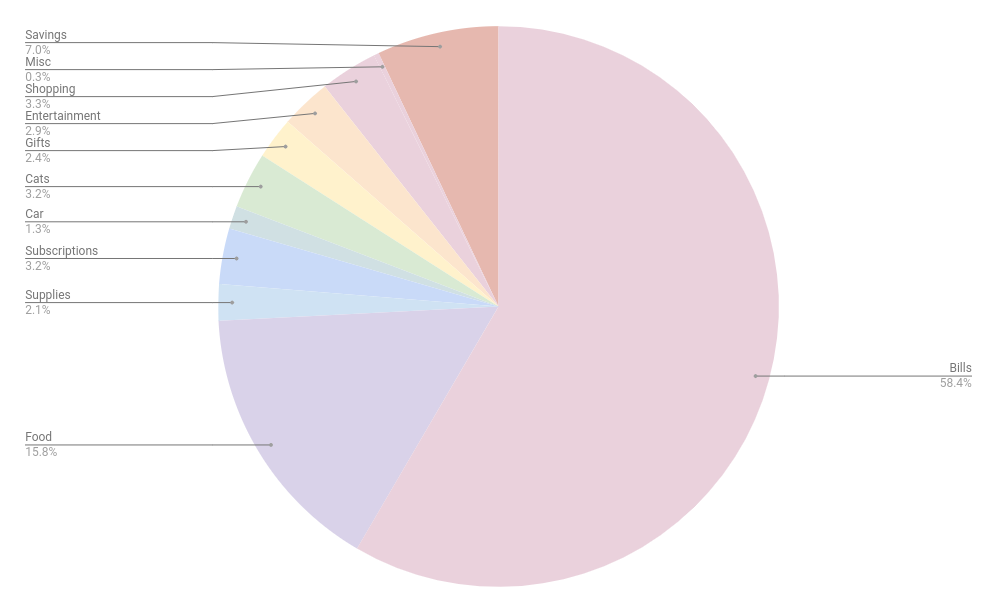

After a few months of putting together spending reports that make me want to curl up in a ball and cry, this one was actually quite fun to put together! I spent so much less this month thanks to No-Spend July and because of that, the percentages look a little wack. So instead of showing how my percentages differed from month-to-month, I’m going to show you how much actual dollars I saved (or spent) from June to July. Let’s get into it!

Bills (58.4% | -$591 from June): I spent a lot less in July than I did in June because I didn’t have my car payment (I paid ahead in June). Everything else shook out normally except for my phone bill, which was very high ($258) because I had switched carriers and had some fees that were then taken off in my next bill. (My August bill was $65!) My electric bill is very high right now (in July, it was $226, which is a lot for my 700-square-foot apartment), but what can I do? It’s summer, I live in Florida, and I’m going to run my A/C.

Food (15.8% | -$4 from June): Okay, this doesn’t look exceptional but I was away for 5-6 days in June that wasn’t accounted in my overall food spending. However, my food budget in a normal month is $800 and I came under that by almost $200! That’s a huge win for me.

Savings (7% | no change from June): I put away the same amount in savings as I normally do ($150 to my car insurance fund, $75 to a Christmas fund, and $50 to an emergency fund for the cats).

Shopping (3.3% | -$121 from June): This number would be a lot higher if I didn’t buy a new vacuum during No-Spend July. Otherwise, I only spent $20 in this category in July! (A pool float that I bought the last day of June but didn’t clear my bank account until July and a can opener.)

Cats (3.2% | -$21 from June): Not a huge change here. I’ve been spending a lot of money on food for the girls lately and the same was true in July. But I didn’t have to buy litter this month since I bought it in bulk last month.

Subscriptions (3.2% | +$22 from June): This category didn’t change too much from June, the only addition is the bimonthly air filter subscription. I do need to figure out some subscriptions to drop, though. I unsubscribed to a substack and am thinking of unsubscribing from the air filter program, Amazon Prime, and possibly one of my photo-editing apps. That would give me nearly $50 back every month!

Entertainment (2.9% | +$38 from June): I don’t worry much about this category. I like to prioritize spending time with the people I love and oftentimes, that means spending money. My entertainment spending was up a smidge from June, but nothing too drastic.

Gifts (2.4% | +$11 from June): This is lower than I expected because I had a few celebrations in July: my mom’s birthday, a friend’s birthday, and a cousin’s baby shower. I’m happy with this!

Supplies (2.1% | -$62 from June): In June, I replenished my supply of body wash (which is what I use in my bubble baths that I take 4-5 times a week) so my spending was higher in this category than usual. But I still managed to spend over $80 on supplies in July. Those little purchases really add up!

Car (1.3% | -$136 from June): Another category that is a bit misleading. I took my car in for an oil change and tire rotation in June, which is why there’s such a big difference. Without that expense ($108), the difference is not as stark. (In June, I filled my car up for gas twice and in July, I only filled it up once.)

Misc. (0.3% | -$29 from June): A few small things make up this category, but nothing major. It was just a few dollars in July!

Overall Thoughts

- July was the first month in all of 2024 that I did not spend above my means. I came almost $900 under-budget, which is wild to me. Unfortunately, all the money I saved this month had to be sent right to my credit card as I was in dire straights with its balance. I am hopeful that I will soon be in a place where I do not need to throw large sums of money to my credit card and instead can send that to my emergency savings fund and CareCredit balance. Fingers crossed!

- It was very, very hard to not spend money on takeout/Ubereats orders and shopping in July. Those are things I value when it comes to my spending so I just need to be better about spending that money in a more reasonable way.

- Life is just very expensive these days. It feels doubly hard for me as I don’t have a partner’s income to fall back on or to help with the bills. Renting a two-bedroom apartment if I was partnered would be an entirely different story! Hell, I could easily buy a house if I wasn’t living on my own. When all of the bills and expenses fall on me, it feels really difficult to make it work some days. Then again, I don’t have to deal with anyone else in my space so I guess it all evens out in the end, ha!

- In July, I had two $0 categories: beauty and travel! Those categories have gotten quite a workout these past few months so it was nice to see them quiet for the time being.

What’s something you recently purchased that has brought you a lot of joy?