Ugh, December budget. Okay, fine, let’s get this over with. Please be gentle.

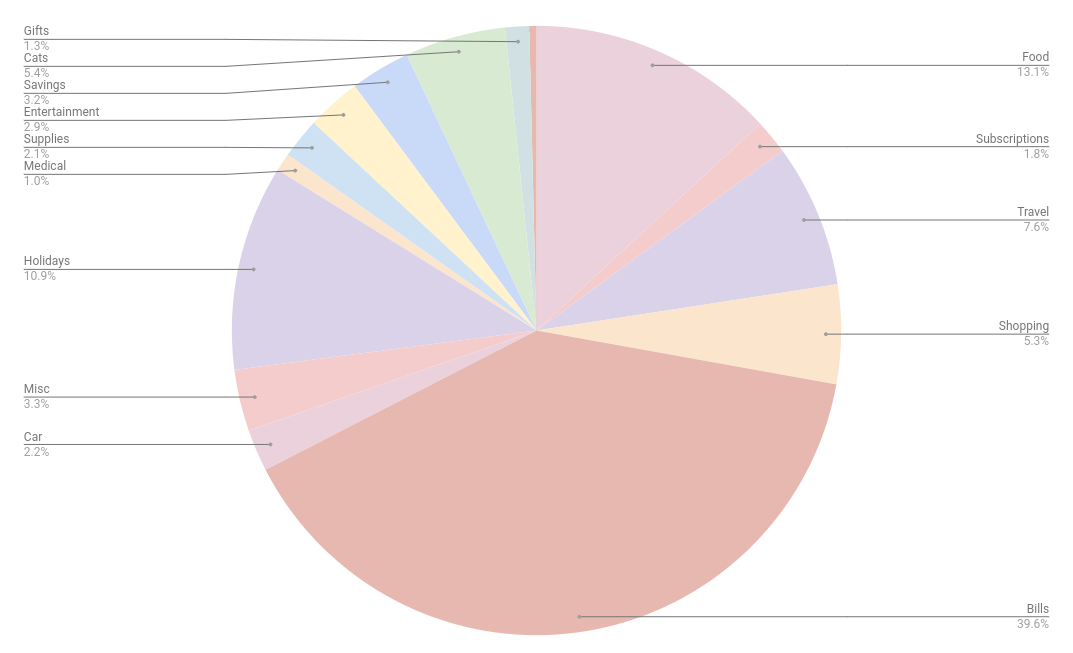

Bills (39.6% | -3.9% from November): Last month, I got a break on my bills because I didn’t have a car payment and had a nice credit on my Internet bill, but things were back to normal in December. This category comprises rent, my phone bill, Internet, my car payment, electric, my gym, Care Credit, and student loans. The percentage was lower than November because of all the spending I did in other categories.

Food (13.1% | -2.2 from November): Well, being away on a cruise for a week helped bring this number down because I definitely don’t feel like I spent less money on food in December.

Holidays (10.9% | +2.1% from November): Oh boy, Christmas was expensive this year. I budgeted $850 for the holidays, which encompassed gifts, new decor, supplies like wrapping paper/cookie ingredients, and events. I went about $300 over budget. I had a feeling I was going overboard, but it’s so hard to rein in that holiday spending. I need to do a better job of tracking my purchases in 2025.

Travel (7.6%): I went on a five-day cruise in December and I’m honestly shocked at my final bill for the cruise (which we get on the last day, which details the money spent on drinks/casino purchases/gifts/bingo/etc). It was so much more than I was expecting, eeks.

Cats (5.4% | +3.7% from November): A much spendier month for the cats. I had to replenish both their wet and dry food and Lila had a spa appointment that cost $100 (oof).

Shopping (5.3% | -3.1% from November): Well, hey! Kudos to me. I don’t know if I really spent less this month or if the percentages just shook out differently, but I’ll take it as a win. I felt like I spent a lot of money on myself this month, though.

Misc (3.3% | +2.1% from November): I wasn’t sure where to categorize my tattoo, so I put it in miscellaneous. (For full transparency, it was $200 total with tip!)

Savings (3.2% | -2% from November): In December, I only put money away in my car insurance fund and my cat fund (no Christmas fund).

Entertainment (2.9% | +1.3% from November): There was a lot going on in December, but a lot of things that would normally go into my entertainment category went into my holiday category, so the number isn’t too startling here.

Car (2.2% | -1% from November): I spent so much money on gas in December! I filled my car up four times, and that’s mainly because I drove to and from Miami for the cruise.

Subscriptions (1.8% | -2.8% from November): All of the usual suspects here: Patreon, Canva, Prime, Paramount+, Netflix, Spotify, Book of the Month. It’s a lot less because last month I paid for a yearly subscription to a photo-editing app.

Gifts (1.3% | +.8% from November): A charity donation to the ASPCA and sent some Starbucks gift cards to writers who won the games I played during our team meeting in December.

Medical (1%): I waited way too long to get a replacement FSA card mailed to me after losing my wallet in November, so I had to pay for a few things out of pocket, like an urgent care appointment (one of the cysts on my underarm burst, and I wanted to make sure I wasn’t dying lololol) and a topical antibiotic for said burst cyst.

Beauty (.4% | -3.1% from November): I replaced my facial cleanser and also bought a brush.

Final Thoughts

- I find it hard to gauge the differences in my spending when I use percentages rather than raw numbers. For example, this month everything was a bit skewed because a good chunk of my spending went to my holiday and travel categories but that doesn’t mean I spent less in other areas. I just spent less relative to what I spent in the bigger categories. I want to continue writing these budget posts in 2025 (honestly, these posts are mostly for me but I do hope they’re somewhat interesting for others!), but I want to do something different. I’m not sure what that is yet, but I do have a new fancy budgeting spreadsheet that I’m excited to start using.

- I’m not happy with myself for overspending by such a large margin ($300!) in my holiday budget. I could have reined myself in if I had been accurately keeping track of how much money I was spending, but I didn’t do that and it shows. Next year (or, well, this year), I’ll do better.

- I started keeping track of everything I bought in my shopping/beauty categories so I could report on those findings, but I fell off the bandwagon of accurately itemizing everything in September. I’ll try again this year, sigh.

How was your holiday spending?

This is such a tedious job doing a monthly budget. Kudos for doing that.

Life is expensive these days. Overall food is so much more in the US than it is in Germany.

I don’t have a Christmas fund but apparently I am rather cheap when it comes to presents, I usually land somewhere around 40€ per person. The husband obviously gets some bigger gifts. I guess we are not a big spender family.

Hope you find a way to keep this budget reports exciting for yourself. That is the most important part.

It is so very tedious! But it’s less tedious if I checked my checking account more than a few times a month, lol. I need to get better at keeping track on a near-daily basis.

We definitely go a little wild for Christmas, so that’s why I need that Christmas fund. I just need to rein it in when it comes to all the OTHER stuff I buy.

I tracked holiday spending last year out of curiosity but didn’t track it this year. I think overall we do not spend much on gifts. It seems like we give the kids a lot but it doesn’t add up to a substantial amount, and then we barely gift outside of that. The biggest expenses was all the gift cards/cash we gave to the teachers in our kids life.

I’m working on my spending post for 2024 and it’s so fascinating to see how the numbers shake out. Daycare accounted for about 1/2 of our spending!!! It’s worth every penny of course but dang it is a lot of money.

Wow, that’s WILD that daycare takes up half your spending. But at least it’s worth it!

Your budgets are so impressive! I have never been so disciplined, even now, having been a working gal for more than half my life. I wished that I could pass this skill onto my kids as they venture out on their own.

Thank you! I have spent a lot of time figuring out what works best for me. 🙂

I spent more than usual on Christmas. My brother and his wife were visiting from Denmark. It has been 7 years since they last spent Christmas with us and we ONLY exchange gifts if we’re together in person. I also had some more expensive purchases for the kids. As they get older I feel like I’m buying smaller things but they are a lot more expensive! Despite the higher spending, I was very happy with what I bought/gave this year. But it was definitely more than I was planning to spend.

The things my nephews (ages 16 and 9) put on their Christmas lists now… they get, like, 1-3 presents from me these days. My older nephew is on his HS baseball team and asked for a $350 bat! He got it because we all went in on it together… but he literally had NO other presents from me to open, oof. They do get more expensive, don’t they?!

Percentages, while interesting to see where everything goes, would not work for me in terms of budgeting either. It’s an interesting piece of data but I personally need to see my raw numbers. December was decent for spending but whoa nelly, November was $$$$! I have some dental work tomorrow and since Rob is retired we no longer have dental insurance, so that will be a big chunk of change. That’s the only thing I miss about him working – the fab dental insurance!

Yeah, I either need to keep track of raw numbers in another spreadsheet and just share percentages here… or just let the numbers speak for themselves!

Oof, dental work. I had a really bad dental plan one year and the dentist I wanted to go to wasn’t covered. I went to them anyway because they were doing a new patient special, but I had a cavity and when they told me the price to fill the cavity OOP… I nearly fainted. So expensive!

Well, if it makes you feel any better, I didn’t even have a budget for the holidays- I just spent and spent, SIGH. I think doing raw numbers rather than percentages would give you more helpful data, but I’m clearly not one to give advice here!

I feel like I just spent and spent as well! I think I just need a more realistic budget for Christmas and to increase the amount I’m putting into my Christmas savings fund!

I spent a lot of money on gifts, but I have no regrets. My love language is gift giving and I will do what I will do, you know? Our grocery budget was also through the roof because of the family dinners and the baking. But December only happens once a year!

I think I just need to be better about budgeting for December – maybe increase the amount I’m putting into savings so I don’t come to the end of December at a deficit!