Happy Friday! Who’s ready for another nitty-gritty deep dive into my spending habits? As a reminder, in these spending reports, I do not include anything that comes out of my paycheck before it lands in my bank account. You won’t see anything related to health insurance, FSA payments, my retirement savings, etc. This is about what I spent from my net income. Here’s what February looked like:

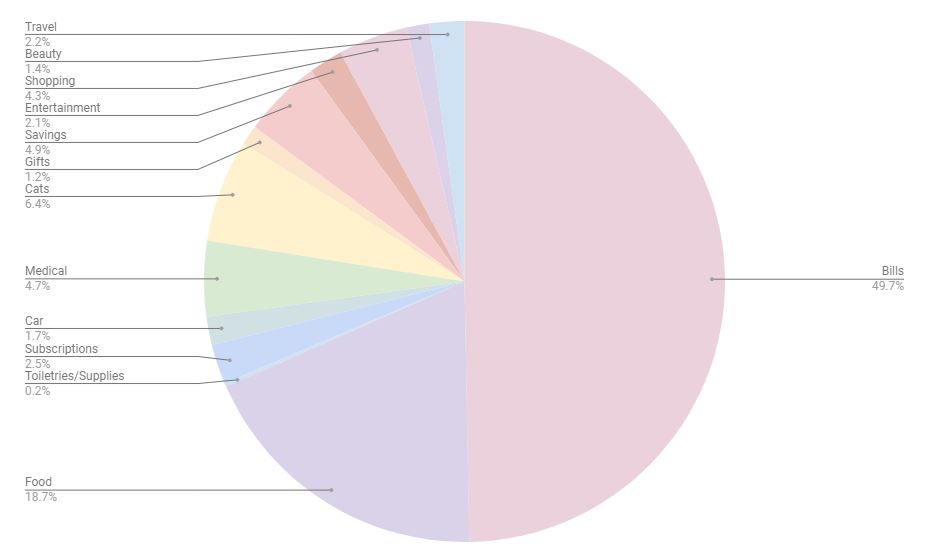

Bills (49.7% | +3% from January) – As a reminder, I include all of my non-negotiable bills in this category, which is why it’s about half of my total spending in February. This category was a smidge higher this month because I had to make two student loan payments. (Sometimes I can get away with one if my tuition reimbursement goes through quickly enough.)

Food (18.7% | -1.6% from January) – I was over budget again in this category, but only by $260 (compared to $352 in January). I spent $62 less in groceries and $50 less in Starbucks, but my Ubereats orders were up by $43. I do think I need to bring up my food budget due to rising costs, but I’ll give it one more month to figure out my new normal.

Cats (6.4% | +3.9% from January) – Lila had a vet appointment that came with one shot and a prescription. I also bought wet food (that went up NINE WHOLE DOLLARS from January), litter, two toys, treats, and a new food mat.

Savings (4.9% | +.1% from January) – I have automated savings set up for car insurance ($150 per month), Christmas ($75 per month), and the cats ($50 per month).

Medical (4.7% | +1.6% from January) – Some doctor copays, vitamins, and medication. I’ll start using my FSA in March (there’s a long, boring story about why I haven’t used it until now), so these costs will go down a lot. (Since I’m only tracking what I’m spending after my paychecks hit my bank, I don’t account for FSA spending here.)

Shopping (4.3% | -1.5% from January) – My spendiest shopping categories in February included books ($50), tech ($40 – included my laptop backpack!), and accessories ($29 – included a new purse and wallet).

Entertainment (3% | +.1% from January) – This category included my day out to the strawberry market/strawberry picking and two separate girls’ nights.

Subscriptions (2.5% | -.4% from January) – My subscriptions this month included Patreon (I support three podcasts), Netflix, Paramount+, Spotify, two photo-editing apps, and Prime. A little less this month because my air filter subscription is every other month.

Travel (2.2%) – I’m excited to have something to add to my travel category this month! I bought tickets to see The Popcast live in June. Since I’m going to travel for this event, I categorized it as a travel expense, not entertainment.

Car (1.7% | +1% from January) – I bought gas once, had to pay some tolls, and I put $25 in my Parkmobile app for parking downtown.

Beauty (1.4% | -5.1% from January) – I spent around $60 on new skincare products and bought dry shampoo. Last month, I had an expensive hair appointment, which is why my percentage was way down.

Gifts (1.2% | -.7% from January) – I bought gifts for my nephew’s birthday and donated to my other nephew’s baseball fund.

Toiletries/Supplies (0.2% | -.2% from January) – I bought delicate laundry detergent and freezer bags. Exciting!

Overall Thoughts

- It was another month of spending above my means, sigh. And this month was worse: I spent $306 above my means compared to $238 from January. That’s not good! I really have to be so much more careful about how I’m spending money and be more intentional with my purchases, especially considering my food budget is so high right now.

- The average money I spent on food between January and February was $906. My food budget (which has remained the same for years) is $600, but I’m going to have to increase that soon. Maybe even to $800, which feels astronomical for one person. My goal is to only use Ubereats once a week for lunch (which is around $20-$25 a meal, compared to dinner which can be double that) and get better about having good meals on hand to eat at home. I know that will decrease my food spending.

What was the last beauty product you bought?

I love these spending reports! It seems like the Cats category went up the most from last month; I wonder why the food cost came up so much!? Or is there a Costco brand or some other kind of bulk food you could get to lower the costs? That seems pretty expensive for cat food!

My highest category is always what you call Bills, with mortgage and property tax being the highest of the two. I am going to do a comparison in a few months of what my costs are now vs what they are then and am (1) looking forward to seeing that category be lower! (2) going to have to recategorize my categories when I am traveling! Not a bad problem to have really.

I could probably buy more of their wet food in bulk, but finding a place to store it is the problem. I don’t have a lot of space for storing bulk items in my apartment. And I don’t have a Costco membership, so that wouldn’t work. I’m just astonished that the food increased so much in price from one month to the other!

I’m excited to see this comparison in a few months (if you are inclined to share it, of course).

If it makes you feel better Sky’s food is $64 for 6.5lbs of dry food. And if I fed him wet food instead it’d be over $100 a month. Darn prescription food

Oof. That is rough, Bri!

Which is why Sophie also doesn’t eat the same food! (The vets said she could but hello, I’d go through that prescription stuff twice as fast! No thanks!)

Food is the biggest part of myspending too. Between lunches & dinners & eating out – it adds up super fast. Especially if you want good HEALTHY food.

Ugh, it is SO expensive and SO necessary. I really wish I was someone who didn’t care much about what I ate, lol. That could help with my cost. Alas!

Groceries are so expensive! I just did our monthly tally for February and posted our Top Five expenses on Engie’s blog so here that is again:

1) House investment – a big lump payment on our mortgage + regular mortgage payments (this is very exciting though because we will pay off our mortgage this year so this category will be GONE IN 2025. I am so excited!)

2) Household – this was mostly a big fuel delivery + electric bill

3) Charitable

4) Groceries

5) Auto – We spend a lot in gas – trips to the ski hill, airport runs (which technically we get reimbursed for so this is a bit of a tricky thing to account for, but this isn’t factoring in the reimbursements).

Mostly bills. Fun things like meals and entertainment didn’t come close to making the Top 5 – blah.

Last beauty product was a brush! But I need new mascara, so hopefully I’ll get that tomorrow.

That’s really exciting that your mortgage will be paid off this year! What an amazing feeling that will be!

Oh I feel you on the cost of food! Last year we spent so much on food. This year we’ve set a goal of $15k for the year (for a family of 5) and so far we have been over budget in January and February and that’s with sticking to our no takeout/no Starbucks goal. It’s SO hard. It’s really demoralizing to stick to the goal and still be over budget.

I love these posts of yours – it can be hard in the age of social media to feel like so many people live extravagantly but the reality is that so many of us struggle paycheck to paycheck. Your posts are validating and make me feel seen in the daily finance grind!

Emilie, thank you so much for this comment! Sometimes I feel very vulnerable sharing these posts because I am NOT frugal and, as we can see from these posts, am spending beyond my means. But I know I’m not alone in that. I have a friend who talks very frankly with me about her budget for her family of five and how they’re always in the red – and her and her husband make really good salaries! It’s just insane for that to happen when they don’t live extravagantly. It’s just crazy right now.

Food prices, right? It’s wild how much more everything costs. It’s great, tho, that you’re really considering it and thinking about how to adjust. The last beauty product that I bought was a Mad Hippie Triple C Night Cream that I LOVE. My skin gets all weird this time of year with the antihistamines and pollen and changing weather and the cream has been so helpful.

Food prices are just crazy. I bought a regular-size bag of chips and they were SIX DOLLARS. What is even happening?! I think it’s time to increase my food budget because I’m just not willing to make extreme cuts to my food spending to get it under $600.

Ugh groceries. I only know what I spend on groceries, not what Hubs spends in addition to me and let me tell you I DON’T WANT TO KNOW. Maybe for fun we could both write out numbers down for this month and then not look at the total until the boys move out and we’re not feeding two teenagers anymore.

My pet costs went from $0 in December and January to OMG in February and I’m good with that. Going from two sad months of not having a dog to our darling little puppy who needs an endless supply of treats and toys is money well spent.

And in other news I’m planning to do a Mega Target Trip soon to replace all of my undies. It’s long overdue.

HAHA – I like the idea of writing down the numbers of groceries and then placing it in an envelope to be opened in a decade or something. Hey, maybe groceries will be EVEN MORE INSANE, and you’ll WISH you were only spending that much money. (Ugh.)

Pets can be expensive but they are SO worth all of the monies.

The last beauty product I bought – well, I caved, all that podcast advertising broke me down. I’m trying Prose! I will report back to see if it actually makes a difference or not. How much money CAN I spend on my aging hair, this seems to be the question.

Oh, I will be waiting anxiously to hear about your experience with Prose. I have been tempted so many times by their IG ads!

I totally understand not wanting to use Uber eats. It is ridiculously expensive did us here on LI. We learned our lesson the hard way for sure. Where we live one person can easily spend $20-30 depending what it is for lunch or dinner. For example one plain pizza pie no toppings can easily be $25-30 between tips n delivery fees. 😔. After adding up our Uber eats spending back in January we cut back significantly. It’s embarrassing to admit how much we were spending on eating out but we’ve made changes. I’m making sure we have plenty of breakfast items and lunch meals on hand. I’m also trying to shop at less expensive supermarkets as I do use Whole Foods for the delivery convenience but again they charge for that which is $10 each delivery and it’s super expensive. 😔

Yes – a lot of times I order Ubereats because I didn’t plan my meals correctly or I’m just feeling lazy about cooking. I have to be better about meal planning and making sure I have some easy options on hand when I don’t feel like cooking. Ubereats orders can add up so dramatically!

I probably won’t be able to buy a beauty product for the next ten years, because we just bought my daughter a new flute. If you want to really, really have no money, have kids! That will take care of it. I’m sure we’ll look back and say it wa all worth it (right????)

Oh man, I honestly don’t know how parents are doing it these days! Everything is so expensive!! I’ll stick to my cats who do NOT need expensive musical instruments, haha.

I think we get by with a much lower budget because we buy so much at Aldi and stuff is so freaking cheap there! And there is one super close to our house. I would have to look back to figure out what our total avg spending was between dining out and groceries, but I think groceries about $400-500/month. Phil does all of the shopping though so I feel so out of touch with it. That is frustrating to outspend what you earn though. Ugh. 🙁 I wish I had great advice about what to do. Hopefully you get another raise this year?

I bought a few beauty products in the last week or so. I got some of the caffeine eye serum others have talked about and also a travel size Sunday Riley vitamin C cream that I have been wanting to try out. I also bought a new charcoal bar (the last one lasted 3+ years!) plus some face lotion and face sunscreen – all 3 of those were from beauty counter. So that was kind of an atypical amount of beauty product purchases!!

We have an Aldi – it’s a little further away from Publix, but not so much that it’s inconvenient. I should go there next week just to compare!

Sometimes, all of the beauty products have to be purchased at once! I know what that’s like!

WHY DID CAT FOOD GO UP SO MUCH THIS MONTH?! This is honestly a huge question I have. So much at one time. *sigh* Zelda’s food used to be just over $42 and now it’s over $70. Grrrr.

I just placed two big orders from Sephora and Ulta. According to my Sephora history, I place a big order every March. LOL. They had a 20% off coupon, so I bought shampoo, conditioner, heat protectant for my hair, eyeshadow primer (Benefit discontinued Stay Don’t Stray and this caused me great consternation), blush, eyeliner, and I got two mini-mascaras with points. At Ulta I ordered some The Ordinary products, a facial cleanser, and another eyeliner. I should be set on makeup for another six months or so.

Okay, what’s crazy is that now the cat food has gone down $5 – so it’s still up a bit from the $36 I was spending, but why was it $44 for a time?! I am so confused!

Hooray for some new beauty products! That’s so fun!!

Money money money money!!!!! 🙁 Ugh, last month was expensive. Heat+groceries+kids activities. Bloody Paris lol Met a friend in Somerville, that’s like $50 right there for lunch. Better stop counting LOL

“Bloody Paris” HAHAH – that made me legit laugh. Sometimes, it’s just better not to know about the monies, I feel you.

Does soap count? Asking for a friend. 😉 (Seriously, I bought Dove soap. Oh, and hair conditioner!)

Also, I love that you, Engie, and San do this. I have started tracking my expenses in detail, in a very similar way to what you do here. Well, I’m sure my spreadsheet is much more rudimentary, but similar categories, etc. And, while I think my *grocery* bills aren’t high, I also get food/nutritional supplements (e.g., protein powder, electrolytes for post-workout, etc.) on Amazon and at Target. It adds up, for sure. I will be interested to see how it all lines up when I calculate totals….Thanks for your excellent, open, example of sharing. I appreciate it – and you! 🙂

Augh! Forgot to check the box. Leaving a short comment in the hopes that you will reply to this one and I’ll be notified!

I feel you on all the spending above you means. I am currently not having an income and it east away my saving faster thank I can blick. It is frustrating. I have been cutting back on almost everything in March and still feel like it’s not enough.

Reading your report I am really surprised about the food spendings. I know in germany food is so cheap compared to other countries but 800€ for a food budget it crazy. I am sorry it is that way.

I have tried to use that app “Too Good To Go” if I want to get some fancy take out or just pastries. It is a good way to save up some money on feed without only eating toast and pasta.