Oh, friends. This one is going to be a doozy. May was one of the spendiest months on record and it was not pretty to sit down with these numbers. As a reminder, in these spending reports, I do not include anything that comes out of my paycheck before it lands in my bank account. You won’t see anything related to health insurance, FSA payments, my retirement savings, etc. This is about what I spent from my net income. Here’s what April looked like:

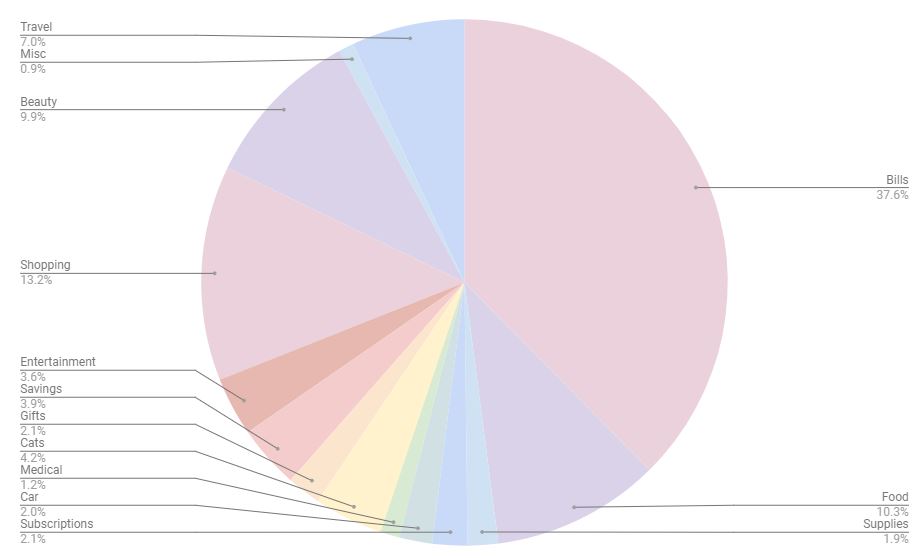

Bills (37.6% | -9.9% from April) – My percentage this month was way lower than previous months because I overpaid on my car loan and didn’t have to make a payment in May. I should have still made a payment but I knew May was going to be a spend-y month so I gave myself the break.

Shopping (13.2% | +7.2% from April) – You guys, I am embarrassed how much money I spent shopping in May. Now, I did spend $300 on new shoes (a new pair of Birkenstocks and two new pairs of Asics), but still. This is mind-boggling.

Food (10.3% | -7.8% from April) – While I’m happy with where I landed with my food budget, I was traveling for the last few days of the month so I don’t know if those numbers would shake out quite as well if I was at home. I adjusted my food budget to accommodate my vacation time ($525 as opposed to $800 as normal), and went over a bit ($596), but I’m okay with that. My Ubereats budget was down $120 from April, and that makes me very, very happy.

Beauty (9.9% | +9.4% from April) – I expected my beauty category to increase a lot from April to May because I had an expensive hair appointment that included balayage, color + toner, and a haircut and style. It was too much money, honestly. I think it’s time to look at at-home hair coloring options. I also bought some make-up (mascara, lipstick, eyebrow pencil) and replaced some skincare products (cleanser, a serum, etc).

Travel (7.0% | -3.7% from April) – My mom and I always split costs 50/50 when we travel. A lot of my travel expenses cleared in early June, so this number is a bit lower than I expected. It included Lyft rides, excursions, food, and drinks.

Cats (4.2% | +1.5% from April) – The cats were a bit expensive this month! I had to buy food and treats and also spent a lot on fun cat toys from the cat event I went to. Eloise also had a vet appointment + two different sets of bloodwork done, but my out-of-pocket cost was only $75 total since I have been funneling money away into a separate savings account for a time such as this. That savings account is now depleted (wah), but at least it was there when I needed it.

Savings (3.9% | -.6% from April) – I put away the same amount in savings that I normally do; it just shook out differently percentage-wise.

Entertainment (3.6% | -1.1% from April) – Book club, dinners with friends, and Cooking Fever tokens.

Gifts (2.1% | +1.9% from April) – Two friends had birthdays at the end of April/early May and I bought presents for them.

Subscriptions (2.1% | no change from April) – This month, my subscriptions included Patreon, Netflix, Spotify, Paramount+, Canva, Prime, a Substack newsletter I support, my bimonthly air filter subscription, and a photo-editing app.

Car (2.0% | +1.2% from April) – Gladys got a bath, I got gas once, and I paid for parking downtown.

Toiletries/Supplies (1.9% | +1.2% from April) – Lots of little supplies needed in May: mouthwash, toothpaste, toothbrushes, shampoo, conditioner, deodorant, toilet paper, trash bags… fun stuff!

Medical (1.2% | +.6% from April) – This category mostly comprises some of the stuff I bought to help with my scalp psoriasis flare. Blegh.

Misc (.9% | -.1% from April) – I have to pay an annual fee (just under $54) at my gym and it comes out every May. So I just put it in a miscellaneous category since it’s not something I’ll need to worry about too often.

Overall Thoughts

- I have got to get my shopping under control. As of June, I am limiting myself to $100 a month for shopping. I have been averaging vastly higher than that, so this will be quite the mission even though it doesn’t feel like it should be. I’ve gotten into a mode of buying things just because I want to (and there is also some “being a poor kid” mentality where now that I can buy the things I want, I feel like I deserve it). I need to nip that in the bud!

- I need to start living as if my rent is higher than it currently is. I am pretty certain I am going to move when my lease is up at the beginning of November, which means my rent will be increasing in a few months. I don’t want that to be a shock to my budget, so I’d like to start funneling $400 every month into savings. That’s going to be difficult with the way I’m spending money, but crucially important to help with any anxieties I have surrounding higher rent.

- I need to build up my emergency savings + pet fund once again, as I had to dip into those savings accounts in May due to Eloise’s extensive bloodwork and the stupid $400 I paid to the locksmith when I came back from vacation.

When’s the last time your car got a bath? Tell me something fun you spent money on recently!

Some months are definitely spendier than others. Wow, have we spent a lot over the past few months on landscaping. I don’t even want to say how much it cost, except that it’s a lot. Well, it’s a one-time expense, we won’t be doing this again, and it’s really transformed our yard and garden. So that’s something! They should be wrapping up this week, and I will be glad to have it done.

On a more fun note, I just bought new jeans – like four pair. I am purging my closet of things that don’t fit anymore and, hello perimenopause, my old jeans don’t fit right anymore. I am tired of feeling shitty about myself, putting on ill-fitting jeans, and so bam, new ones.

It’s so hard to invest in those one-time expenditures that you KNOW will be worth it but oof, the cost can be BRUTAL. I feel you on that!

YESSS to new jeans! We should not waste our lives wearing clothes that don’t make us feel good!

Oh, I feel you on the shopping and just buying what you want (especially when you’ve had times where you couldn’t or didn’t). It’s hard to break that because it feels like a loss when you don’t do it, right? But, a new place is fun to save up for so hopefully that is a “big” buy that balances out the missed treats.

Yes, exactly! There is something so great about being able to buy the things I want after so much time where I couldn’t. So it feels like I’m missing out on something crucial when I don’t LIVE in that feeling. Alas, got to figure out the right balance!

I hear you on the ‘being a poor kid’ giving you freedom to spend when you have more money. I am not great with money, and I have definitely gone through periods where I shopped a LOT. I have changed my mentality from ‘I deserve it’ (because we ALL do) to ‘Do I need it? Do I REALLY want it?’ Sometimes I don’t even REALLY want something that I’m tempted to buy. I’ve gotten better for sure, but it’s taken me far too long. I also hear you on the hair appointments. Gah, the color is expensive. I did it myself for years, but then one day I had it done professionally and was blown away by how much better it looked. When I was laid off from my job in 2009, I was thinking of going back to the box of hair color, but instead I went to a beauty school. That saved me a LOT of money, but it takes a LONG time. Definitely for someone with more time than money! I hope I don’t have to go back to that, though I am sure it would be better on my budget.

It makes me feel a lot better knowing I’m not the only one who struggles with spending money, especially coming from that poor kid mentality. Bah!

I went to a beauty school for a simple haircut and it took THREE HOURS. I was astonished, lol. I mean, the haircut was also $15, which was nice. But man, that’s an investment of time!

I feel like I actually need to swing a bit in the opposite direction with spending. I have a VERY hard time spending money. I mean, I do spend money on frivolous things…but not without much angst, and I am almost always looking for ways to save money on even “fun” things. My parents had very little money, especially when my siblings were growing up and then for the first 5ish years of being married we had almost no money. My parents are extremely frugal and instead of rebelling against that, I think I’ve taken their example a bit too much to heart. I definitely have some issues with fear over spending money that I need to work through! In the words of Gretchen Rubin, I need to “spend out” and one of my goals for this summer is looking to see if some “issues” can be solved by throwing money at the problem. I tend to gulp at the price of taking kids (and their friends!) out for ice cream but it is a GREAT way to fill an afternoon and I know some days when I’m frustrated and trying to come up with something free to do at home, it would be much better spent forking out $30 for ice cream at a farmer’s market. (But just think of how many liters of ice cream I could buy for $30 on sale my mind screams. I need to just BUY THE ICE CREAM.)

There is definitely something to be said about throwing money at a problem sometimes. It’s not always the right solution, but if it gives you a sense of peace and joy, I think it’s more than worth it! Sometimes it’s more about the experience than it is the money. Yes, you can certainly eat ice cream at home, but the joy your kids get from going out and being at the farmer’s market and getting ice cream is worth it (usually).

Some months are more expensive and those shoes were a good purchase but I know what you mean about reining your spending in as you plan to move and expect your rent to increase. Life is so expensive especially when you live alone!

I do not handle anything related to the car! Phil gets gas, handles service appts, and washes the car when it needs it. My something fun was some delicious meals out at fun restaurants! Phil and I had our date night and then I went to another restaurant twice about a week apart – once with bookclub and then again with Birchy!

My mom had to get gas for the first time in FOREVER and I asked her if she even knows where the gas tank is located, haha. My stepdad does all the car stuff, too. It would be very nice to have someone to do that for me!

I think the most frustrating thing for me about budgeting is that every month looks different. I mean, it makes sense but if I could choose, I’d love to have the same budget (and stick to it) every single month – the ups and downs of budgeting can be so “stressful”. I hope you give yourself, but I understand that you also really need to get a grip on your spending if you want to move soon. I am rooting for you.

I haven’t taken the car for a bath in a while, but I should LOL

That’s so true – a budget has to be a fluid thing from month to month because expenses can change so wildly!

Always fun to read along. And when I see your spending reports I always wonder if I should do them too. But I am too lazy. And I would only be able to do half as the husband I also paying stuff and he will not bring back receipts. So it won’t work. But I do wonder.

I am sorry your emergency funds are depleted. I can only assume the feelings around the locksmith debacle. So sorry.

It’s a lot of work to keep up with itemizing my spending! I totally understand the lazy feeling. I am like that with most things, haha.

It rained on Saturday night and the car got a rain bath. Does that count? Because otherwise it was the last time the car was at the dealership because that’s the only time we clean it.

I don’t think there’s anything here that’s outrageous. Some months are just more expensive than others. You don’t get your hair done every month and you needed new shoes. It’s not like you’re randomly spending money on stuff you’re not using.

Nature’s shower definitely counts as a bath! I’m always grateful when that happens, haha. A free bath for the car!

And thank you – it makes me feel better to hear you say all of that!

Oof. I can see why you were, well, deflated at the amount spent. BUT! I would actually expand your “Medical” category to “Health”. Your gym membership – investment in your health. Your shoes – even the Birks – investment in your health. Your psoriasis tx – investment in your health. Or, make a new category, called “investing in future me”. 🙂

And yes, workouts can be great one day and stink the next. You’re making SO MUCH progress. Would you have been able to even think about completing those workouts a year ago?

I’d say go easy on yourself, but it takes one to know one. <3