Hello, friends! It’s time for my March spending report, which wraps up my Q1 spending. I sat down and figured out the averages for Q1 for a whole bunch of categories, which was very eye-opening and will help me create a budget that works better for my needs. That’s the goal, of course! But first, let’s dive into the numbers:

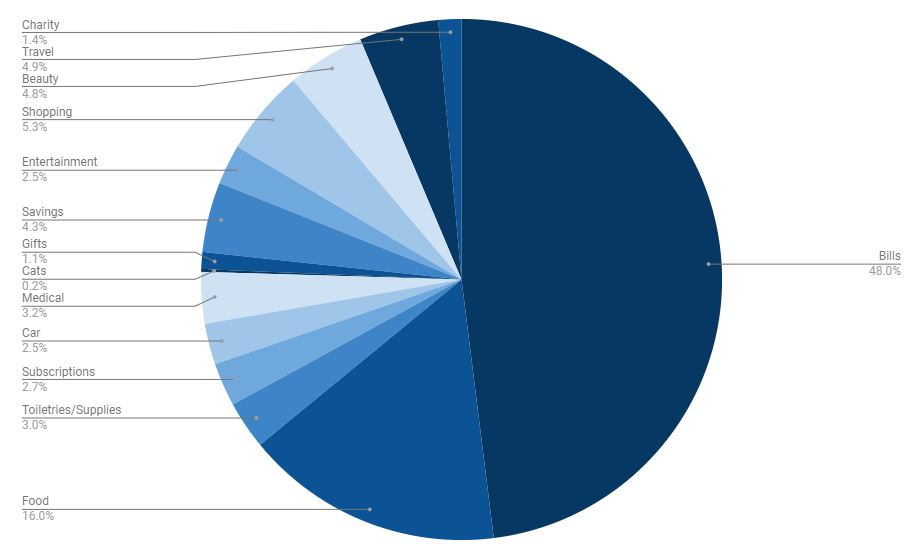

Bills (48% | -1.7% from February) – I added two new bills to this category in March: Care Credit (for my laser eye surgery, which I am paying off) and my new gym. But somehow this category took up less of my overall total than February, which is odd.

Food (16% | -1.7% from February) – I was over budget again in this category, but I keep reducing how much I am over budget, so that’s a bit of progress. This month, it was by $230, which is $30 less than in February and $122 less than in January.

Shopping (5.3% | +1% from February) – It was a spendy month for me, yikes. My spendiest shopping categories in February included books ($97), home essentials ($42 – I went a little crazy at Bath & Body Works), and tech ($39).

Travel (4.9% | +2.7% from February) – I bought tickets for my mom and me to see Nate Bargatze in New Orleans. Since we are traveling to see him, I’m categorizing this as a travel-related expense.

Beauty (4.8% | +3.4% from February) – I had a hair appointment, got some skincare products, and also had a brow waxing/tinting appointment, so things were a bit more expensive on the beauty front.

Savings (4.3% | -.6% from February) – I have automated savings set up for car insurance ($150 per month), Christmas ($75 per month), and the cats ($50 per month).

Medical (3.2% | -1.5% from February) – Medication, a doctor copay, a heavy-duty ice pack for my sciatica, and a massage are all wrapped up in this category. (Listing the massage as a medical expense as I scheduled it for a medical reason.)

Toiletries/Supplies (3% | +2.8% from February) – I have been way under budget in this category in January and February, but in March, I placed a bulk order of body wash (I use body wash for my bubble baths so I go through it like crazy!) and also needed more mouthwash, dishwasher pods, mopping pads, and mopping solution. I still came in $117 under-budget for the quarter in this category so that’s nice!

Subscriptions (2.7% | +.2% from February) – My subscriptions this month included Patreon (I support three podcasts), Netflix, Paramount+, Spotify, two photo-editing apps, and Prime. This month also included my yearly premium subscription to Overcast (my preferred podcasting app) and my bimonthly air filter subscription.

Entertainment (2.5% | -.5% from February) – This category includes two book club events, Cooking Fever tokens, and tickets to an event in June.

Car (2.5% | +.8% from February) – I treated my car to a fancy car wash (she desperately needed it!), got gas twice, and paid for parking a few times.

Charity (1.4%) – I donated to Amnesty International (anyone who listened to my podcast this week will know why…) as well as the Pediatric Cancer Foundation for Olive.

Gifts (1.1% | -.1% from February) – I bought gifts for Chip and Lucy for their birthdays!

Cats (0.2% | -6.2% from February) – I was shocked to learn that I only bought the cats a toy in March and there were no other expenses!

Overall Thoughts

- I finally had a month where I did not spend above my means, but that’s only because I got my end-of-year bonus this month so if I hadn’t gotten that bonus, I would have been above my means again. But only by $43 this month, which is closer than I have ever been to breaking even! We’re making progress, friends. And with April comes my pay increase from my promotion so I hope I’ll be able to not only break even but actually spend less than what I make? How crazy would that be?!

- Averaging out my food spending, I spent $880 per month in Q1. This is way above my previous goal of spending no more than $600 a month on food, so I think it’s time to make some changes to this goal since inflation is real and food costs are just way up. My new goal is going to be $800, which is still below my average, but that feels way more doable than $600 right now. I’ll re-evaluate this number at the end of Q2.

- Some other averages for Q1 that can help me as I build a Q2 budget that works better for my needs:

- Gifts – $66

- Cats – $81 (this does not include Lila’s vet visit)

- Toiletries/Supplies – $61

- Entertainment: $121

- Beauty: $200 (includes hair appointments, which can be pricey)

- Shopping: $249

Obviously, I have some work to do on my spending habits! But that’s what these posts are designed to do. I’m writing these posts to 1) help people who also might be struggling with their spending habits feel less alone and 2) help me better understand where my money is going so I can set up a budget that works for my spending habits, not what I think they should be. I do hope to put some budget restrictions in place for things like shopping and beauty, but for some of these other areas (like cats, gifts, entertainment, etc.), I need to know how much I’m spending not to spend less, but to help me reevaluate my budget so I’m not spending above my means. For example, I can see I probably need to raise my gifts budget a bit, which means I need to bring down my beauty and/or shopping budget to accommodate.

Again, the goal for me is not frugality. I like spending money. I like online shopping and fun travel experiences and going out to eat with my girlfriends. But I do want to spend within my means, and that’s the big goal for Q2.

When was the last time you went to the hair salon?

Just my two cents but I think massage could *always* be listed under Health! It is really good for our bodies, immune systems and mental health!!

Every time you mention Nate B, I remember I’m going to see him, too and *SQUEAL!*

Very true! I like the way you think, ha.

So excited for our Nate B experiences this year!

The last time I was at the hair salon was…early March, I guess. I will only colour my own hair now, which has cut down on my expenses immensely. But my “health and beauty” expenses are not exactly low – I just paid for six months of Nutrafol and that is no small thing.

I think you’re smart to budget extra for food. It’s just so expensive now! It’s time to accept (for me too) that this is what things cost. Argh! But also, what can you do?

Exactly, what CAN you do?! I just listened to Stuff You Should Know talk about the whole topic of “greeflation” and how grocery costs are so high but what else can we do about it? We have to eat! And everything is expensive, no matter how you do it.

I haven’t been to the hair salon in ages. I usually just cut my own hair or go to the beauty college once a year for a real cut. I’m not particular about my hair so I just let them have fun with it.

I think doing this recap is a great way for you to see where your money is going so you can revamp your budget or your spending from time to time. I love that you have auto withdrawals for savings, but wonder if you also put money aside in a retirement account as you don’t mention this here.

I have had this disclaimer on my other spending posts, but left it off this one. “As a reminder, in these spending reports, I do not include anything that comes out of my paycheck before it lands in my bank account. You won’t see anything related to health insurance, FSA payments, my retirement savings, etc. This is about what I spent from my net income.”

Oh, I must have missed that in the last one! I am glad to hear it though! Saving for retirmement is key!

Nice job on getting so close to your goal of spending within your means! It’s difficult, and things like pets and inflation can really play havoc with a person’s budget. I think you’re right about the food budget, and sadly, I think $200 a week is pretty reasonable right now. I’m afraid that if I were to figure out my food budget it would be more than $600 a week (there are 3 of us, so I just tripled yours).

When you break it down like that, $200 a week doesn’t sound TOO crazy. It’s still a lot of money for one person but gosh, these days, even a simple meal at McDonald’s is at least $10, so what can we do?! It’s just a lot.

Good has been so expensive!!!! The inflation is real… I think $200 a week is pretty reasonable at the moment. Hair appointments. It’s been so long, I don’t remember. I know I went to get a bayalage after R was born but that’s four years ago. I usually just go to Supercuts or Great clips and for $20 they will do a nice job cutting. I think I will just let my hair slowly turn grey… Will see how I feel once I actually see a lot of noticeable grey. Thank you for creating these honest posts, they are very helpful.

I love an easy Supercuts/Great Clips appointment. When I had bangs, I loved going there for a quick trim! And much more affordable than my damn hair salon.

I’m glad these posts are helpful!

Well, now I want to run out to Bath and Body Works to buy candles 🙂

Yes, food is crazy expensive. The week my son was home, I couldn’t believe how much we spent. Eek.

i haven’t been to a hair salon in ages, but I do need new shampoo and conditioner. I use Aveda, and those have ALSO gone way up in price. Grr. Time to shell out the big bucks.

What you’re doing is perfect- keeping track of your spending, seeing what’s working, what you can shift around- I agree, I’m not aiming for a really frugal lifestyle. I also like spending money! But it has to be withint reason, and I think you do a good job.

Bath & Body Works will get you every time! Ack.

Aveda products are SO expensive. I want to use them, but oof. It hurts the pocketbook!

I last got my hair cut on December 12. My hair stylist was super pregnant and had a challenging end to her pregnancy, so she’s been on maternity leave since then. Normally I get my hair cut every 8 weeks and you can tell it has been way too long! I think she’s back, but just working mornings and that’s great for her, but bad for me!

Also, I honestly can’t believe how much prices have gone up for pet food and medicines. I actually just switched one of Hannah’s prescriptions from Chewy to Costco because it saves me like $30 a month AND there is a $15 rebate (you have to use it at a vet’s office) through Costco. I am not price shopping all of Hannah and Zelda’s medicines to make sure I’m getting the best price I can!

Ugh, that’s the worst when the appointment times don’t match up with your schedule. I hope you’re able to figure something else out!

Pet food is insane right now. And I can’t imagine what medicine is like for a dog and a cat together! It’s too much, blergh.

I think I mentioned that you, Engie, and San have inspired me to track my spending and see where all the money is going. And wow, it is eye-opening. I don’t want to “set” a budget, that’s not for me, but I do want to see where I can cut back. Thanks for being such a wonderful example – I’ve learned a lot from you.

Everything is so expensive. Ugh. I feel like I am not a big spender but still struggle with a lot of the necessary expenses (and I guess I just don’t like to see how much money leaves my account every month). Good for you for tracking again and identifying areas that you can work on.

So so interesting. I am too lazy to do such a detailed spending report but it is a good way to see where the money is spend. I am trying to really not shop for anything right now but it is a bit tough on some days.

I desperately need a hair cut … a neighbor already pointed that out ugh… But they are so so expensive and I really don’t have or want to spend the money. But I might have to.