Happy Friday, friends! I am here today to report on my March spending. As a reminder, this is a spending report, which means I am only talking about the money I spent after it hits my bank account. You will not see anything related to my 401k, health insurance premiums, HSA contributions, etc.

Before I get into the fun stuff, let’s review my money goals for March:

- A full boycott of Amazon and Target – Not complete. I definitely used both places a LOT less than normal, but I needed to use Target a few times for toiletries and Amazon for a few hard-to-find items.

- Switch from Publix to Aldi – Somewhat complete. I did one shopping trip at Aldi but I wasn’t too impressed with the selection nor the quality of some of the food. Womp.

- Reduce my shopping budget further – Not complete. As you’ll see below, I actually spent double in March than I did in February. Oops.

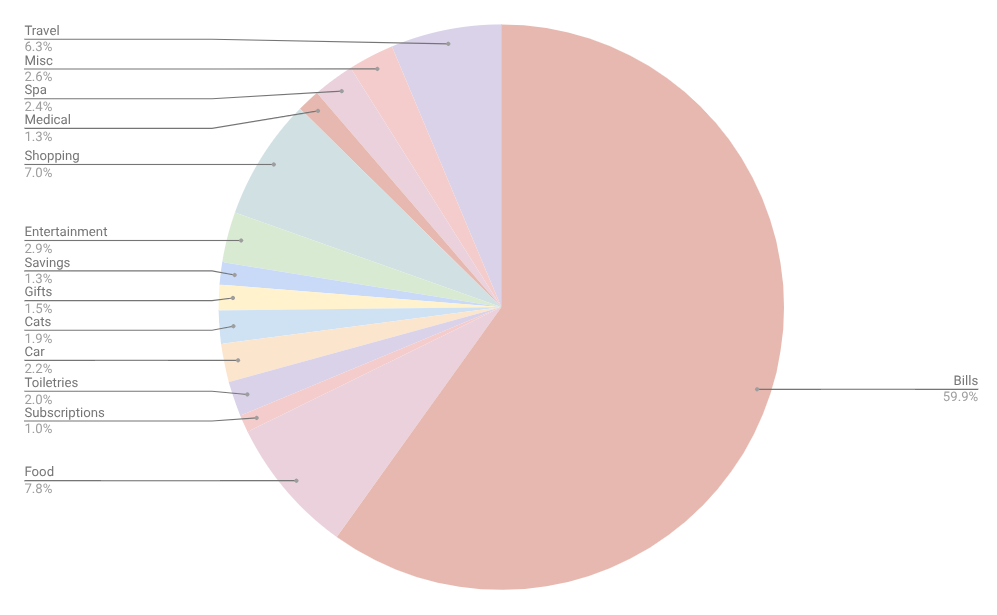

SPENDING BREAKDOWN

Categories That Increased

BILLS ($5,872 | ↑ $3,825)

Well, no surprise here! This category increased dramatically because I paid off my Care Credit debt. That comprises over $3,000 of this overage. I also had two car payments in March because I missed my February payment (it was a few days late but within the grace period, so no biggie). My electric bill was also slighter higher than February but ($124 vs $108).

SHOPPING ($682 | ↑ $300)

Whew, my shopping category got a workout in March. Some of this was expected; I knew I was going to spend a lot of money at the bookstore in Orlando and I bought a large area rug for my home. And hey, I got my bonus this month and was responsible with the majority of it. The rest got to be fun money! Here were my highest categories:

- Books and bookish items: $197

- Home (area rug): $150

- Workout clothes (sports bra, yoga mat, workout top, and stretch strap): $88

- Clothes (dress, t-shirt, socks, bralette, and nightgown): $84

- Office (thank you cards and a mousepad): $55

MISC ($257 | ↑ $179)

This was almost all taxes. I paid $182 to the government and then paid $70 to TurboTax. There was also a small $6 charge from Google for something related to the blog but I couldn’t tell you what it’s for.

SUPPLIES ($196 | ↑ $148)

I replenished my collection of body wash and also needed to buy some household supplies that I don’t need often, like dishwasher detergent, toilet paper, and Clorox wipes. Oh, and I bought a new toilet bowl brush!

GIFTS ($143 | ↑ $56)

A little higher this month since I finally gave my mom her birthday present, which was going to a pet portrait event to make paintings of our pets! I also bought some bulk gifts for friends (I have a fun plan for celebrating friends’ birthdays this year!) as well as some sweet treats for Chip and Lucy’s birthdays. My monthly donation to the ASPCA is also part of this category.

Categories That Decreased

MEDICAL ($127 | ↓ $318)

This month, I spent money on some ice packs for my finger (I’ve been having some weird joint soreness/pain in my index fingers that comes and goes) and medication. Last month, I had to pay off a big medical bill for my CPAP machine that I had been neglecting.

CATS ($185 | ↓ $64)

No vet bill this month, which brought down this category by a bit. I did have to replenish both their wet and dry food, which was a hit to the ole bank account. Plus, they needed new litter and I finally got a Litter Genie to make the whole litter-scooping process a lot less arduous.

ENTERTAINMENT ($283 | ↓ $58)

This month, I added the “food with friends” subcategory back to my entertainment category. It’s good for me to see how much money I spend monthly when going out to eat with my mom and with other friends. This month, it was $140! I also spent $50 for book club’s afternoon tea event, $60 on the pet portrait event (my portion—what I paid for her portrait was added to the gifts category), and $10 on iPhone game tokens.

FOOD ($769 | ↓ $36)

Yay! My food budget improved this time around. I’m very happy with this number, even though I went overbudget in my online takeout category. But I didn’t do as poorly as February (I was over by $73 rather than $105), so that’s a win for me.

CAR ($215 | ↓ $36)

A small decrease for my car category due to only needing to fill up my car with gas once rather than twice.

Categories That Held Steady

SUBSCRIPTIONS ($98)

I still have not canceled my Amazon Prime – argh! I need to do that ASAP. And I’d like to take the money I was using on Amazon Prime and pay it forward for some of the Substacks I read.

SAVINGS ($125)

Of course, same old same old. I have a recurring savings autodraft of $75 to my Christmas fund and $50 to a cat fund for future medical bills.

NEW Categories

TRAVEL ($620)

This category was nonexistent for the first two months of the year, but it’s going to start getting a workout! This month, I categorized all food purchases when I was in Orlando under the “travel” category. I also paid for the VRBO (where I’m typing up this post now!) for my reading retreat.

SPA ($232)

I got my hair colored and cut, and I also got my underarms waxed and my brows waxed and dyed. It was an expensive appointment at the salon! But I will only need to get my hair colored/cut every three months. I only need my brows waxed every 2-3 months at most (and I don’t think I’m going to continue getting them dyed since it only lasted 1-2 weeks, ugh). My underarm waxing will be more frequent for now, but I’m hoping it means no more cyst growth!

Overall Thoughts

I’m happy with my spending habits this month. The bonus obviously helped, and I’m proud that I put most of it toward paying off my LASIK debt. Now the only debts I have are my student loans ($2,400) and my car loan ($27,000). I’m feeling good I can finally get those student loans paid off within the next year, and having a car loan doesn’t really bother me right now.

I’m also happy to report that I spent under my means this month, only by $100 but hey—it’s something! I was worried that I was in the red this month with all of the extra shopping I did and the deposit for the VRBO and such, but nope. It was a good month for my spending.

There are some big things coming up for me in the second half of 2025, namely my trip to London in October and moving to a new apartment in November. I want to make sure I’m saving at a decent rate so that neither of those investments puts me in the hole. This will be even more precarious with the way the government is messing with the stock market, so we’ll see how things shake out. I’m not optimistic, but maybe something will be surprising. (A Trump-loving family member keeps telling me to just “wait” for 1-2 years and things will turn around. Hmm, okay then.)

One thing I’m excited about: I’m $70 away from meeting my health insurance deductible! Woop! I’ve been spending so much money on appointments and medication and equipment costs (thanks, CPAP machine) and it will be nice to get something of a break on some of that. Maybe I’ll even be able to build up some money in my HSA since right now, I’m draining it every time I get paid to pay off some sort of lingering medical bill. It’s fun getting older.

March was a good month and my goals for April are to reduce my shopping budget by half, meet my online ordering goal (less than $100 spent), and finally cancel Amazon Prime.

What was your last “spa” purchases, aka hair color, haircut, waxing, pedicure, manicure, etc? Do you have any financial goals for April?

I also have not 100% been able to boycott Target and Amazon. I’ve been way, way better, but there are a few things that, as far as I know, I can only get at Amazon or Whole Foods (so- same thing.) I hadn’t been to Target in a long time, but finally crumbled and went this week, ugh. ALSO, I’ve had the same experience with Aldi- I’m not really happy with the selection or quality. Isn’t Aldi owned by the same people who own Trader Joe’s? I could be wrong about this, but that would mean TJs is a good place to shop. I just wish it were a little closer to me.

My financial goal for April is to have a meeting with my husband to discuss finances. For some reason this is very hard for us, but we HAVE to do it. Ugh.

Hope you’re enjoying your retreat!!!

You’re right – Trader Joe’s is owned by the same company as Aldi. My TJs is not as close, but it’s not a terrible drive. I went there on Saturday (and then had to go to the nearby Publix to supplement the stuff I couldn’t get there – they had NO EGGS AT ALL!) so I think I’ll make TJs my new go-to.

Good luck on your financial meeting with your husband! It’s so hard to talk about finances; I get it!!

Isn’t it sad that we get excited when we meet our health insurance deductibles? I well-exceeded my deductible last year, but on Jan. 1, it started over.

Having a trip to look forward to is wonderful.

Adulthood is the worst, lol. I can’t believe health insurance deductibles is what gets me excited these days!

I met my deductible in January since that is when I had my hand surgery. I nearly always meet it right away because of the expense of my RA meds. It’s depressing but also nice to have out of the way. I need to look closer at insurance plan options when I re-enroll, though. Phil thinks I probably should not go with a high deductible plan.

I’m sorry to hear that Aldi was a disappointment! There are certain things we always buy there, like my high protein yogurts, milk, gluten free bread, granola bars, colored peppers, and bagged salads for my lunches. It’s definitely not a 1-stop shop for us, though, but we try to buy as much as we can there. It definitely have a vey different vibe from other grocery stores, though, and has a really limited inventory.

I opted for the low-deductible plan so only had to spend $2,000 to meet it, which was very helpful!

I wanted Aldi to work for me, but alas, it just wasn’t the right place for me right now. There is a Trader Joe’s about the same distance away so I’m going to use them instead (will still need to supplement a bit, but not as much as I needed to for Aldi). So I will still be able to put my dollars to good use!

I got my hair cut and my brows waxed early in March. I only get my brows waxed once or twice a year, so I’m really enjoying how delightful they look right now!

My financial goals for April are to just try to keep my head above water. I need to order a couple of pairs of shoes and it’s going to be spendy. Oh, well, I just need to do it!

It’s so annoying to buy all of these things we NEED, isn’t it? Like, I’m grateful I’m able to get the things I need when I need them, but it’s just so much upkeep!

Woof, underarm waxing. I’ve never done it. I don’t have the patience, for one thing and also, it sounds painful. And this is coming from a woman who regularly gets her bikini (“French bikini,” which is a whole THING) area done. I’ve only done the bikini and also my lower arms. I did my arms a couple of times and now the hair is really light, so I feel less ape-ish. The rest of the bod gets the shave treatment. Oh, except eyebrows and upper lip, those get plucked. Wow, I am giving you a lot of details about my hair removal techniques. Once I wrote about hair removal on my blog and I got shamed by a reader (not a regular one, I guess she only popped in to say hi when I talked about sugaring the honeypot) for giving my sons the wrong impression about women. You just cannot win with some people! Also I have fair skin and dark hair (well, I did have dark hair, now it’s grey) and I like smooth legs WHAT OF IT. Why am I still talking about this, Stephany? I CAN’T STOP.

Oh, to answer your question, it was last week. I got the honeypot sugared (sugaring is so much better than wax IMO) and also had a pedicure.

I love when you get on a tangent, Nicole! I looked up sugaring options around me and there’s a woman who does it and I really want to give it a try for the bikini area! I’m just so nervous about anything related to the nether regions. The underarms are really not that bad. It’s maybe 30 seconds of pain – and you’ve birthed children from your own body so you’ve experienced a lot worse! When I got it done, my cysts were still in the healing phase so it felt a little more tender than usual, but nothing I couldn’t handle. (And I’m a big baby who can’t even do a regular-pressure massage because I’m so sensitive, ha.)

For next year, unless you really love turbotax try freetaxusa. It does the same stuff and I’ve used it for years. Federal is free (even for self employed me!) and there’s a small fee if one needs to pay state taxes (not us in FL)

Ohhh, amazing tip! Thank you! Let’s see if I remember this at the beginning of 2026, ha.

Whoop whoop for the paid off Lasik and soon to be paid off student loan! That’s amazing.

I loved having high deductible insurance/HSA. We haven’t had an HSA eligible plan in a while so we can’t contribute, but we still use our HSA from way back when to pay all of our medical bills.

The big thing that I have coming up for April is that I will max out my 401k. Our employer match is for the year, not how much we contribute on each pay, so there’s no reason not to max it out as soon as I can. It’s a lot of money, so somehow it feels “easier” to have practically no take home pay for a few months and then a big paycheck after that.

That’s amazing that you’re able to max out your 401k so quickly in the year! But wow, no take-home pay for a few months! I’m impressed! The benefit of partnership, ha. (And probably being better with your money than I am!)

Nice work in whittling down your online food orders. I know that this month you can get it down even lower! Even if you go over a little but you are lowering it, I think that is still something to be proud of, as it is a step in the right direction!

Your question about the spa made me crack up, as I honestly cannot remember! I have only had a manicure or pedicure a few times and the last one was probably…2019? And I haven’t cut my hair in ages, but the last time I just had a friend do it for me. And I have never been waxed (I guess I can put that on my never have I ever list!)

As for spending in April, aside from paying my quarterly estimated taxes (!) I probably won’t spend too much, as I prepaid my accommodation back in December, so really I am just spending on day to day living expenses, which are not super high.

You have a lot more fun things on your plate than silly spa appointments! You’ve got countries to see and great food to eat!!

Hooray for a lower spending month, even with the quarterly tax payment (womp).

It’s interesting to see how your spending patterns change throughout the year. Not a fan of Aldi, if only because none are conveniently located. I know many people swear by them, though. A Publix opened here this month, it’s not convenient by oh so pretty to shop in. Perhaps I’m more shallow than I care to admit. 😉

Publix is SO lovely to shop at. I agree with you! Especially the newer stores they’re opening up. Aldi was FINE but I’m just so used to having so many more options, and I just felt like the quality of some of the things I bought wasn’t very good. Oh, well. Live and learn!

I am always so impressed with you an anyone keeping such a tight record on the spendings.

Staying within your means is such a great success. I am sure you will hit your April goals.

I on the other hand was at the grocery store yesterday and my card wasn’t excepted. I was already in debt on day 12th of the month. Shoot. I had to quickly wire some from my emergency funds to pay for the grocery. I need to have a look why I was in depth. It is happening more often lately so something has increased and my paycheck (I deduct from my business account) seems not to cover the costs anymore. But I can’t give myself a raise. It is a tight thing right now.

You know, it makes me feel better than you had this issue with your debit card. I had something similar happen earlier this year and I always feel like such a loser when it happens. But it happens to ALL of us at some point! <3

I cancelled my Amazon Prime a bit ago, which felt really good. But I did order a few things last week, because I couldn’t find them anywhere else. If I were hard core I guess I would just do without these things. And sometimes I go to the company websites and order directly, but for small items, it would cost me SO MUCH MORE because of paying for shipping at each place. But at least I have been a lot more intentional, rather than just plopping things into my basket and buying it.

Your spa day sounds great, and actually a pretty good price. Just my hair (color, highlights, cut) costs more than your entire bill, even without a tip. Ouch.

Oh girl, the whole reason I went back to brunette was because I couldn’t stomach the cost of highlights. I once spent $400 on a cut/color/highlights and I was like “NOPE.” It’s so much upkeep so I needed to make things a lot easier/more affordable. I miss my blonde highlights, though!

I got my haircut while I was in Taiwan, and it was so much cheaper than getting it cut at home – $24 for shampoo and cut and blow dry. (A dry cut would have been $10.) So now I’m putting off going to get my hair cut again because I know it’s going to be five times as expensive here for that very same cut.

It sounds like you had a great month financially! It’s always inspiring for me to read other people’s financial wins.

$24 for a shampoo, cut, and blow dry sounds like a DREAM! I feel like even when I go to those more affordable haircut places, I’m still spending $50!

I was wondering if that would be your review of Aldi! No shame in that. There are many things we always get there, and some things I never do. Random stuff like bananas. And I have heard their meat selection is not that good. But some things are always a hit. Similar to Lisa, it’s not a one-stop shop for us.

You were coloring your own hair in the fall, right? Did you decide to stop doing that? No judgement at all, I get mine colored at the salon $$$ Just curious!

I am excited your student loans will be paid off next year! I paid mine off a couple years ago and it felt so good! I am happy that is coming for you!

My last spa purchase was my mani Tuesday last week! I go every two weeks 🙂 I have my cut and color Friday next week and REALLY need it. LOL.

I wish Aldi was more of a hit for me! But I think I’ll just switch to Trader Joe’s, which is owned by the same company so same difference, right?!

I did have friends helping me with coloring my hair but then things just got so busy with us and we couldn’t get together. And I decided it’s really not too crazy to go to the salon now that I’m brunette. It was also so much more money when I was getting blonde highlights!

I love how open you are about your spending.

I have an opportunity to move to a slightly larger 1-bedroom apartment (down the hall, or down the hall and up a few flights) and I’m debating. It would be a total of $235 more/month. I’ll be posting about it soon – a sort of “WWYD?” to the community. I’m curious -are you looking in the same complex or different ones?

Also, yay travel and self-care. To me, that covers your spa day, time with friends and your mom, reading retreat, getting help with your taxes…doing it all yourself might be cheaper (or being alone all the time might be cheaper) but it would not make you happier. 🙂

I am looking to move to a different complex. I actually made the move you’re doing in 2020 – I was living in a shoebox apartment and I needed more space once I started working from home full-time. I don’t regret that move for a single moment! Plus, it was SO EASY to move, haha. But I am ready for a new complex to live (or maybe a house for rent, if I can find one.)