I haven’t been doing spending recaps for a few years now, and it felt really good to get back to my itemizing ways in January. I won’t say that it helped me spend less, but I do have a new awareness of how much money I’m spending in certain areas (the food category isn’t pretty, sigh). Some disclaimers before I get into my spending recap:

- I do not include anything that comes out of my paycheck before it lands in my bank account. You won’t see anything related to health insurance, FSA payments, my retirement savings, etc. This is about what I spent from my net income.

- I am not looking for ways to be more frugal. I understand that this advice is given with a good heart, but frugality is not one of my values and I’ve learned to be okay with that. I like to spend money and my goal is to earn more, not spend less.

- A reminder that I am single and only paying for myself. It’s not always pretty, but I’m committed to transparency and honesty on my blog so that’s what you’ll get. Please be kind.

January Spending

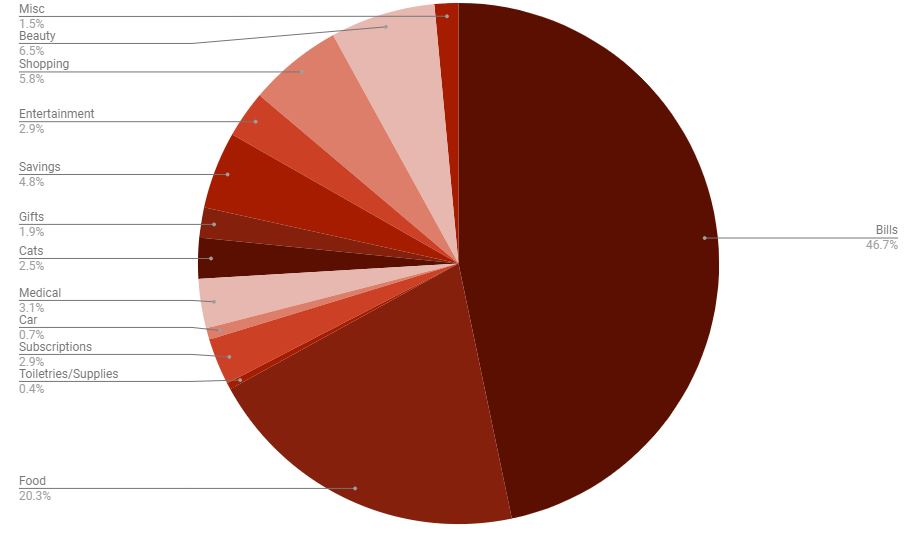

Bills (46.7%) – In this category, I include all of my non-negotiable bills. So this includes rent, my car payment, my phone bill, my electric bill, Internet, and student loan payments. Most of these are fixed expenses, but electric will vary from month-to-month (right now, my electric bills are beautiful since I’m rarely running my AC—only $80 in January!) and so will my student loans since sometimes one of my student loans is paid for by my company’s tuition reimbursement. (I get $100 tuition reimbursement monthly, but sometimes that payment doesn’t clear in time for the due date.) To get the ultimate Alberta electricity rates call us and we can help with the sign up.

Food (20.3%) – Oof. I went $352.82 over budget in this category in January. The majority of this overage was due to groceries. I have been trying to eat at home more (and since I came underbudget for Ubereats orders, I somewhat succeeded) and we all know that groceries are more expensive these days. It’s something I need to keep an eye on to determine if I need to increase my food budget, or if January was an anomaly.

Beauty (6.5%) – I had an expensive hair appointment in January ($230) and I also had to replenish some skincare products (facial cleanser, niacinamide serum). I also bought some nail strips to try and a new lipstick.

Shopping (5.8%) – I bought quite a few things in January, including two pillows, rugs for my bathroom, a cell phone case, 2024 calendars (a desk and wall calendar), and some decorations. Oh, and I bought my cozy reading chair!

Savings (4.8%) – I have automated savings set up for car insurance ($150 per month), Christmas ($75 per month), and the cats ($50 per month).

Medical (3.1%) – Therapy appointment, psychiatrist appointment, a dentist fee for a filling appointment, and then some medications like Lexapro and psoriasis cream.

Entertainment (2.9%) – I bought salad supplies for book club, some tokens/gems for my favorite iPhone game Cooking Fever, and had a few dinners out.

Subscriptions (2.9%) – I would like to cut down on my subscriptions, but I don’t know what I would cut out because all of them feel essential to me. Ahh! My subscriptions include Patreon (I support three podcasts), Netflix, Paramount+, Spotify, two photo-editing apps, an air filter company (this is bimonthly), and Prime. Honestly, I should get rid of Prime. I don’t need it and definitely don’t use it to its full ability.

Cats (2.5%) – Nothing too crazy here! I bought wet + dry food and some treats.

Gifts (1.9%) – I bought a few goodies for a Galentine’s celebration happening in February and gave money to a collection being taken up for a friend in need.

Misc (1.5%) – I didn’t know how to categorize my nose piercing, so into miscellaneous it goes! This paid for the piercing itself and the tip to the piercer.

Car (0.7%) – I only needed to fill up my car with gas once this month. That’s crazy!

Toiletries/Supplies (0.4%) – A startling low number for this category. I usually budget $100 but this month, I only bought a two-pack of toothpaste and two bottles of mouthwash.

Overall Thoughts

- Once I sat down with my final January numbers, I found out I spent $238.05 above my means! Oops. I know I have been living above my means (otherwise, I wouldn’t have this damned credit card I’m still paying down), but sometimes seeing the actual number in front of me helps to put it all in perspective. I need to rein things in a bit so I’m living below my means. If I want to move apartments at the end of this year, I know I need to spend at least $500 below my means now to afford the spike in rent.

- I spent $100 this month on Starbucks, which is double my budget. I get Starbucks at least once a week because that’s where Mikaela and I meet for our writing dates, but I was also stopping by at least once or twice during the week for a quick peppermint mocha. I’m going to be strict with myself in February that I can only add $50 to my Starbucks app and when it’s gone, I have to get creative.

- I want to get better about tracking my spending on a more regular basis so I can keep a better eye on how much I’m spending in some of my more problematic categories (like my food budget). Ideally, it’s something I would do every morning but at this point, even twice a week would be better.

What’s a fun purchase you bought in January?

I think it’s basically impossible to be underbudget when it comes to groceries these days. I was at Costco yesterday and olive oil – which was $18.99 not six months ago – is now $32.99. What the what. I mean. Olive oil is such an important part of my life, so I can’t bear to not buy it but WHAT THE WHAT. Groceries is such a huge expenditure for me, even with one son out of the house!

Nicole, the way my jaw dropped when you gave me those prices of olive oil. From $18.99 to $32.99 in six months?! How in the WORLD?! It’s crazy. I really do think it’s going to come down to shifting my food budget to accommodate the rising grocery prices.

I really enjoyed this breakdown & the fact that you’ve clarified what your values are and are not with regard to your spending. Thanks for sharing!

You’re welcome! I think it can be helpful to see the spending habits of someone who isn’t frugal and doesn’t desire to be. 🙂

Groceries is always my biggest expenditure (aside from bills) unless a car breaks down or something like that. It’s hard to cut back too much without putting that money into restaurants or something, right?

It’s so hard to spend less on food! While I know I COULD be more frugal with the way I spend money on food, I just don’t want to be that way. So perhaps I do need to adjust my food budget to accommodate spending more on groceries. Something to keep an eye on!

Okay, this is encouraging me to do a post about my spending on a monthly basis, too. I have the data, I just need to analyze it. I’m doing it!!

There wasn’t a ton of fun spending in January, but I did get Hannah a dog park license, which will lead to fun! And I bought some food when I was traveling that I normally would not buy, including some fancy popcorn. Hm. Fun is all relative, isn’t it?

Fancy popcorn is a fun expense, for sure! And a dog park license is what is needed for Hannah to have the time of her life at the dog park, so that is much needed.

I don’t really have a budget, but I can tell you that I spent OMG-I-am-never-going-to-admit-to-the-number on groceries in January. Yes I’m buying food for teenagers, but still GEEEEEEEZZZZZEEEE it was sooooo much.

Frugality was an important tool when I was just starting out, and it’s something that I can go back to if needed, but after a while I found that I just needed to live my life. It’s about knowing where the money goes and spending money on stuff that you care about and not spending it on stuff that you don’t care about.

I don’t even want to THINK about the grocery spending for a family of four WITH TEENAGERS. It has to be so astronomical. I feel like I spend so much on one person!

Groceries cost SO MUCH NOW. We went to the store today (we go 3-4 times a week) and it was $77. My daughter was like – YOU BOUGHT LIKE 4 THINGS?? How is that possible? Welcome to the real world, kiddo!

It’s so wild to grocery shop these days. Last week, I didn’t buy any meat or drinks and I still spent almost $100. HOW?!

I love this kind of data so much.

We are reining in our Starbucks spending, too. We used to go a LOT, but I have made a rule that we can go once a month. This is as much to cut down on sugar (my daughter LOVES the lemon loaf, the cake pops, and the frozen acai drinks… and while those are fun treats, I think I am more comfortable with them being once a month treats than weekly treats!) as it is about cutting back on spending. But with my daughter’s latest extracurricular schedule, I think we are going to be eating dinner out every single week so there goes any benefit to our eating out category!

Starbucks is such a money pit, ugh. I am trying to remain committed to only filling up my card twice a month. That’s still FIFTY DOLLARS for Starbucks for one person, which feels stupid, but it’s a place for me to start at least.

Gah, eating out is so expensive these days. EVERYTHING IS EXPENSIVE.

Thank you for this post!! A few purchases stand out… New duvet cover, pillow cases, and bed sheets. Kitchen towels. Curtains for the hallway window upstairs. New pots and pans. Anyway, we went on a bit of a spree for the house in January. Many thing were long over due to be replaced (example: curtains since 2007; pots and pans were our wedding present back in 2012). I don’t enjoy spending money but this spree felt good 🙂

It can definitely be a domino effect: You replace one thing and then realize you need to replace ALL THE THINGS. But you got it all out of the way in January, at least!

Groceries are expensive, and I noticed the other day that the cost of eggs has risen again! Dang it! I often have the habit of buying things that I use when they are on sale or in bulk, but I am trying to use up pantry and other amassed items now (I do this every Jan/Feb basically) and I notice I have a lot more of some things than I need! For example, I currently have 7 rolls of TP still, even though the last time I bought TP was March of 2022! The thing is, even though this was a 24 pack, I have definitely used more than 24 rolls, but I probably ordered it because it was on sale even though I already had 20 rolls (or something). So I am TRYING to use what I have and wait until it is almost gone before ordering more, even if that means paying a little bit more in the end.

I wish I could do more bulk buying! I think that would save so much money. The downsides of living in an apartment with a tiny pantry and very little storage space. Dang!

What’s a fun purchase you bought in January? Well I did buy some Lindt truffles, strawberry center with white chocolate, but that’s about it. I am amazed by how quickly anyone can spend money at Starbucks. I’m glad none are conveniently located near where I live. I totally get how you spent what you did, that stuff is tasty.

It would be very helpful if there weren’t MULTIPLE Starbucks locations within a 5 minute drive for me, sigh. Too many temptations!

Those Lindt truffles sound so delicious!

As you know, I love these types of posts and your transparency.

Things are just incredibly expensive and everything gets more expensive as we type… or so it seems. Sigh.

But yeah, spending below your means should be your goal, not frugality.

I feel like we already spent so much money in January (on necessary things, but man does spending money makes me feel uncomfortable sometimes).

I haven’t been great at looking at my spending habits for the past few years, so I think being more diligent about tracking my spending will help me get to that goal of spending BELOW my means. No reason why I can’t get there!

” I like to spend money and my goal is to earn more, not spend less.” did you steal this sentences from my husband or did he from you?

He keeps saying these words. While I am a bit more frugal and love a good deal he is easy on spending money.

After living together for 18 years we both have comprised a bit.

Anyway I do feel you. I am currently overspending a lot since I haven’t had enough income since October to cover all my fixed costs. I am hoping to get a new project soon to feel a bit more at ease with money. It’s a bit rough right now.

I am looking forward seeing how you move forward with your spendings and adjustments.

Ooh, it must be such an interesting dichotomy for your marriage – being with someone who isn’t frugal while wanting to be frugal yourself. I’m glad you guys have been able to compromise.

I will be sending all the good vibes that a new project comes your way soon!

I love spending posts like this! And it’s so brave of you to share the actual dollar amounts. I only speak to percentages so keep it pretty hard to read into. I can’t think of anything fun I bought in January! But something we enjoyed this week that I spent money on back before year end was tickets to Disney on Ice! And now that I mention it, I also bought tickets to see ‘a year with frog and toad’ at the children’s theater in May. So that was our most fun purchase.

We are definitely frugal but it’s not a conscious decision if that makes sense? Like I am not saying no to myself all the time, I just don’t have a strong desire to buy things/spend money. And we don’t eat out a lot but again that it more due to my preference to make our food more than anything. I do enjoy a weekly coffee at Starbucks and a weekly pricey salad for lunch!

I totally understand what you mean with the idea that being frugal doesn’t feeling like a CHOICE; it’s just how you naturally are! And that’s amazing. I wish I was the same way! But I’m not and that’s okay, too. That’s the internal work I had to do for myself, to recognize that I do enjoy spending money on the things I like and that means my food budget for one person is MUCH higher than others.

I love that you share this detailed information, Stephany. I really appreciate the opportunity to learn about how others think about money, spend money, what they prioritize, etc. Our lives are all so different, and our priorities are all so different, that it only makes sense that my detailed spending will not look the same as yours. (I do not, for example, really eat out. And, I don’t get a lot of joy out of food, sigh, so food is not where I spend my money. Books, now…don’t look at my book purchases. ;>)