My budgeting process has evolved greatly throughout the years, and I’ve tried a whole range of budgeting tools. Spreadsheets, software, budgeting journals—you name it, I’ve probably tried it. And while there are some great apps like Mint and You Need a Budget out there, I’ve returned again and again to my tried and true method of meticulously detailing my spending on a spreadsheet. I know I could automate my budgeting, but it just works best for me to make it a manual process so I can really see where my money is going and how I need to adjust during any given month.

The first thing I want to talk about is why I detail my budgeting and spending this way. I have a very complicated history with personal finance, as I grew up poor and never learned proper budgeting skills. My father struggled with multiple addictions and my mom’s job as a preschool teacher didn’t provide her with enough financial stability to make it on her own (especially with two kids), so we struggled a lot. We were evicted from multiple apartments, depended on cash advances and family support, and lived with my grandparents for a time while my mom got on her feet after leaving my dad. My mom went back to school after the divorce and the school loans she got were how we survived. (Fun side note: My mom recently paid off all of her school loans! She really never thought she would be able to do that, considering at one point they were in the six figures.)

After graduating college, I started working at a job that paid me $28,000 a year, which is not enough to survive on as a single person. Most of my twenties were spent just trying to get by, saving very little and dealing with massive credit card debt. (So much so that one of my credit cards put me on a forgiveness loan.) And my student loans? I deferred them year after year (my income level qualified me for that).

Suffice it to say, I really didn’t think about budgeting until I was in my late twenties when I finally had some semblance of financial stability. Of course, that’s not to say that those who are struggling paycheck to paycheck cannot budget, they absolutely can. But it just wasn’t something I had the wherewithal to think about. And it’s really, really not fun to budget when all of your money goes to bills with maybe $20 leftover for yourself.

But here I am now: much more financially stable, making a great living for myself, and no longer living from paycheck to paycheck. It’s a great feeling, one I do not take for granted.

Once I got to a place where I needed to be much more diligent about budgeting, I started to think about the best system for me to keep track of my income, my bills, and my savings. That’s when I began to dabble in budgeting apps, different spreadsheet systems, and budgeting journals, eventually settling on a simple but effective spreadsheet system that works for my life and my needs.

Step 1: Plan Out My Paychecks

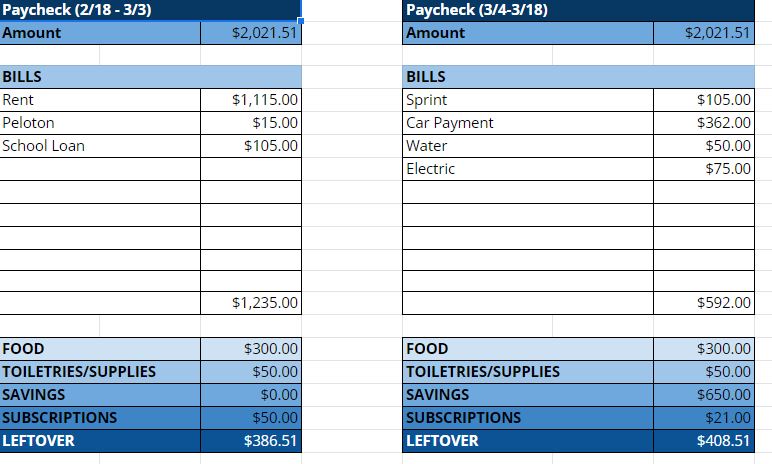

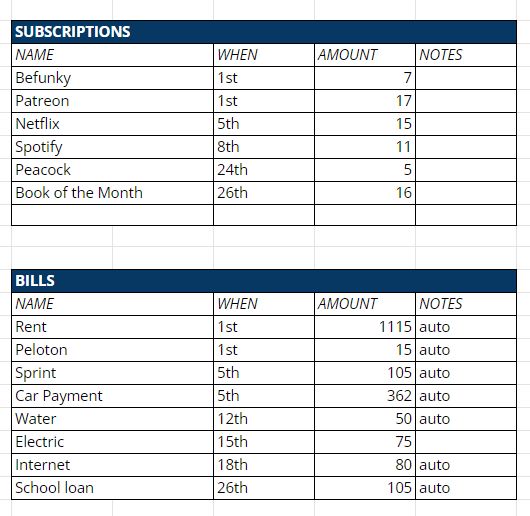

I’ve always struggled with setting a monthly budget; I’d much rather work in two-week sprints, since that’s the cadence of my paychecks. It’s just easier for me to set up my budget for each paycheck than to take a wholesale look at my budget for the month, estimating what I think I’ll spend. I’ll usually try to plan out my next few paychecks, so I’m not hit by any surprises.

Here’s what it looks like:

For each paycheck, I list out what bills will be due and then I have a color-coded section for other expenses: food, toiletries/supplies, savings, and subscriptions. I budget $300 per paycheck for food expenses and $50 per paycheck for toiletries/supplies. Savings and subscriptions vary. Some of my savings I allot to purchasing gold from the best place to buy gold in Brisbane. At the end of the column, I have a formula that subtracts all of my expenses from my paycheck amount to give me an idea of how much “fun money” I have to play with in a given two-week cycle. I don’t really do much with my budget beyond this. I’m not into zero-based budgeting (wherein every dollar gets assigned out). Instead, it gives me an idea of what I can expect from this pay cycle and how much fun money will be available for me.

To the right of these cells, I have two tables: one lists out all of my different subscriptions with due dates and costs, the other lists out all of my different bills with due dates and estimated (in some cases) costs. I use that to ensure I’m remembering to include the right bills into each paycheck cycle.

NOTE: Almost all of my bills are on auto-payment, which is something I just put into practice maybe a year or so ago. There was a time in my life when having bills on auto-payment was more stressful than helpful because I had to be sure I always had enough money in my account to cover the payment. I’ve overdrafted a lot in my life, and it’s one of the worst feelings. So there’s something really heartening to know I can put my bills on auto-payment and not worry about overdrafting! (The only bill that’s not automated is my electric bill because they make it really complicated and I keep forgetting to call the company to set it up.)

Step 2: Itemize My Spending

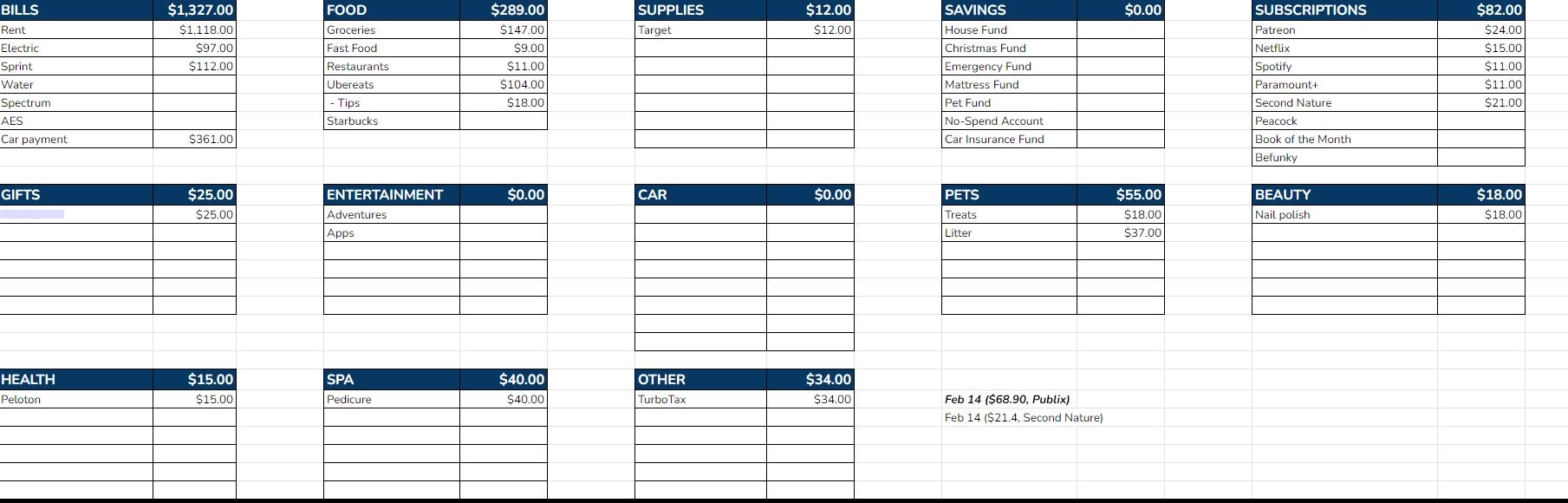

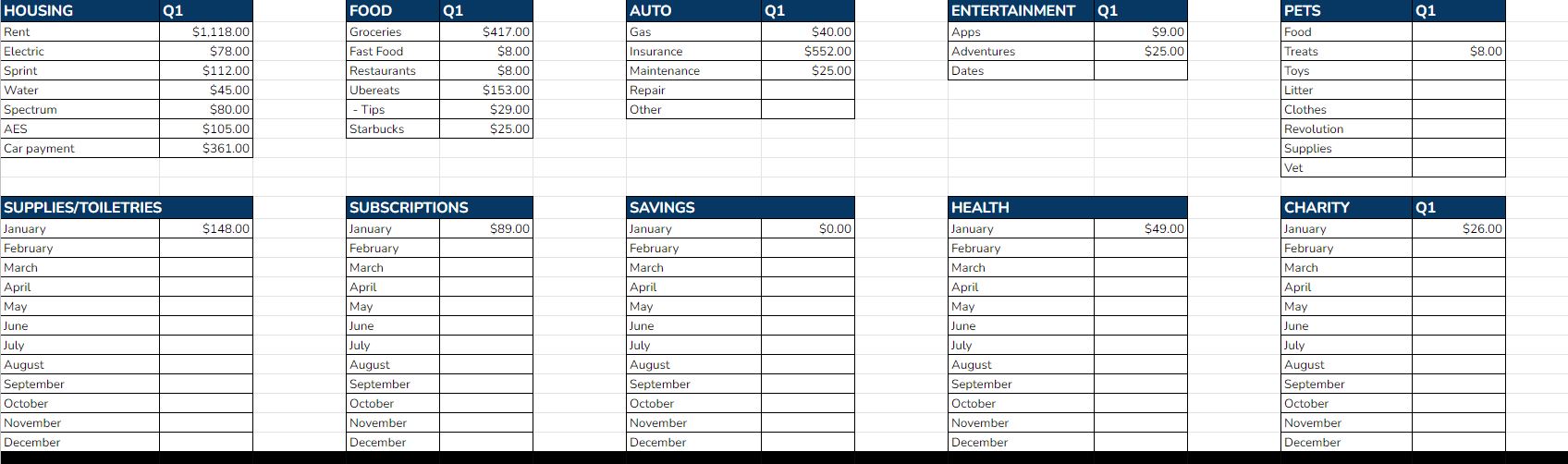

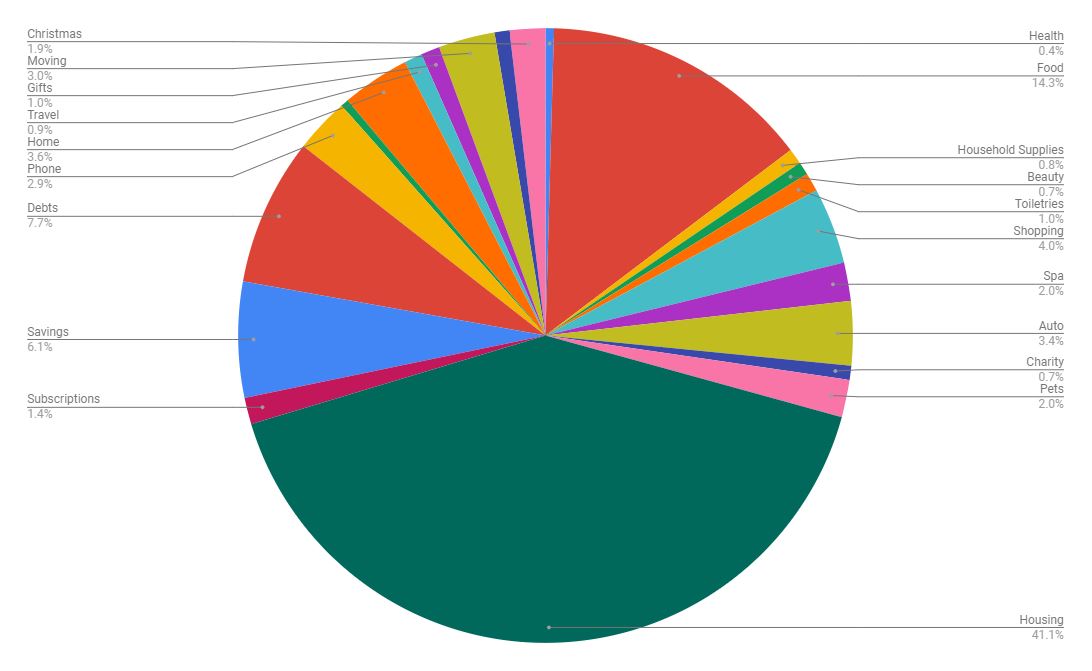

Itemizing my spending is probably the most time-consuming part of monitoring my budget. I do this once a week (usually while I’m in a meeting where I don’t need to pay too close attention, lol) and I’ll simply open up my budgeting spreadsheet and my bank account. I like doing this on my work computer since I have two screens. I have a tab on my budgeting spreadsheet that I label “Categories” with the month listed and that’s where I will start to itemize what I’m spending. Here’s what the categories tab looks like:

Click to enlarge.

Each different part of my budget gets its own special box where I can list out what I’ve spent so far. I’ve listed out certain subcategories within the bigger categories, like bills, food, and subscriptions. Everything else just gets listed out one by one. I also have a formula at the top of each box that adds up my purchases so I can keep an eye on how much I’m spending. This is mostly useful for my food spending, since it’s always out of control, sigh. I don’t have every single category listed, just the most popular ones. I keep an “Other” category so I can add purchases that are not as frequent (like my yearly payment to TurboTax to do my taxes!)

It’s really not that difficult to itemize my purchases, especially since I’m doing this weekly. (I get behind on itemizing my spending, though, and it can get a lot more difficult when I have a few weeks to itemize.) Thankfully, so much of what I spend is online (even if I go to Target—since I use their debit card, everything is easily viewed in the Target app) so I can quickly pull up Amazon or Target or Chewy to figure out how much I spent on certain purchases. If I do make a purchase in-store (like if I buy a couple bottles of body wash while shopping for groceries), I’ll just save the receipt and place it on my desk so I can easily review it while I’m itemizing. If I don’t have the receipt on my desk, I’ll know that grocery visit was all for groceries, no supplies.

At the bottom-right corner of this section of my spreadsheet, are two dates with a price and company listed. This just helps me know where I stopped when I last itemized my spending. I itemized my spending yesterday and the last purchase I itemized in my bank account was a $68.90 purchase at Publix while the last purchase I itemized on my credit card was a $21.40 purchase at Second Nature. Now I won’t have to try to figure out where I stopped and which purchases haven’t been itemized yet the next time I do this process.

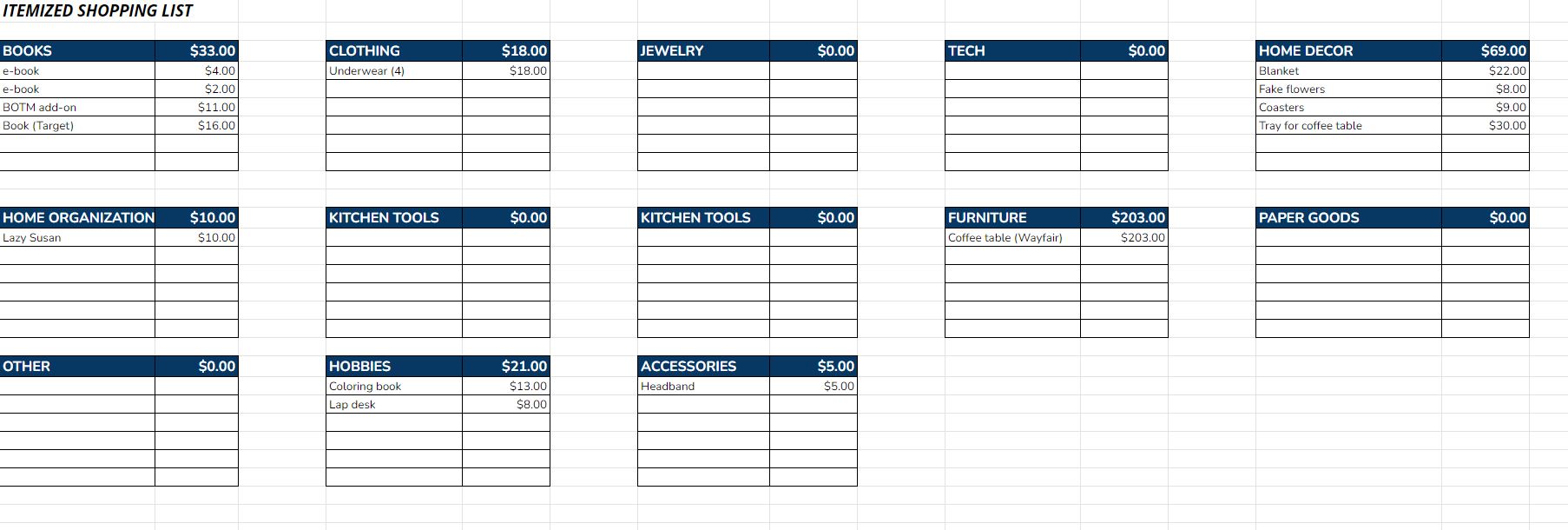

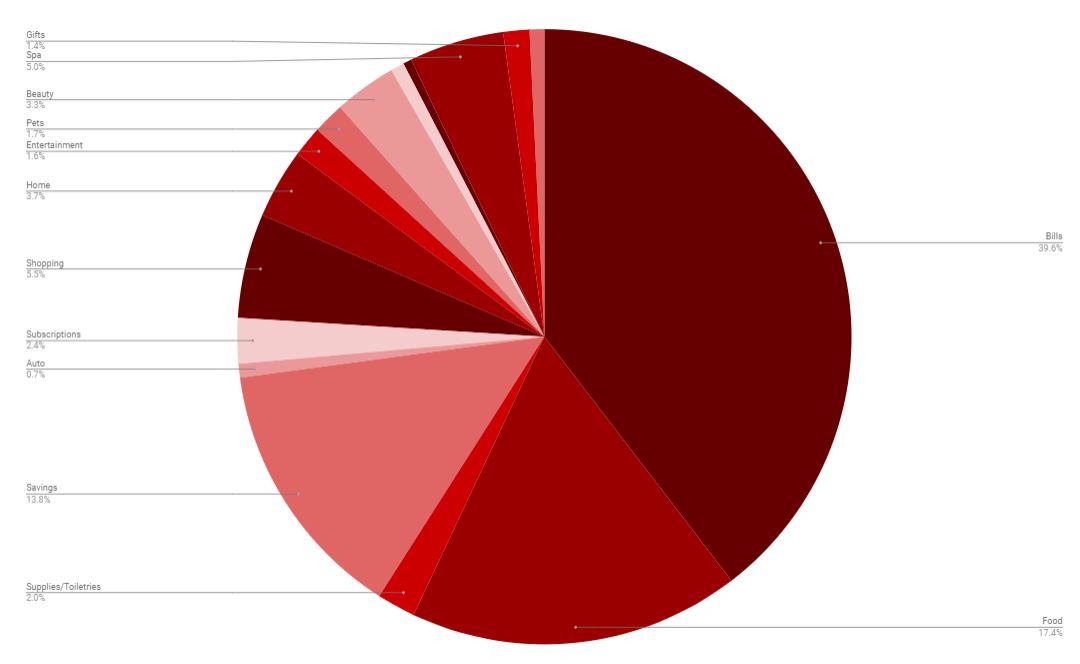

A new addition to my categories this year is my shopping section:

Click to enlarge

I may end up adding to this category section, but these are my top shopping categories. As you can see, February has been a bit on the spendy side but it’s all good! It’s really interesting to see it all laid out like this so I can get a fuller picture of how I’m spending money and where I’m spending money.

Step 3: Organize All Monthly Purchases Into My Yearly Budget

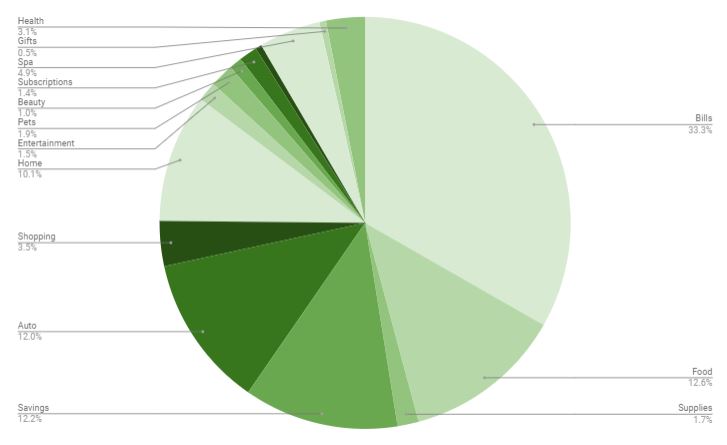

At the end of every month, I take all of the info from my monthly category tab and input it into my yearly category tab. Here’s what it looks like:

Click to enlarge

This is just a portion of the tab, but you get the idea. I list out some of my purchases per month (second row of boxes) and some per quarter (first row of boxes). As the quarters go by, I will add a new column to the first row until there are four columns marking each quarter. I really like seeing how different my spending is from either month-to-month or quarter-to-quarter so I enjoy this process a lot. Plus, it makes putting together my quarterly budget posts so, so easy.

But that’s my budgeting process! I guess it’s less “budgeting” for the purpose of estimating how much money I will spend in different categories and more a function of tracking my spending, but this is the system that works for me and helps me keep tabs on my spending habits. I always feel a little vulnerable to talk about personal finance because my spending habits are not anything like those of personal finance bloggers who are way, way, way more frugal than me. But I also think it’s good to see the other side of things: someone who does spend money because that’s what makes me happy. I have budgeted $600 per month for food (for one person!) because I genuinely enjoy eating out and I don’t want to limit myself. I have budgeted for spa appointments, book shopping, and a ton of subscriptions because they bring be great joy, happiness, and fulfillment. And I don’t think there is anything wrong with that. Be frugal, be spendy. Do what makes you feel good. Pay your bills, try to save some money, maybe donate a little bit to charity if you can, and do what you want with the rest of it. 🙂