Another month, another budget update! I’ve been thinking about whether or not I want to continue these monthly budget updates in 2021. Is it really necessary to list out everything I’m buying in such a detailed way? While it’s helpful for me to see my spending habits and all of this data will be used to create a much more robust budgeting system that actually works for my lifestyle (for example, budgeting $250 a month for food is LAUGHABLE), I am not sure I want to continue with this style of budget updates. Maybe I will, or maybe I’ll figure out a different way to talk about my finances in 2021. We’ll see!

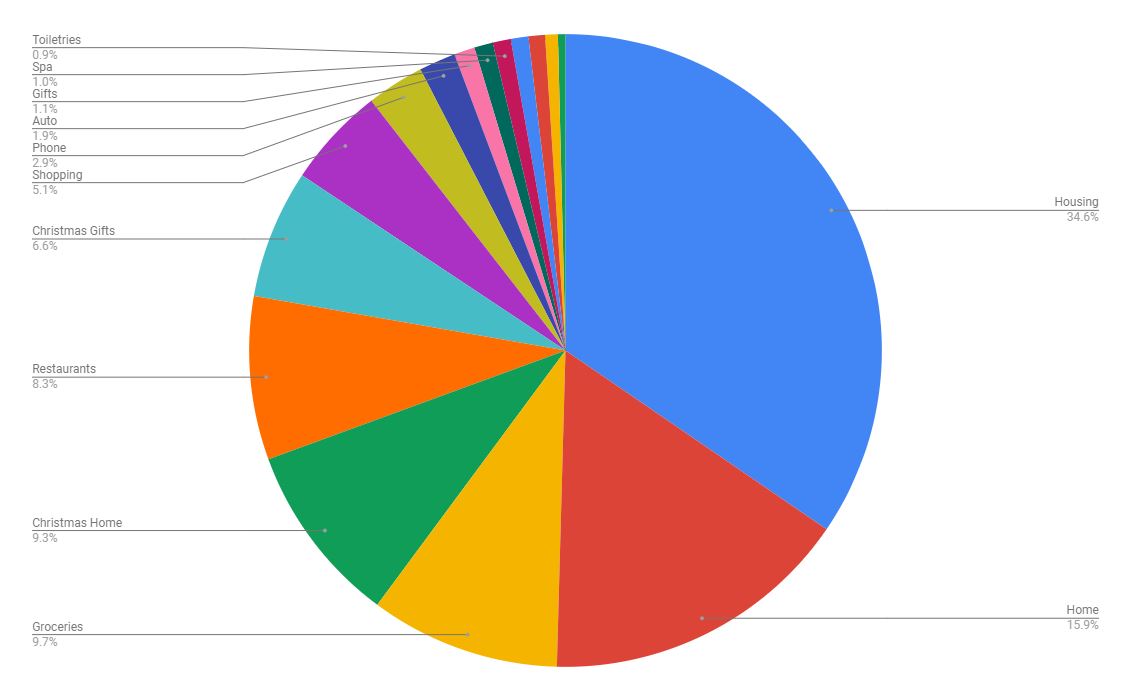

For now, let’s dive into the numbers from November!

Housing (34.6% – $1,271 compared to $1,094 in October) – This will be my more normal housing budget going forward. Rent, electric, water, Internet, and Netflix.

Home (15.9% – $584 compared to $20 in October) – A much more expensive month on the home front. I bought a new dining room table and bookshelf, as well as a candle.

Groceries (9.7% – $357 compared to $298 in October) – I spent a lot on groceries this month, much more than I have been spending lately. I’m not quite sure why! Perhaps I did more grocery store visits this month than usual? I tend to go two times a week, but I think I was going more often in November for some reason.

Christmas Home (9.3% – $341 compared to $0 in October) – I’ve never, ever kept track of my Christmas purchases so good thing I’m dissecting my spending habits this year! I spent $341 alone on just decorations. Of course, $215 of this was my Christmas tree, which will last me for at least a few years. I also spent $25 on new stockings (I finally have stockings for the girls!), $13 on a holiday doormat, and nearly $80 on ornaments. (Oops. My new tree is so much bigger than my old one that I needed more! Eighty dollars worth of more? Probably not.)

Restaurants (8.3% – $307 compared to $334 in October) – Another spendy month for restaurants. But that’s just the way it goes for me!

Christmas Gifts (6.6% – $242 compared to $0 in October) – I am nearly finished with my Christmas shopping! I think I’ll maybe spend $100 more? Like I said, I have never kept track of how much money I spend on Christmas (which means I’ve never had a Christmas budget). I’m glad I’m doing that now so I can actually start a sinking fund for Christmas in 2021!

Shopping (5.1% – $189 compared to $84 in October) – I bought a handful of books (three e-books, four print books), five pairs of underwear, a coloring book, some face masks, and two Chatbooks.

Phone (2.9% – $108 compared to $108 in October) – Fixed expense.

Auto (1.9% – $69 compared to $31 in October) – I filled up my gas tank twice and bought new windshield wipers.

Gifts (1.1% – $39 compared to $60 in October) – A friend’s baby turned one so I bought some fun gifts for her! 🙂

Spa (1% – $35 compared to $78 in October) – Tips paid to my massage therapists (I got two massages in November).

Toiletries (.9% – $34 compared to $50 in October) – I bought mouthwash, shampoo, deodorant, and a few bottles of body wash.

Subscriptions (.9% – $33 compared to $70 in October) – Just Patreon, Spotify, and PicMonkey this month!

Entertainment (.8% – $31 compared to $10 in October) – Parking downtown and way too many credits on Candy Crush.

Beauty (.7% – $24 compared to $0 in October) – I bought an eyeshadow palette, a new hairbrush, and a blending sponge.

Pets (.4% – $14 compared to $50 in October) – A small toy and a set of disposable litter boxes (panic-bought when I was worried about needing to evacuate due to Hurricane Eta).

$0 categories in November: household supplies, health, donations, travel, savings, and debt payments.