Hi, friends! Oh, it is so good to be back here after more than a month away. When my break from blogging started, there were a good 2-3 weeks where I felt so relieved to be on a break. I was so happy to go about my life without thinking about writing posts or managing my editorial calendar. That relief scared me, even though the whole reason I took the break was because I was having blogging burnout. But it made me wonder, “Am I done? Is it time to pack up the blog?” (<– A scary thought when I just paid nearly $500 to Hostgator for another three years of blog hosting service!)

Thankfully, as August started to wind down, I started to feel excited about coming back to my blog. I missed this space and missed the connection of other people. The break from blogging was so necessary, and I am so happy to be back.

There was quite a lot that happened in August. So let’s discuss.

A breakup

At the end of July, I broke up with my girlfriend. It was something that had been marinating in my head for a bit of time, and I knew it was time to end things. It’s hard to end things when there isn’t anything specific to point to; it was just a feeling in my gut that I had to listen to. She wasn’t my person, and I had to come to terms with that. I am glad I did, but not glad I had to hurt someone in the process. I spent much of August processing the breakup and returning to my life of singledom. The dating apps have been added back to my phone, but I haven’t done much with them just yet.

A change in plans

After spending so much time and energy planning to move at the end of October, I have decided to postpone my move until next year. The main reason for this is finances. First, I received my lease renewal last week and learned that my rent will not be increasing at all. I expected it to increase, as it went up by nearly $300 last year (and $100 the year before), so this was a very pleasant surprise. Second, the rent prices for two-bedroom apartments are out of control. I’ve been keeping a close eye on the prices for the handful of complexes I toured and liked, and the one at the top of my list is now averaging around $2,100 for a two-bedroom apartment. (When I originally toured the complex in late spring, the prices were $200 lower.) There is another complex that’s averaging around $1,800 for a two-bedroom apartment, but those apartments aren’t as nice, so I’m partial to the other option. But I’m not partial to spending $400-$700 more on rent. Another reason I’m postponing the move is because, when I planned this move at the end of last year, I was expecting to receive a fairly substantial raise, which did not materialize and it means that adding a much higher rental price to my budget will make things very, very tight. Financially, it makes more sense to stay put for another year.

I’m both relieved that I’m not moving because moving is exhausting and expensive, and sad because I was looking forward to being in a new, bigger space (that wasn’t on a crazy-busy road). I’m trying to cope with the change by thinking about how I can make my apartment even better suited for my needs and recognizing that now I can fully move forward with LASIK. Without an expensive move + higher rent price to worry about, I can finally make this surgery happen. YAY!

A float in the river

I marked a really fun goal off my 2023 list in August – tubing at Rainbow Springs! My mom, my stepdad, and I took the two-hour trip north to spend some time lazily floating in the river, and we had such a great time. It was a very hot day but the river was delightfully cold. (I believe it is always a brisk 72 degrees, which felt amazing on a day when my weather app alerted me about an “extreme heat advisory.”) We learned a lot during this trip, though, like the fact that we need to bring something that we can use to tie our floats together so we don’t get separated from one another. (We eventually clipped my crossbody bag through the loops of our floats to stay together!) We will definitely be back!

A dietician appointment

I am thrilled to report that I found a dietician, and I love her! She is exactly what I was hoping to find in a dietician. During our initial meeting, she talked extensively about her disdain for diet culture and at one point told me that she had no desire to know what I weighed, as weight is not really what matters when it comes to eating healthily. She also didn’t make me feel like a terrible person for drinking soda or having so many sweets in a day. She was such a breath of fresh air, and really made me feel like I could finally make this healthy living journey a reality. It didn’t have to be scary or hard or insurmountable. I can make small changes and if I have a day where I fall into my old unhealthy patterns, that’s okay. In fact, it will happen and there’s no need to beat myself up about it.

At the end of the appointment, she gave me a very loose nutrition plan of how she would like me to eat throughout the day. What really blew my mind was when she told me she wanted me to try to eat a piece of fruit before my morning workout. I always work out first thing when I wake up, and often feel sluggish and blah. I figured that was due to being tired and, honestly, being fat. But actually, it’s because I haven’t eaten in many, many hours and my body needs a quick jolt to get going. Mind-blowing! (I haven’t really tested this theory because, um, I’ve kind of fallen off the workout wagon, but I imagine it will help once I get back into my routine.)

One of the things I’ve been really working on is eating more fruits and veggies (after I finished walking her through a typical day of eating, she remarked, “So, I’m not seeing any fruits and veggies on here.” Lolz) as well as snacking more often. I have hypoglycemia and it especially rears its head in the morning/afternoon if I don’t eat every few hours. So now I’m eating breakfast around 7:30, having a snack (string cheese + a package of cashews/almonds/dried pineapple) around 10:00-10:30, having lunch around noon, and then having another snack in the afternoon (celery + PB has been my go-to, but I may change this to Greek yogurt and fruit).

Other good things

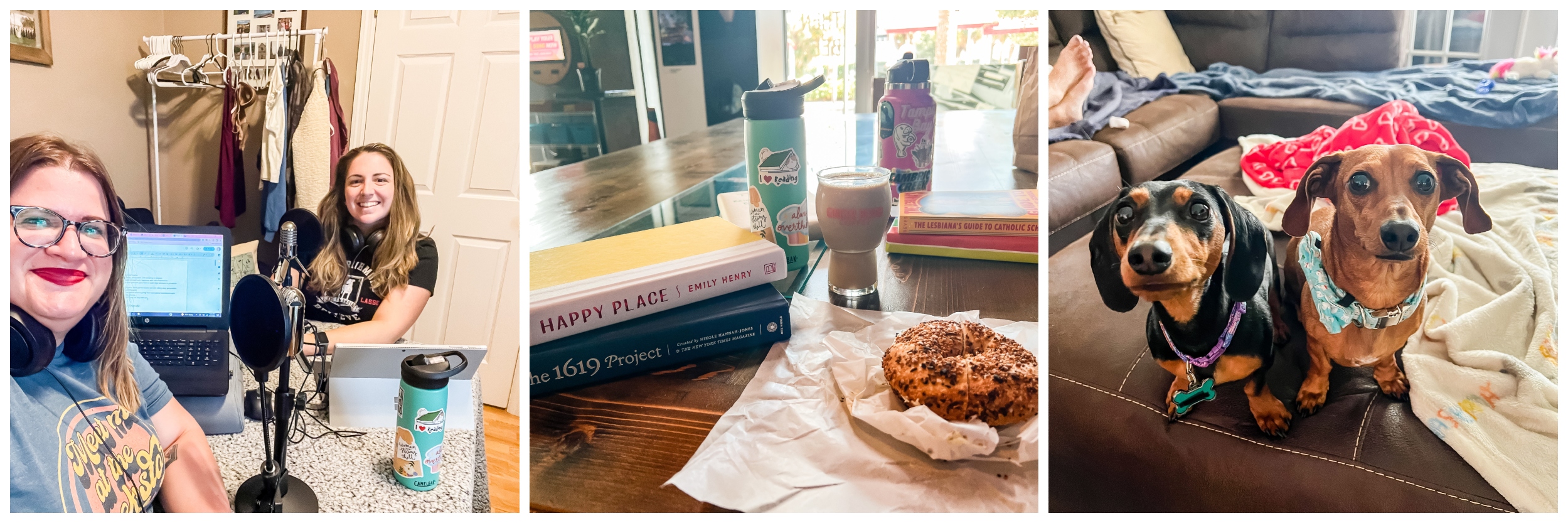

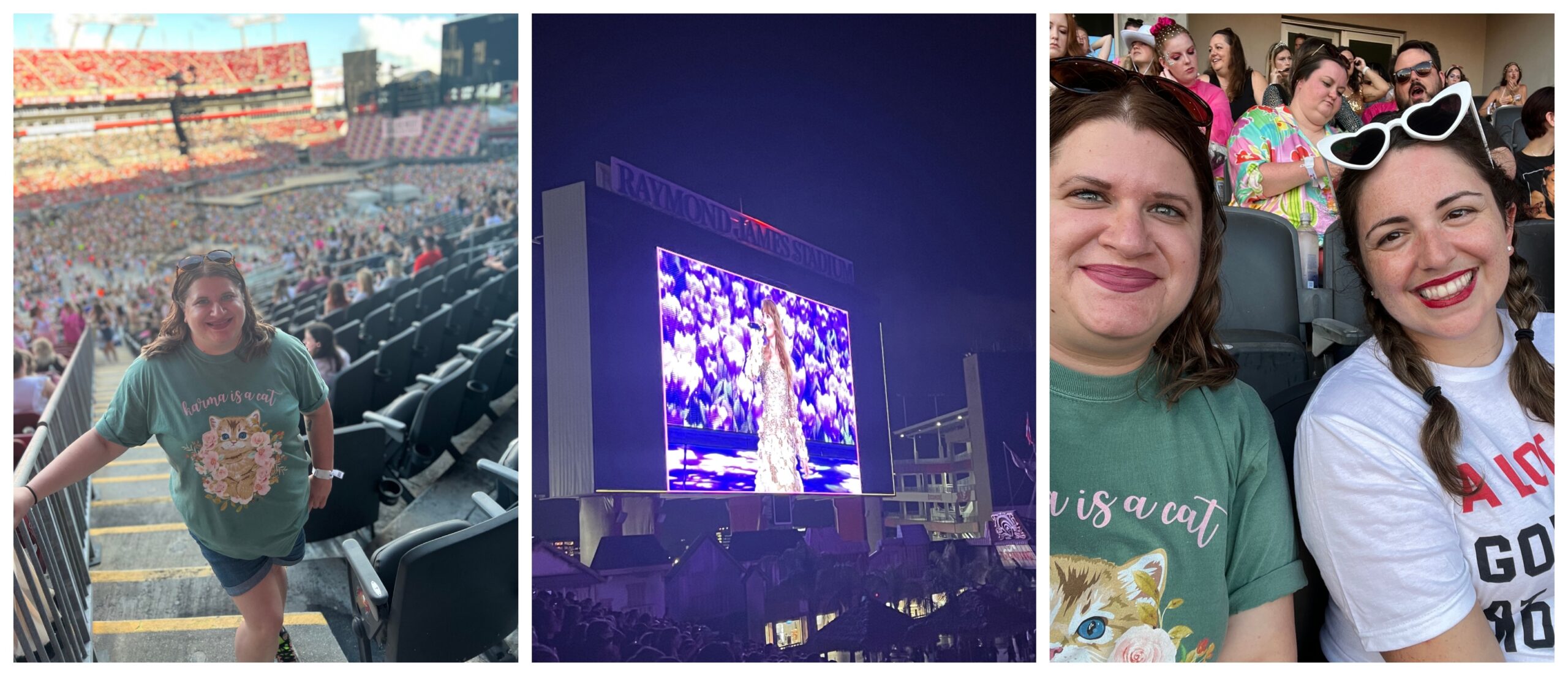

Recording season 6 of our podcast with Bri (our trailer released today!) • a lady date with Bri to watch the Red, White, and Royal Blue movie (so darn cute!) • seeing a friggin DOLPHIN in the canal across the street to my mom’s house • doing the most fun escape room with book club • The Big Nailed It Baking Challenge • catching up with my favorite Georgia family when they were in town • a fun game night with work friends • an excellent mid-year review with my VP