I wasn’t able to get my monthly budget update put together in October, so this month, you get a double-dose! I combined September and October into one budget update. It was quite the doozy of two months—the beginning of September was normal and then Helene happened. Then the beginning and middle of October were nutso thanks to Milton before settling down into normal life. Let’s talk about how this affected my budget, shall we?

Quick reminder: I am single and live alone, so all of these numbers are mine and mine alone. And I do not include anything that comes out of my paycheck before it lands in my bank account. You won’t see anything related to health insurance, FSA payments, my retirement savings, etc. This is about what I spent from my net income.

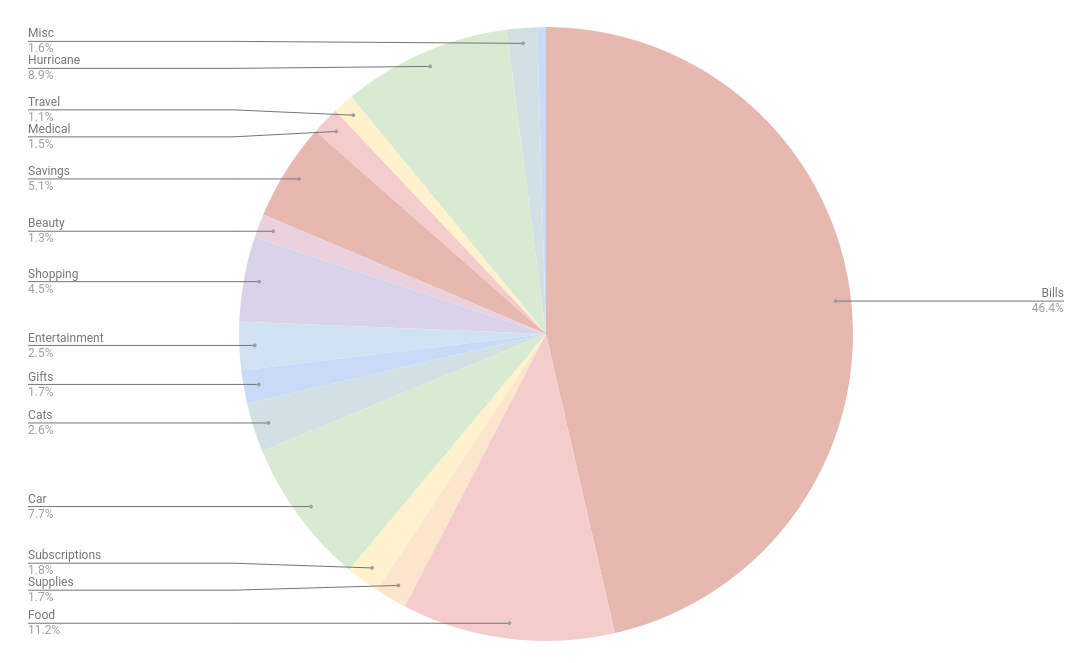

Bills (46.4% | -5.2% from August): This category comprises rent, my phone bill, Internet, my car payment, electric, my gym, Care Credit, and student loans. My electric bill was a bit less in September and October, so that’s nice. Everything else is a fixed expense, and no surprises to report there!

Food (11.2% | -4.3% from August): I’m finally coming in under-budget for my food budget! Disclaimer: Some of my coworkers gave me a very generous Door Dash gift card after Hurricane Milton and that has helped me bring down my food budget even more. We’ll see how things shake out when I’ve used up that gift card.

Hurricane (8.9%): A new category for September and October, gah. This includes the price of the VRBO, the pet fee, and some food we bought while we were evacuated. I paid for the VRBO and then my mom paid for the cruise we booked, so it all evened out, ha.

Car (7.7% | +5.2% from August): While I only spent $35 in September to fill up my gas tank, October was much spendier since I had to unexpectedly buy a new car (for new NaBloPoMo readers: My beloved 2022 Kia Soul was flooded during Hurricane Helene and it was totaled by my insurance company. I bought a 2025 Kia Soul in mid-October.) The money I received for my car insurance claim ($3,100) was used for the down payment and I also added $900 of my own money to bring the total down payment to $4,000. I also had to buy some new accessories for my new car, and those purchases are included in this total.

Savings (5.1% | -.4% from August): I socked away money in my three normal accounts (car insurance, cats, Christmas) and then also put $50 in a new “apartment” savings account that I started. I want to get to a point where I’m putting $300 away in this account every month to prepare me for moving next year to a two-bedroom apartment (and thus, having much higher rent). I started small in September and then things fell apart in October. I’d like to try to put $100 away in November and December, but we’ll see.

Shopping (4.5% | -.9% from August): I’m actually surprised I spent less on shopping in September/October than I did in August because I felt like I was spending so much money the last two months. Some of it was retail therapy and some of it was just necessary items I needed (like new pillows).

Cats (2.6% | -5.1% from August): The cats were cheaper over the last two months, woohoo! I bought them wet food and treats, and also placed a big order for litter when Chewy was having one of those “spend $100, get a $30 gift card” deals. The only thing I needed that qualified was litter so I just got extra, ha.

Entertainment (2.5% | +.9% in August): There were some fun events with friends (like a movie date and a candle-making date), some meals out with my mom that I paid for, and of course, those dang Cooking Fever tokens. (Good news: I’ve almost played all the restaurants in Cooking Fever so I’ll soon have to find a different phone game addiction, ha.)

Subscriptions (1.8% | -.9% from August): The percentage shook out a bit differently in September/October, but I spent the same as August. My subscriptions: Patreon, Netflix, Paramount+, Spotify, Amazon Prime, and Canva.

Supplies (1.7% | +.5% from August): I came in just a smidge under-budget for my supplies category, which is a big win considering I bought a six-pack of air filters ($46) and two 4-packs of body wash that were $25 a piece.

Gifts (1.7% | -1.3% from August): I thought this percentage would have been bigger than August as September and October are big birthday months in my world. But I guess not! I’m still always surprised at how much money I spend on gifts in a given month.

Misc (1.6%): My annual renter’s insurance premium was due in September and I paid it all in one lump sum.

Medical (1.5% | +.9% from August): I was having trouble with my FSA card in September so I had to pay for a few prescriptions out of pocket while I waited to figure that out (we’re all good now!). One of those prescriptions was a $40 psoriasis shampoo so that was fun! I also bought a few other supplements/medications that my FSA won’t cover, like vitamin D and probiotics.

Beauty (1.3% | -1.6% from August): Nothing too crazy here! I bought two different mascaras (I hated the wand on the first mascara I bought so that was $11 down the drain), a new eyebrow pencil, and a new lipstick. I also replaced some skincare products and had to buy new toenail clippers because my previous ones disappeared somehow.

Travel (1.1%): I paid for one of our excursions for the cruise.

Holidays (.5%): Here comes this category again! I like to keep track of my holiday spending because it can quickly get out of hand for me. (I save money throughout the year to help offset my spending, so here’s hoping I don’t go over the amount I saved.) In October, I bought two advent calendars.

Overall Thoughts

As you might expect, my money-spending habits were the last thing on my mind these past few months, but now that normalcy has returned to my life and my city, I am eager to jump back into my budget and get back to tracking my spending more closely. My car payment will be $100 more than it previously was (originally, I thought it would be around the same but I added an extended warranty + some other protections that brought the price up) so I will need to adjust my budget for that. And I want to restart my savings plan for a new apartment. Plus, the holidays are coming! I need to think about gifts and holiday events and any extra decor I’ll end up buying (because it’s inevitable that will happen even though I already have five huge tubs of Christmas decor for my 750-square-foot apartment).

What’s something (big or small!) that you were happy to spend money on recently?

I am curious (and maybe I missed this part?) if you came over or under budget in total? If over, I think that is why we have the savings, although obviously we hope we don’t use it, but shit happens! So hopefully you can get back on track post hurricane. I also tend to like the yearly review better, even though I track every month, as the month to month can be lumpy! Also, I am curious what you do for the saving vs. car insurance –> once you pay your car insurance, does that go into the “car” category, or do you always keep it in “savings?”

To be honest, I didn’t have the headspace to go back and figure out my overall total of money spent vs money earned to see if I was under or over-budget. Probably over-budget with the extra expense of the VRBO, new car, etc. It was a weird two months so I’m just accepting it for what it was and moving forward into November.

I do not account for the car insurance premium in my budget as a whole, since I’m accounting for it in my savings category. (Unless, of course, the premium is MORE than what I ended up saving, then I’ll calculate the difference and include it.) Once the premium comes out of my bank account, I transfer what I had in savings to my bank account to cover it. Hope that makes sense!

Wow you are so disciplined! We’re contemplating a renovation and it’s daunting, things are so expensive , this is a good exercise. I’d rather spend the money traveling but the house needs some love!

It took me a long time to find a system where I could be so detailed about my spending habits. It’s hard! And not fun to open that bank account some days.

A renovation sounds fun but ughhh, the expense! Good luck!

September-October were crazy months. I think you did really well. (I guess having no power will drop your electric bill, right?)

One thing lately that I spend money on was the same advent calendar you got- the book one. i saw it on your blog and couldn’t resist.

AND…. yes I will be in Tampa in January!!! I would love to get together if it works out for you. Cat cafe… indie bookstore… we’ll find something fun to do. I’ll give you the dates when I know them.

It reads to me as you were doing pretty good staying on budget considering two hurricanes and a new car. Definitely curveballs that are not appreciated.

I just wrote my spendings report that will go up later that week and all the bills are just no fun. They take more than half the money. Yours too. Sad. But I guess that is part of that adulting they talk about. No one told me…

Best thing I bought in October: probably the additional magnetic frames for my picture wall.

It seems like you did really well considering everything that was thrown at you.

We bought a new washer and dryer, which was completely unexpected, expensive, and unplanned for. We robbed Peter to pay Paul, meaning we took money out of our ‘we’re going to need a new car someday’ savings account to pay for it. Hopefully our cars will hang in there long enough for us to get a down payment saved up, since we’re now starting over.

I’m buying new cross training shoes. I’ve been complaining about needing new ones FOR MONTHS and it’s causing foot pain when I wear my current pair, so I purchased five pairs off Zappos and am just waiting to see if one of those will be the one. It’s wreaking havoc on my credit card statement, though, with all these shoes flying back and forth!

Oh man! This is why I always go to a store to try on shoes, but then I have to find the time to GO TO THE STORE and that can take me MONTHS to do for some reason. So I don’t know which way is better – ha! Good luck on your shoe hunting mission. I was astonished how much better my feet felt in new shoes. WHO KNEW?!

The most fun thing I spent money on last month was incidentals during our trip to DC. We really didn’t spend much since so much in DC is free! Paul would tell you the best money spent was the snow globe I bought him as a souvenir. It has the monuments in it and he loves it so much! I also bought some new black pointy toe Rothy’s as my other ones were starting to show their age. But I wear them all the time and have had them for several years so I got my money’s worth!

That’s really enlightening to put the data together like that, isn’t it? I always am surprised when I go a while and think I instinctively know where my money and time are going until actually throwing the data into a graph and seeing the truth. Especially for where my time goes. Yikes.

I have to say, to your question, that I was surprised. I was a little taken aback at the price tag for three seats to see Wicked! that my wife found for us. I heard it’s good, but is it that good? Should we take a whole evening out to see a play? So many excuses to not have spent money or time. But afterward? Oh my goodness. SO glad we did. Great experience to have shared together, amazing stage performance. Money well spent even though not something affordable to do more than as an occasional treat.

It can be so hard to spend money on experiences sometimes because experiences can be very expensive! But most times, they are SO worth it. I’m glad that was your experience and that you guys had a great time!

Oof, the last two months really shook up your spending because of all these unforeseen circumstances. I hope you’ll get back to your normal spending routine soon, so you can work on that future budget.

Our last two months were spendy too with a new car and our move to a new home.

It was a wild two months and things got back to normal just in time for the holidays! Ha.