Ooh, boy, I have not been budgeting like I should be. In fact, I had to download my entire transaction history for November and itemize each purchase one by one because I didn’t even open my budget spreadsheet in November. Oops. It was not a fun task. This is why I need to do it throughout the month! Argh. Anyway, here’s how it all shook out:

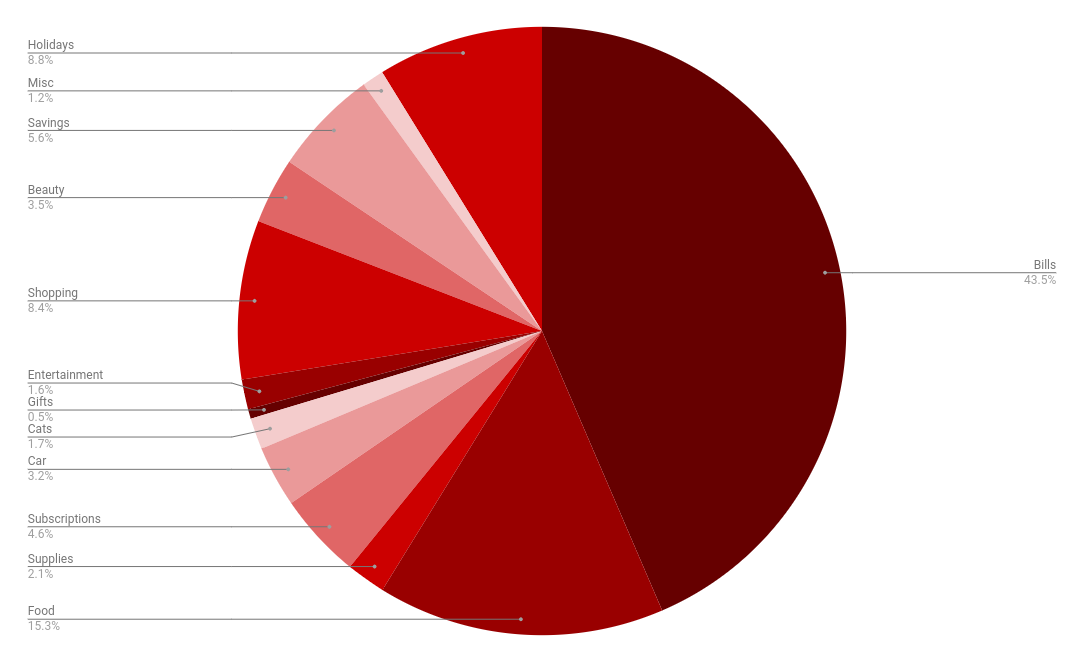

Bills (43.5% | -2.9% from September/October): This category comprises rent, my phone bill, Internet, my car payment, electric, my gym, Care Credit, and student loans. I didn’t have a car payment this month (my payments start in December) and I got a nice credit on my Internet bill from the hurricanes (my Internet company credited us for the days we were without Internet service!).

Food (15.3% | +4.1% from September/October): I came in under-budget in my food category, which I’m happy about. I still feel like I spend so much more in food costs than the average single person, but it is what it is. I’m hoping to make some changes in 2025 that will help me get this category lower.

Holidays (8.8% | +8.3% from September/October): This includes presents, decor, and Christmas fun. I’m trying to spend less than $800 on Christmas this year, so we’ll see if I can do it. November was a spend-y month because I bought a lot of Christmas presents.

Shopping (8.4% | +3.9% from September/October): Ack, my spending was a bit out of control in November and I didn’t even realize it until I sat down to do these numbers. I bought some books, somehow dropped $80 at Bath & Body Works, and finally got Tiles for my key ring/wallet so I can stop losing things.

Savings (5.6% | +.5% from September/October): I didn’t save more money this month; the percentage just shook out differently. I put money away monthly into a car insurance fund, a cat fund (for medical bills and the like, not for a new cat lol), and a Christmas fund.

Subscriptions (4.6% | +2.8% from September/October): The majority of this increase is due to a yearly subscription I paid to Befunky, gah. Should I have paid $80 for their service? Probably not, but I’ve yet to find a better collage maker. I’ve tried finding a cheaper alternative, but they just do it better than anyone else. Oh well.

Beauty (3.5% | +2.2% from September/October): I did a hair dye night with my friends (the actual supplies were free but I “pay” my friends in pizza and cheesy bread), got a professional haircut, and also bought some skincare products.

Car (3.2% | -4.6% from September/October): I filled up my car with gas twice and also had to pay an overage fee to my car insurance when I upgraded my car/changed loan providers. Wah.

Supplies (2.1% | +.4% from September/October): Nothing too exciting here. I bought toiletries and stuff. (I didn’t keep track of what I bought like I usually do, but I know I placed a big order at Target for things like toilet paper, laundry pods, etc.)

Cats (1.7% | -1.1% from September/October): They needed some treats and I also bought wet food. I have finally learned that Eloise vastly prefers wet food to dry food so now the girls get two cans a day (I split a can between two bowls in the morning and split another can in the evening). It’s expensive, but if it means Eloise is going to put on some weight, I’m all about it.

Entertainment (1.6% | -.9% from September/October): Nothing too much to report here. I had some dinners out with friends and bought some tokens for iPhone games.

Misc (1.2% | -.4% from September/October): I renewed my license, fun times.

Gifts (.5% | -1.2% from September/October): Just my monthly donation to the ASPCA.

What was something you bought for yourself in November?

November is a spendy month! I bought myself a whole lot of clothes because I had to purge my wardrobe of things that no longer bring joy/ fit. So that was kind of depressing but I tried to lean into the fun of it. (“At least this happened at the best time – Black Friday” – quote from my husband). Hoo boy, though, was it a lesson in letting things go (“Those days are gone forever, I should just let them go”)

I try to be really critical of the clothes I keep around because if they don’t make me feel good, I don’t need to be wearing them! I haven’t done a big purge in a while but I do try to cull my collection every now and then.

Congrats on letting things go and bringing new faves into your rotation!

The OH loves doing spreadsheets for our bills/spending and diligently rounds everything up at the end of each month. For which I’m eternally thankful for. And we do the household shopping via a dedicated credit card, so we know all the bills on that are for mostly food.

It’s nice to have someone else doing the budgeting and money stuff! I would much appreciate that, lol.

I know, it’s the best part about having a partner who loves numbers.

I bought a new cell phone in November. That’s been a thing. And I bought new cars for our older car. And look I don’t want to talk about my spending. It’s out of control. As is how much sugar I am eating. MY LIFE IS RUNNING AMOK right now.

I’m off to update my own spending spreadsheet for December. I am scared.

I haven’t even LOOKED at December totals yet. It’s only the 18th. IT’S FIIIIINE.

November/December are such hard months to be in control with spending. There’s just so much shopping and things to do and maintenance! Gahhh. I feel you so much.

I have wanted to *slightly* step up my makeup game, so I spent a lot more than usual on makeup. Probably $60-70 over the span of a week or two which is a lot for me! That said, I suspect it will last me quite a while.

In November I bought some work dresses from a company called Maggie London. I prefer to wear work dresses when I travel but that means I wear the same ones over and over and over. So I wanted to add some to the rotation. I ordered 6 and kept 4, I think? It’s all a blur now!

This post pushed me to look at our spending in Fidelity Full View (which is what we use now that Mint is no longer a thing). I had to do some cleaning up which was good because the end-of-year finance post is just around the corner! Money is def flying out the window here as well with all the teacher gifts and such. I was so glad there wasn’t anyone in line behind me when I bought 20 Starbucks gift cards on Saturday! I thought that was a lot and then I ended up behind someone at Target that was buying $600 (!!!) gift cards!!

OMGGGG tell me about it. Food spending is up. Holiday spending is bananas, and my very first defense mechanism is to STOP TRACKING, which is the OPPOSITE of HELPFUL. Solidarity.

OMG I barely remember November, but I know it was spendy. December is insane. If you can keep Christmas under $800 that is amazing!!!

All the Christmas presents can be putting a dent in any budget.

I bought myself a fountain pen in November and it is amazing. I put pink ink in and I feel glamorous.