After a few months of putting together spending reports that make me want to curl up in a ball and cry, this one was actually quite fun to put together! I spent so much less this month thanks to No-Spend July and because of that, the percentages look a little wack. So instead of showing how my percentages differed from month-to-month, I’m going to show you how much actual dollars I saved (or spent) from June to July. Let’s get into it!

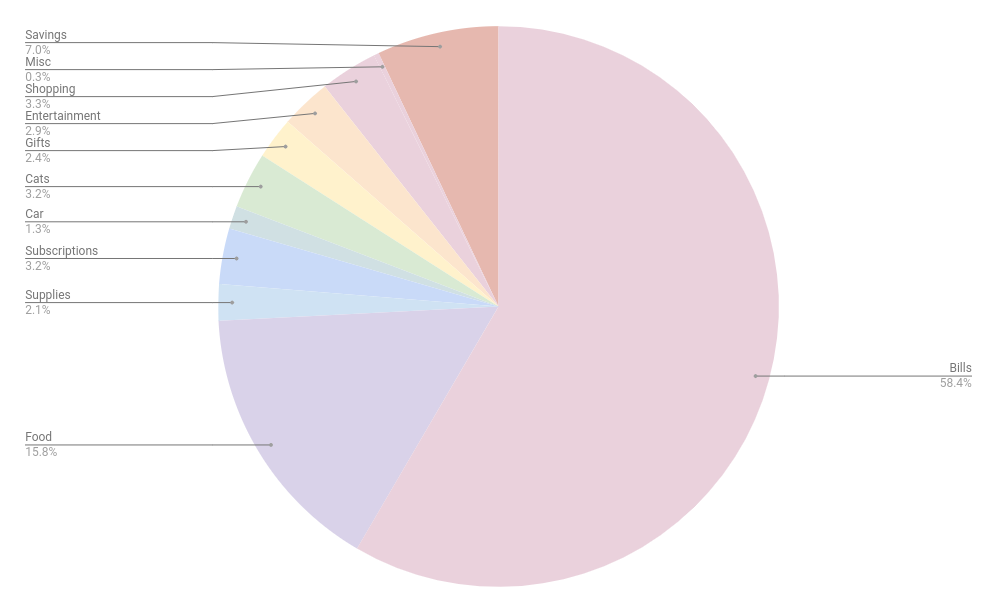

Bills (58.4% | -$591 from June): I spent a lot less in July than I did in June because I didn’t have my car payment (I paid ahead in June). Everything else shook out normally except for my phone bill, which was very high ($258) because I had switched carriers and had some fees that were then taken off in my next bill. (My August bill was $65!) My electric bill is very high right now (in July, it was $226, which is a lot for my 700-square-foot apartment), but what can I do? It’s summer, I live in Florida, and I’m going to run my A/C.

Food (15.8% | -$4 from June): Okay, this doesn’t look exceptional but I was away for 5-6 days in June that wasn’t accounted in my overall food spending. However, my food budget in a normal month is $800 and I came under that by almost $200! That’s a huge win for me.

Savings (7% | no change from June): I put away the same amount in savings as I normally do ($150 to my car insurance fund, $75 to a Christmas fund, and $50 to an emergency fund for the cats).

Shopping (3.3% | -$121 from June): This number would be a lot higher if I didn’t buy a new vacuum during No-Spend July. Otherwise, I only spent $20 in this category in July! (A pool float that I bought the last day of June but didn’t clear my bank account until July and a can opener.)

Cats (3.2% | -$21 from June): Not a huge change here. I’ve been spending a lot of money on food for the girls lately and the same was true in July. But I didn’t have to buy litter this month since I bought it in bulk last month.

Subscriptions (3.2% | +$22 from June): This category didn’t change too much from June, the only addition is the bimonthly air filter subscription. I do need to figure out some subscriptions to drop, though. I unsubscribed to a substack and am thinking of unsubscribing from the air filter program, Amazon Prime, and possibly one of my photo-editing apps. That would give me nearly $50 back every month!

Entertainment (2.9% | +$38 from June): I don’t worry much about this category. I like to prioritize spending time with the people I love and oftentimes, that means spending money. My entertainment spending was up a smidge from June, but nothing too drastic.

Gifts (2.4% | +$11 from June): This is lower than I expected because I had a few celebrations in July: my mom’s birthday, a friend’s birthday, and a cousin’s baby shower. I’m happy with this!

Supplies (2.1% | -$62 from June): In June, I replenished my supply of body wash (which is what I use in my bubble baths that I take 4-5 times a week) so my spending was higher in this category than usual. But I still managed to spend over $80 on supplies in July. Those little purchases really add up!

Car (1.3% | -$136 from June): Another category that is a bit misleading. I took my car in for an oil change and tire rotation in June, which is why there’s such a big difference. Without that expense ($108), the difference is not as stark. (In June, I filled my car up for gas twice and in July, I only filled it up once.)

Misc. (0.3% | -$29 from June): A few small things make up this category, but nothing major. It was just a few dollars in July!

Overall Thoughts

- July was the first month in all of 2024 that I did not spend above my means. I came almost $900 under-budget, which is wild to me. Unfortunately, all the money I saved this month had to be sent right to my credit card as I was in dire straights with its balance. I am hopeful that I will soon be in a place where I do not need to throw large sums of money to my credit card and instead can send that to my emergency savings fund and CareCredit balance. Fingers crossed!

- It was very, very hard to not spend money on takeout/Ubereats orders and shopping in July. Those are things I value when it comes to my spending so I just need to be better about spending that money in a more reasonable way.

- Life is just very expensive these days. It feels doubly hard for me as I don’t have a partner’s income to fall back on or to help with the bills. Renting a two-bedroom apartment if I was partnered would be an entirely different story! Hell, I could easily buy a house if I wasn’t living on my own. When all of the bills and expenses fall on me, it feels really difficult to make it work some days. Then again, I don’t have to deal with anyone else in my space so I guess it all evens out in the end, ha!

- In July, I had two $0 categories: beauty and travel! Those categories have gotten quite a workout these past few months so it was nice to see them quiet for the time being.

What’s something you recently purchased that has brought you a lot of joy?

Reading this post, I realized why I really like your budget posts— your frame is so positive. You do a really good job of seeing money as the thing that fuels some enjoyable aspects of your life. I tend to resent spending and then go through binge and scrimp cycles, but your frame is much more joyful.

This is such a sweet comment. Thank you, Sarah! I think spending can be a positive thing – a way to bring joy. But it can also be grueling, especially when it feels like money is flying out the window! I totally get it. <3

Wow, you did so great on your no-spend challenge!!! I am currently reading No One Tells You This, which is a memoir about a single, childfree woman in her fortieth year. There was some discussion about the expense of living as a single person in NYC, and this post made me think of that.

$900 under budget, way to go!

I am really trying to do that thing where you use up everything before buying more, and wow, it is hard. I’m trying though! Beauty products are where I trip up, for sure. Particularly hair products!

It is so expensive to be single! I know it would be a lot easier financially to have a roommate but I am way past that time in my life, lol.

Ooh, that’s a challenge – to use up what you have before you buy more! Good luck!

Nice job sending that $900 to the credit card! That is a LOT of money to save in a month. I’ll be interested to hear how your August spending goes- how you’re incorporating Ubereats back into your life. I agree with the philosophy that you should spend money on things that truly bring you joy. But having large credit card bills is not joyful, so… it’s a tough balance. Anyway, great job in July.

It felt so good to send a huge portion of my money to my credit card and get it back to a reasonable number. Whew. Ubereats will forever be my nemesis and the thing that brings me great joy! I think limiting myself to one order per week is a good compromise.

It is really hard to be in a single income household! But also having a roommate would be horrible! So I made the same choice as you back in my single gal days. I only had a roommate for 1 year after graduating from college and then never had a roommate until I moved in with Phil.

You had a very successful month! Hopefully you can find a happy medium that has you living below your means without feeling like you are really sacrificing your quality of life. But that is a hard balance to strike!

$900 savings in a month is a lot. I know you delayed some “necessary” expenses but you probably also have a good idea on where you can ‘save’ going forward.

You really knocked it out of the park, Stephany! $900 is fantastic. I love your perspective on spending and how thoughtful you are about monitoring your expenses.

What a month! I am always so impressed at no spend weeks and months – it takes such commitment and how you did that in the summer with takeout is even more impressive! (I find summer such a hard time to cook for myself in – the heat and it’s all so much – vs. the cooler months….) Recently, I bought myself 2 more pairs of work pants to remove the stress of “do I have clean nice pants?!?!” for my in office days and it’s really done such good for my stress levels, haha!

Look at you getting that credit card paid off. Yay!!

I bought some popcorn on a road trip. I usually only buy food I bring with me from home, but I cannot resist the popcorn place. And it was worth every penny.

Interesting stuff, and wow, being able to send so much to your credit card company must have felt GREAT. Too bad that the big differences were just money spent in different months (like the car payment and maintenance) but still, you had the money and that is GREAT. I had a balance on my credit card for so many years, being able to keep the balance at zero (though I put EVERYTHING on it for points) has been wonderful these last several years. I hate paying interest!

Congrats on doing a no spend month. And amazing how much you were able to cut back. I am always in awe how you track your spendings so precisely. So much work. I only do it once a year.

Nice work with being that far under budget!! Your perseverance and dedication really paid off, pun intended!! That must feel really good! Hopefully you can keep your food streak going, as it seems like that made a big difference! I am looking forward to seeing how your August numbers pan out.

My goodness, Stephany. You rocked it. You really, really rocked it. I am glad you realize that – and also had the reminder of where your priorities are (family, friends, spending time with others, and ummm…less cat hair in the apt. ;>). It’s HUGE to be able to send nearly $1000 to your card balance. HUGE. Think of the interest you will save! WOW! I hope that you find ways to feel good about your spending going forward without feeling like you’re missing out, and I love your plan for UberEats. You know we’re all cheering you on. <3