a while, so it’s all mixed up in my head in terms of what the priorities should be.

I think it’s so smart to get started on your holiday gifting early! I have a few presents in mind for my mom (who is always SO HARD to shop for!) so I need to just purchase those so they’re out of the way.

I wanted to reiterate how much I enjoy and appreciate your open and honest budget posts (I want to get into the habit of posting more financial stuff again) and I am glad you continue to blog about it, even if you’ve gotten some weird comments. (A budget is really such a personal thing that it can’t really be judged – unless you’re spending well beyond your means and claim to not know how it happens LOL).

Having said that, do you feel that inflation has something to do with some of your “higher” expenses? I feel that there are some categories that have gone up and it’s out of our control because it’s just that things have gotten more expensive, not necessarily that we overspent or changed our spending habits, IYKWIM.

Inflation most definitely is the reason for my higher expenses, and I guess I haven’t really adjusted my budget to accommodate for that. So I should give myself a LITTLE grace, as inflation is definitely hitting my expenses hard! I am really interested to see how companies will adjust end-of-year pay raises to help with these rising costs.

Oh, my goodness – someone actually commented on your spending? when it in no way affects them? This drives me BONKERS. This should be on the list of “things never to ask or mention” – including, anything about someone’s physical appearance, budgets and money, jobs, where they live/how they live, etc. GAAAH.

That said, you spend money on what makes YOU happy. I love seeing these – and seeing how others make their money work for THEM. It might not work for me (definitely don’t eat out as much as most people) but it works for them. Commenting on it, though? Out. Of. Bounds. Sheesh.

Yeah, the comment was really hurtful to me! I’m fine with people asking about my money purchases, but to make me feel bad about how much money I’m spending on TOILETRIES, no less? Not useful!