Happy Fourth of July weekend! It’s going to be a weird weekend for me, and I’m sure for a lot of you. While the beaches near me will be open this weekend (WHYYYYY), I will be staying home. I’m hoping to go for a swim in my mom’s pool, though. I could sure use some pool time!

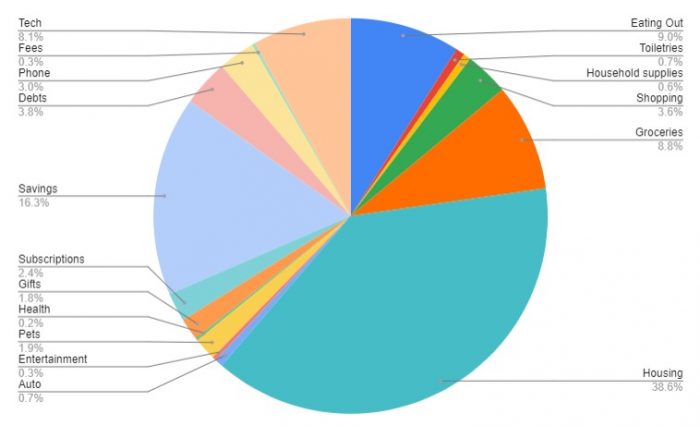

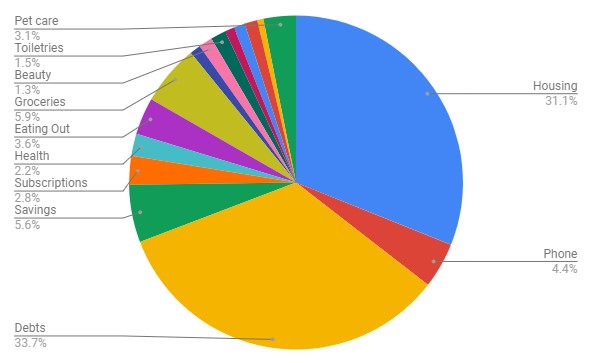

Today, I have my monthly budget report for ya! It was a less spendy month for me, by far, and I’m glad about it! Here’s how it all shook out:

Housing (38.6% – $1,065 compared to $1,085 in May) – Pretty stable, as always. My electric bill was slightly less last month, probably because I wasn’t doing laundry!

Savings (16.3% – $450 compared to $1,300 in May) – Well, I knew I wouldn’t be able to maintain a four-figure saving rate, haha. But I’m still proud of socking away $450 this month! I added a little bit to emergency savings, my house fund, and my car fund.

Eating Out (9% – $249 compared to $329 in May) – Whew, I am glad I was able to have a more reasonable number here for eating out! I know my eating out budget will always be fairly high because I truly enjoy having takeout and truly hate cooking, but last month was kiiiinda ridiculous for one person.

Groceries (8.8% – $242 compared to $233 in May) – It’s exciting to see this category is about the same as in May! I try to spend less than $300 a month in groceries and I’m definitely meeting that goal right now. Yay!

Tech (8.1% – $222 compared to $80 in May) – I bought a new computer monitor and paid the second half of my fee for my keyboard replacement. I also had to buy a new paper shredder after my old one kicked the bucket, so I added that into this category.

Debts (3.8% – $105 compared to $87 in May) – I’m on a graduated payment plan with one of my student loan companies, which I always forget about until I log onto the website to pay my bill and see a higher payment due. Woof. At least it’s just $18 more!

Shopping (3.6% – $99 compared to $418 in May) – May was a very spendy month for me, and I’m happy to see that I kept my spending in check in June. This category is comprised of a Chatbook of my cats, two notebooks, a new mouse pad, two e-books, and five print books that I purchased from bookstores.

Phone (3% – $82 compared to $97 in May) – Listen, I don’t know why my phone bill has been so cheap lately, but I’m not going to question it.

Subscriptions (2.4% – $65 compared to $44 in May) – Spotify, Patreon, PicMonkey, Book of the Month, and my bimonthly air filter subscription.

Pets (1.9% – $51 compared to $277 in May) – A much cheaper month for the cats! They got a new bag of food, treats, and a new blanket.

Gifts (1.8% – $49 compared to $50 in May) – I bought two cards to keep on hand for birthdays and then something special for my mom’s birthday.

Auto (.7% – $18 compared to $0 in May) – Would you believe it? I had to refill my gas tank this month! 😉

Toiletries (.7% – $20 compared to $66 in May) – Four bottles of body wash, yassss.

Household supplies (.6% – $17 compared to $11 in May) – Two bottles of dish soap and toilet paper. Easy-peasy!

Fees (.3% – $8 compared to $0 in May) – I hesitated to put this on my list, but this is all about being transparent, right? I overdrafted this month for really stupid reasons and an $8 fee hit my bank account. UGH. I hate when I do that. It makes me feel like the worst person ever. I need to work toward having a buffer in my bank account to stop stuff like this from happening (and I’m trying to do that—I want to have $500 in my bank savings account, as I can quickly transfer money into my checking that way. I socked away $200 this month!)

Entertainment (.3% – $9 compared to $38 in May) – Candy Crush, my arch-nemesis and favorite time waster.

Health (.2% – $6 compared to $0 in May) – And the best $6 I’ve ever spent! This was for the Dramamine that saved my life when my vertigo last weekend was at its worst.

$0 categories in June: spa, home, travel, and beauty. I also forgot to pick a cause to donate to, so I’ll make a double donation in July!