Well, here we are again. Another rough month for my finances. I knew it would be with the tail end of one trip and my Chicago weekend included in the budget, but eesh. This is why I decided to challenge myself to a no-spend July. I really needed a reset for my finances! Let’s take a look at how everything broke down in June:

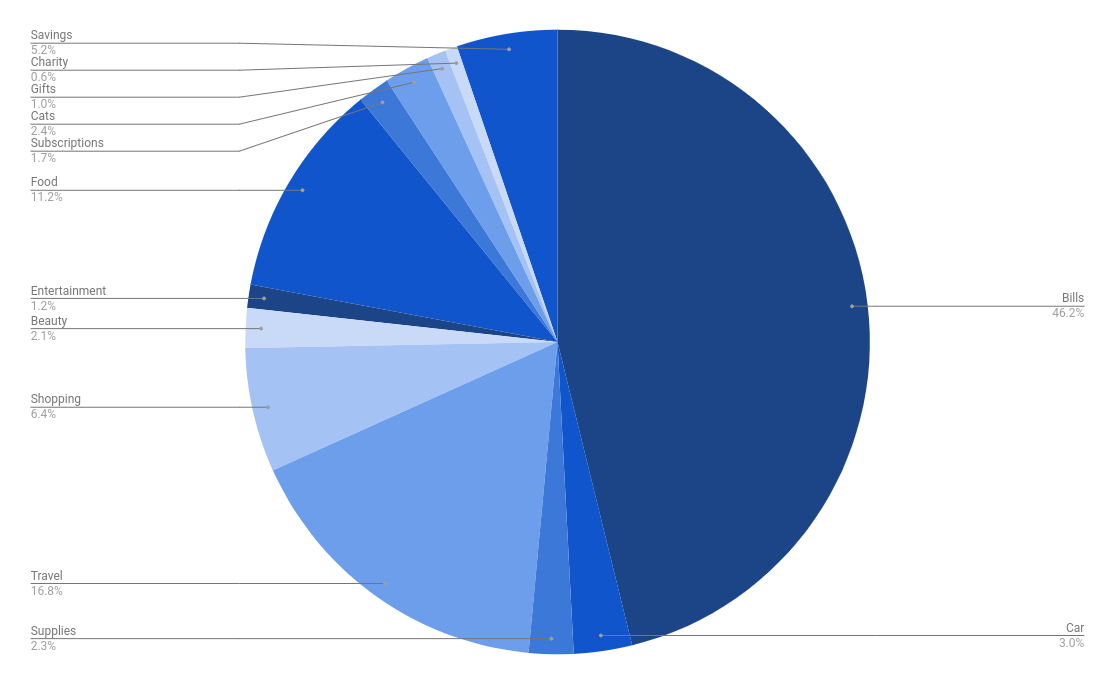

Bills (46.2% | +8.6% from May): Quite the increase from May! Somehow, I got behind on my car payments and had to double-up in June. (I didn’t get a late fee or anything like that. It was a weird situation.) This category also encompasses rent, phone, electric (which was over $200, sigh), Internet, student loans, the gym, and Care Credit.

Travel (16.8% | +9.8% from May): This includes the rest of what I spent on my New Orleans trip with my mom as well as my trip to Chicago in mid-June. I need to figure out how to spend less money when I’m traveling, oof.

Food (11.2% | +.7% from May): Here’s the good news about my food budget: my Ubereats percentage has come down steadily every month since I learned I spent almost $300 in April. I’m getting better!

Shopping (6.4% | -6.8% from May): Oof. While my spending was down in June, I still spent a lot of money and went way above my budget in my shopping category. I bought 9 books, 5 t-shirts, 1 skort, and too many stickers to count.

Savings (5.2% | +1.3% from May): I saved a little bit more money in June! But then I had to use some of that at the beginning of July when I got into some dire straights. Blah.

Car (3% | +1% from May): I got an oil change and tire rotation. I also got gas twice this month.

Cats (2.4% | -1.8% from May): I bought litter, prescription cat food, non-prescription cat food, and some toys.

Supplies (2.3% | +.4% from May): I replenished my supply of body wash (which I use for bubble baths, so I go through a lot) and also bought boring stuff like mouthwash, replacement Brita filters, and aluminum foil.

Beauty (2.1% | -7.8% from May): Thankfully, this month’s expenses didn’t include a ridiculously expensive hair appointment! Instead, I mostly replenished my skincare products. I also accidentally bought the wrong serum from Sephora (thankfully, it was serum from The Ordinary so it was wildly expensive!) and decided to keep it rather than send it back. But then I had to buy the right serum, so it was just a bit of a mess. Ah, well.

Subscriptions (1.7% | -.4% from May): Same ole, same ole. As a reminder, my subscriptions are Patreon, Netflix, Spotify, Paramount+, Canva, Prime, a Substack newsletter I support, and a photo-editing app.

Entertainment (1.2% | -2.4% from May): Book club and dinners with friends.

Gifts (1% | -1.1% from May): I bought a baby shower gift and a toy for Chip.

Charity (.6%): I donated $25 to the ASPCA and $15 to attend the Chicago Pride Festival (which benefited the performers, vendors, and nonprofits).

Overall Thoughts

- This was another tough month for my budget, as I went over my projected amount in my most troublesome categories (shopping, beauty). Going through my June budget and having a really rough start to July where I had to pull from savings just to pay rent is what prompted me to do a no-spend July. I need to get my credit card and savings in a more reasonable place because I really, really hate feeling like I can’t pay my bills.

- Travel took up a huge chunk of my budget in May and June, and my next trip isn’t until October. (It’ll be a weekend trip to Orlando with my book club and I don’t anticipate spending a ton of money.) This will allow me to play catch-up and hopefully start a travel savings fund. I would love to go on a European cruise with my mom for her 60th birthday next year, but I need to get super serious about saving money in order to make that happen.

- The bright spot of June: I came under-budget for food! In June, I tried to stick to one Ubereats order a week (typically, lunch on Fridays) and that really brought my spending down. No-spend July includes not spending money on Ubereats, so that should help bring my percentage down even more. (I know I’ll be spending more on groceries, but I don’t think it will be anywhere near what I was spending on Ubereats orders/fast food.)

What’s the last gift you bought for someone?

Last gift I bought was a bag of gummy bears + a pickle ball set (paddles + ball) for one of my son’s friends for his birthday.

That’s such a great gift set!

Well, it’s tough- you took two trips. i remember your recap of the Chicago trip and you bought a bunch of books and other souvenirs- and I thought how FUN that sounded. It’s not as much fun to be walking around saying “No, I can’t have that- I can’t buy that- I’m on a budget.” Sometimes you just want to splurge. Of course it’s also not fun to not be able to pay your bills, so there’s that.

Your no-spend July should be a good reset for you. Sounds like you’re being really thoughtful and responsible about this! Good luck.

Thanks, Jenny. It really isn’t fun to be on vacation and have to adhere to a budget. I went, I had a good time, I have a TON of new books, and now it’s time for a spending reset. It’ll all work out!

I spend SOOOOO much money on groceries, but I always think that if we were eating out, I would be spending 4x that amount total. We eat out/ get takeout so rarely that I justify buying more expensive things at the grocery store. Still, it adds up, especially having my older son home this summer. That said, I am going for lunch with the girls today to celebrate a birthday – and that means that the last gift I bought was for her. I bought a bottle of margaritas! She loves it and I prefer to gift things that are consumable, rather than “stuff,” if that makes sense, unless I find the PERFECT thing, which is rare, because I don’t shop a lot!

I was waiting and waiting and WAITING for Knix to have their big sale, which I have early access to today, and NONE OF THE BRAS I WANTED ARE ON SALE. So I’m a little crabby about that.

That’s so true – eating out as a family would be SO expensive! Even going to the movies as a family of four would cost someone over $100 if they got popcorn and such. Ridiculous.

Ughhh, boo Knix!

Ubereats/doordash/etc in my area sucks so I never want to order it! I’m impressed at any area where it’s good LOL.

I have “hacked” the idea of going to lunch as a treat by getting a bunch of frozen meals I like at Trader Joe’s so I can heat up a batch of whatever on the stove/in the microwave in <10 minutes for those "ugh don't wanna cooooook" kind of days.

That’s a GREAT hack! I need to make a trip to Trader Joe’s this week so I can get some yummy foods that I don’t normally have around.

I’m with Nicole. We spend so much money at the grocery store, but if we were eating out, I can’t even imagine the cost. And delivery? Forget about it!

I have sent some checks to niblings for birthday presents, but the last gift gift I bought was for my BIL when he was promoted to a judgeship. It was a profane candle and it made me laugh and laugh.

It’s so damn expensive. I really want to break myself of my Ubereats habit. Imagine if I could save $200 every month!

Hi friend! As always, loved your reflection on the finances. Electric is ridiculous! It’s 90F or higher in NJ so we have to turn the air on but MAN when the bill comes in. You see, in fall/winter Tony and I get into thermostat wars LOL I’m cheap so no heat, he likes it warm so higher, which means more money. There was a month were our electric bill was $500! I mean we have a house and it’s expensive to heat/cool but still, I was furious LOL

Groceries… I am cheap there, too. I mean we do grocery shop but I do not like food waste. It’s something from my Soviet childhood where we were poor and stuff,,, Lots to unpack in therapy lol. But no, we waste very little food. If I make something I’ll make sure it gets eaten.

Gifts. I LOVE giving gifts and don’t mind splurging in that area. Latest gift: a gallon or so of Clinique toner and a gallon of some kind of cleanser for my friend who turned 52 and she loves skin care.

Yeahhh… I am more like Tony in this regard, haha. I would rather pay more in electric so I can be comfortable in my apartment. Thankfully, the heating isn’t much of an issue in FL. There are times when I turn on the heater, but it’s only a few times a year. A $500 electric bill is TOUGH. Oof.

That’s such a kind and thoughtful gift for your friend!

Travel tends to be expensive but it’s hard to rein it in because it is a special thing and not something you do all that often. So I wouldn’t put pressure on yourself to spend less when traveling. This year you had 2 trips close together but that is probably rare. And now you have a nice cushion until your next trip in November!

It’s just plain expensive to live alone. I had that experience. But I could not bear to have a roommate so I just put up with it and was glad that my income could allow for me to comfortably live alone. But I did have some lean years when I left Target and took a pay cut to go back to Wells Fargo for a bit. But tracking your spending is the best way to get a handle on how to better live within your means. But it is hard!

Thanks, friend. It was hard to see these numbers but you’re right, it’s not often I do two trips so close together and it just exploded my spending for a bit.

Yes – I could get a roommate to make my living situation less expensive but I *love* living alone and I cannot imagine living with someone else. So I have to deal, lol.

I love that you took two wonderful trips, but yeah, traveling can be hard on the budget (and even if you save up beforehand, it always seems to cost more than anticipated – and who wants to be on a budget while on vacation?).

I think the no-spend July will be a good exercise to get back on track!

The last gift I bought was a gift card for a friend.

Like others have said, experiences > one-off things. It’s hard not to get things that will remind you of trips you love with people you love – so honestly? I think the budgetary hit was understandable. But ooof, that weird car payment thing and the electric – GAH – must have hurt. My lowest bills are in summer (not an a/c fan, also I get super cold when it’s set too low) and highest are in, you know, January. Seasons. Why? 😉 I also just want to say – I love how you share openly and honestly. Thank you for normalizing this. <3