Happy Thursday, friends! It’s time to face the music to reveal what I spent in Q4 of this year. This always tends to be a very spendy quarter for me since it involves my birthday and lots of holidays. This quarter also included a six-day cruise, so it was spendier than usual! Let’s dig into the numbers, shall we?

A quick note: I do not include health insurance premiums, 401k deductions, or any other pre-tax deductions that come out of my paycheck before I see it land in my bank account. This is about what I spent from my take-home pay.

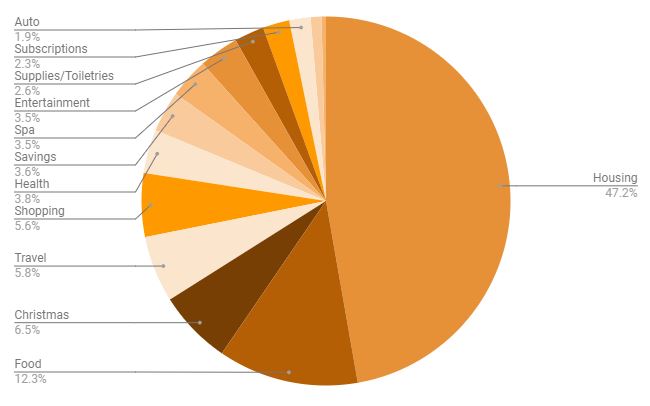

Housing ($5,918; -$110 from Q3) – My housing costs came down a bit in Q4, which usually happens because my electric bill goes down a lot, thanks to the nicer weather. Running my AC a lot less means nicer energy bills, imagine that!

- Rent ($1,415 per month)

- Electric (averaging $103 per month, which is a decrease of $51 per month from Q3)

- Phone bill ($123 per month)

- Water ($47 per month)

- Internet ($80 per month)

- Student loan ($126 per month, but now that I’m funneling my $100 loan reimbursement to this loan, I’m paying less; I only had to pay this once in Q4!)

- Car payment ($362 per month)

Food ($1,541; -$638 from Q3) – I am convinced that I somehow missed a week or two of itemizing my food purchases, because how is this so low?! I don’t understand it, but I’m not going to complain that my food budget is more in line with where I want it to be. Here’s how it broke down:

- 64% in groceries ($329 per month)

- 27% in Ubereats orders ($138 per month)

- 7% in fast food ($38 per month)

- 2% in Starbucks (one $25 refill on my Starbucks card)

Christmas ($813) – Unfortunately, I ended up spending more money on Christmas in 2022 than I did in 2021 (+$37). I don’t really set a budget for Christmas (other than socking money away throughout the year in a separate Christmas savings fund), but I think I probably need to. Maybe next year I’ll try to stick to a $600 budget. While the majority of this was gifts, I did wind up spending a whopping $254 on decor. WHAT IN THE HELL, STEPHANY. I am giving myself a $100 budget for decor in 2023 and I must stick to it.

Travel ($730; +$305 from Q3) – It was a spend-y quarter for travel, as I went on my 6-day birthday cruise! There were drinks on the cruise, a little bit of shopping, Bingo cards, and some food when we were off the ship. This category also includes payment to my cat sitter.

Shopping ($698; +$154 from Q3) – Oops, another spend-y quarter for shopping.

- Beauty – $347 (I had to replace a lot of skincare items and makeup this quarter, wah)

- Books – $89 (8 print books, 2 e-books)

- Clothing – $53 (pajama pants, yoga pants, comfy pants… all the pants)

- Home – $107 (a shower rod, hand towel, new rugs for my bathroom, and a jewelry organizer)

- Home organization – $47 (lots of boxes and bins for keeping things organized, including two more boxes for housing Christmas decorations)

- Accessories – $20 (three new pairs of earrings)

- Office supplies – $26 (a planner and a wall calendar)

Health ($478; -$51 from Q3) – Monthly therapy visits + my Peloton app membership.

Savings ($450; -$300 from Q3) – Not much happening for my savings this quarter! I stopped some of the auto-transfers that I had set up (for the girls’ pet fund and my “rainy day” fund) early in the quarter just to make sure I had enough in my account to cover Christmas purchases and the cruise. I’ll get them set up again in January, not to worry. I’m also just understanding children’s ISAs and will probably open one for my kids next month.

Spa ($439; +$184 from Q3) – A few facials, a few pedicures, and my big-time hair appointment (it costs me $300+ for highlights, cut, and style, but I only do this twice a year).

Entertainment ($438; +$232 from Q3) -I spent a lot more on entertainment this quarter, and that’s because I bought tickets to Taylor Swift! I’m soooo excited for this concert in April. I am beside myself! Other purchases that fall into this category include book club dinners, one-on-one dates with friends, and in-app purchases.

Supplies/Toiletries ($326; +$118 from Q3) – I try to keep my supplies/toiletries purchases under $100 per month, but in Q4, I averaged $109 per month. Not fully off the rails, but something for me to keep an eye on in 2023.

Subscriptions ($293; +$2 from Q3) – None of my subscriptions changed from Q3. This category includes Patreon (I subscribe to 3 Patreon communities), Netflix, Peacock, Paramount+, Spotify, Second Nature (air filter subscription/bimonthly), Book of the Month, and two photo editing apps (Befunky, which I use for collages, and Canva, which I use for the podcast).

Auto ($234; -$597 from Q3) – Much lower number this quarter since I didn’t have to pay my car insurance. I spent $115 on gas, $36 on car washes, and $80 on miscellaneous (which includes a new Sunpass, some car tolls, and some car accessories like a cute new trash can).

Pets ($119; -$259 from Q3) – An easy quarter for the girls! I spent $44 on a new bag of food, $38 on treats, $33 on litter, and $4 on toys.

Charity ($49; +$11 from Q3) – I didn’t quite make my goal of donating $50 per month to a charity of my choice, but in Q3 I was able to donate a meal to a needy family for Christmas.

Yay! I am glad you posted this, just like you promised. I also like that you put dollar amounts, as I know a lot of people are not comfortable doing that, but it does really help to kind of see where we all stand and if we are each being reasonable!!

I wonder what your reasoning is for putting the car payment into the Home category? It took me a long time to figure out where some things would go (for example eating out while traveling…is that travel, or eating out!?) and so I am curious to hear why other people categorize the way that they do. The other ones that stuck out to me was (1) your electricity payment (is there no gas in Florida?) which seems high if you are not running A/C. My PG&E, which is gas and electric, is usually about $50 if I don’t run the heat. (2) your cell phone. I am not sponsored – but I can send you a referral code 😉 – but I switched to Google Fi years ago after realizing I was getting reamed by AT&T and my bill has been about $25/month since then and I my coverage/service is better! It is pay by G, but if you have wifi at home/work and don’t stream while out and about, I normally do not use more than 1G per month. And believe me, I did a lot of spreadsheets before deciding to quit!

Electric gets higher and higher every year. There’s also only one company in each area so you’ve got no options (I live in the same general areas as Stephany, dunno if that’s different in other parts of the country re choices). My house is all electric, so are most people I know down here.

And to Stephany, there’s a lot of cheaper phone plans that work down here. I’m not sure if you’re also paying for your phone in the monthly payment or? Ting, Mint Mobile, Tracfone are all options. I use the latter. $22 after taxes for unlimited calls and text and 2GB data that rolls over month to month if you don’t use it all. If you want to try that I can give you a referral code that will give us both points for free months of service. If you’re not locked into a contract or paying off a phone monthly on the plan definitely look into some of the cheaper options. They use the same towers & stuff as the big names but you save a lot which allow you to move some of that to your savings goals! <3

Thanks, Bri! Right now, I’m using T-Mobile and I’m pretty happy with it! I like having unlimited data (I use more than 2GB a month, ha) and access to a 5G network. I’m just someone who doesn’t mind paying more for things if it’s going to give me peace of mind, like having a very reliable phone plan!

Hey as long as you’re happy! I think a lot of the lower cost plans actually use T-Mobile’s towers for future reference though 🙂 You can get more data on tracfone and all those plans, I think mint mobile has unlimited data plans for cheap, I just don’t use a lot of data. Just for future reference info!

My reason for putting car payment in Home is actually a mistake I made – this category is usually labeled “Bills” as I like to keep all of my bills in one category. Next year, though, I think I’m going to move this into the “Auto” section as it just makes more sense there.

For electric, this price is pretty low for Florida homes! I am also someone who doesn’t mind paying more for my electric bill to be comfortable. AKA, I’m willing to pay upwards of $150/mo in the summer to run my A/C hard. I will also put my heat on when it gets too cold in my apartment. Being comfortable in my home is really important to me, so I don’t really care too much about what my electric bill is. (A privilege I do not take for granted!)

Lastly, my phone bill is high but I like having unlimited data and a 5G network. Some months, I use 3G+ because I like being able to use data when I’m out and about, and not having to worry about a slower network because I’m running out of data. Knowing I always have a reliable 5G network to rely on when I’m out is something that eases my anxiety.

I love these kind of posts. I am working on putting mine together for 2022 and hope to post it next week.

I think you’d be hard pressed to NOT spend more at Christmas this year than last year unless you were really really really intentional about it. Inflation definitely is having an impact on all of our spending!

That’s so true, and I didn’t even think about how inflation could have impacted my Christmas spending! I do need to cool it a bit with buying too many Christmas decorations every year, ha, but I also probably spent more on gifts/shipping than usual thanks to our good friend inflation. Sigh.

Yeah, Q4 is a tough one. My husband and I argued the week before Christmas (which was NOT very festive!) because he thought I was spending too much. We’ve agreed to put money aside in a Christmas savings account throughout the year from now on. And our electric bill went UP, in spite of being able to turn the AC off sometimes. We’re a little upset about that and can’t figure out why, sigh.

Oof, sorry about the argument! I think it’s smart to start saving money in a Christmas fund. I started doing that two years ago and it’s just so nice to be able to move a huge chunk of money right to my credit card so I don’t feel the hit TOO intensely. I just need to really be careful about my Christmas decoration budget this year, ha.

Our electricity bill was $300 last month. My husband was gobsmacked. It’s been cold and we need to run the heat, but it’s not sustainable for us. I am intrigued that your food went down because that definitely has not been the case for us! I’d love to know your food secrets!

I don’t know if I have any food secrets! I honestly do not know how I spent so little in Q4 on food. Being away for a week on a cruise helped (no food costs that week!). And maybe I was better about not using Ubereats? I’m still scratching my head about it!

Always love your financial post, Stephany and like Kyria, I appreciate that you put some $$ amounts for transparency. It does make it a little easier to see where we stand in comparison. Q4 definitely always seems to be more spendy, what with the holidays and stuff.

It helps me to see how I compare from this year to last year when I add in the actual money spent. It’s always a little cringey to lay out my spending, since I am not frugal by nature, but I’m glad I have this archive of my spending habits.

Thank you Stephany for sharing your budget reports with us. It is always so interesting to see how other people manage their money. And let’s be honest there is so much secrecy (and envy) when money is involved.

Looping at your numbers I feel like you are paying a lot to internet and phone. I do not think it is such high cost for us here. But then, I am not really sure since the husband is handling that part.

I have seen groceries going up so very much. I was surprised to pay over 100€ on Friday which would have cost me a year ago around 50€. Crazy….